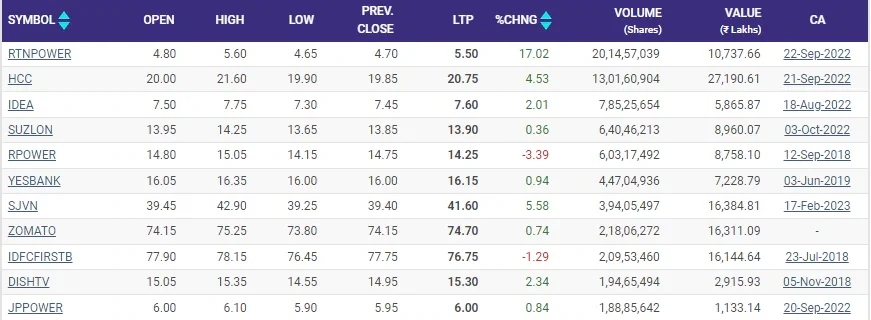

HCC increased 5.04 percent to Rs 20.85. HCC had the second-highest volume on the NSE, with 12,71,64,592 shares traded. So far, HCC shares worth Rs 266 crore have changed hands.

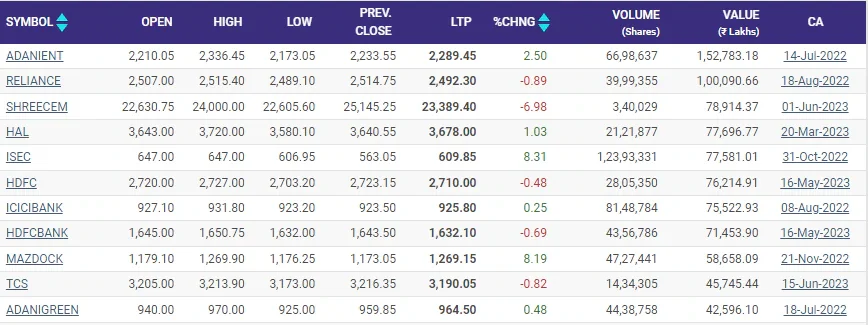

Adani Enterprises and Mazagaon Dock Builders gained after significant turnover on NSe, according to statistics.

RTN Power rose 18.09 percent to Rs 5.55 on the penny stock exchange, as 19,42,88,288 RTN Power shares worth Rs 103 crore changed hands. RattanIndia Power obtained a loan of Rs 1,114 crore in a transaction sponsored by Kotak Mahindra Bank, lifting the stock.

The thermal power company had previously concluded a resolution with former lenders for the 1,350 MW Amravati Thermal Power Plant in December 2019, in which the loans from Indian banks and financial institutions were taken over by international financial institutions including Goldman Sachs and Varde Partners through Aditya Birla ARC, with both sets of lenders (outgoing and incoming) receiving a 15 percent equity stake each.

Sulzon Energy (6,33,56,515 shares traded) and Vodafone Idea (5,83,61,123 shares traded) were trading slightly higher. Reliance Power rose 3.39 percent to Rs 14.25 on strong volume. SJVN rose 6.60 percent to Rs 42, with 3,77,55,634 shares changing hands.

On the other hand, shares of Adani Enterprises, Reliance Industries, Shree Cement, and ICICI Securities showed massive turnover on the NSE. Adani Enterprises topped the turnover table on the NSE, with a transaction of Rs 1,488 crore. Reliance Industries reported a revenue of Rs 961 crore.

Shree Cement shares plummeted after it was revealed that an income tax (I-T) evasion totaling Rs 23,000 crore was discovered during investigations at different business locations. Last week, the I-T department conducted a survey activity at five of the company’s facilities in Rajasthan.

Adani Enterprises increased by 2.8%, while Reliance Industries fell by 0.8%. Shree Cement’s revenue was Rs 777 crore.

- “We have learned that in connection with the above survey, a lot of negative information about the company and its officials is circulating in certain sections of the media.”

- We’d like to make it clear that the survey is still ongoing. The company’s complete management team is available and willing to work with the officials.

Otherwise, any material circulating in the media is inaccurate and was published without getting prior feedback from the company,” Shree Cement stated.

FOR MORE INDO CLICK THIS

SITE: https://learningsharks.in/

FOLLOW OUR