According to the foreign brokerage, Nomura India, RIL benefits from its favourable crude oil procurement, which would keep realised margins at a significant premium to benchmark margins.

Reliance Industries Ltd. (RIL), the most valuable stock in India, has underperformed the BSE benchmark Sensex since Jio Financial Services’ demerger, declining 11% against the 30-pack index’s 3% decline over the same time period.

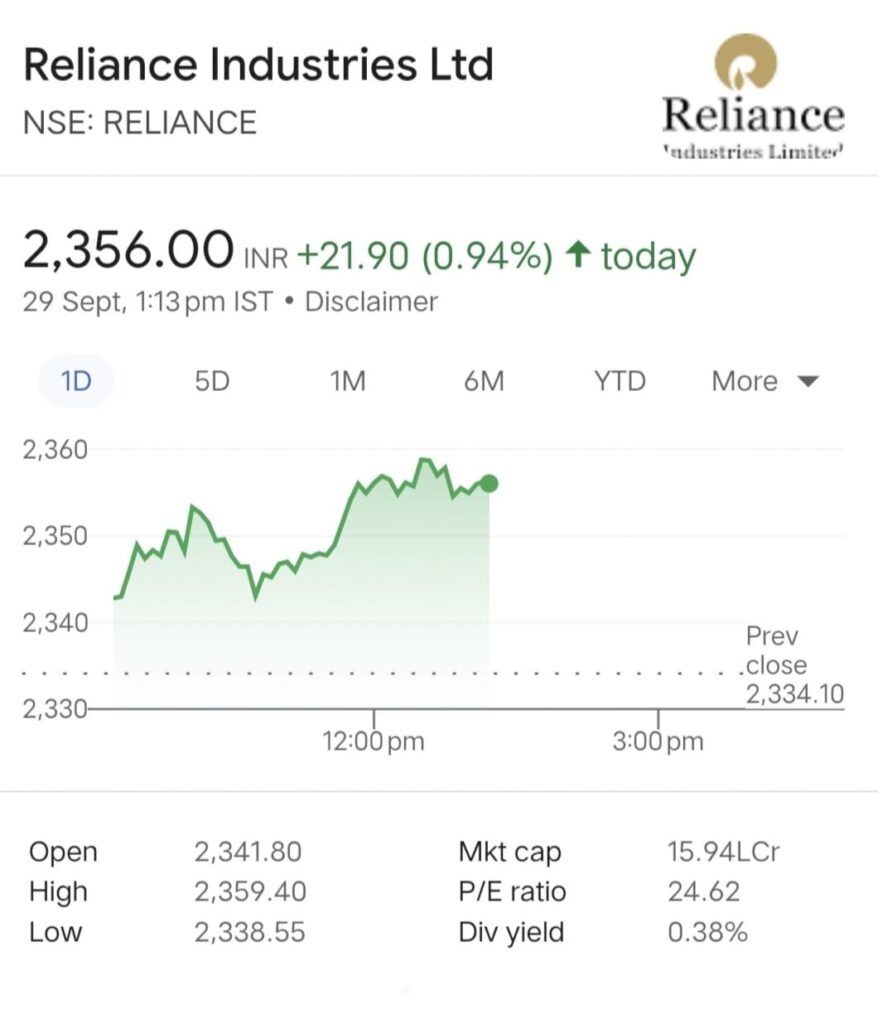

- The market capitalization (m-cap) of the Mukesh Ambani-led firm dropped by Rs 1,89,463 crore to Rs 15,83,122 crore at its closing price on Thursday from Rs 17,72,585 crore on July 20.

- The oil to telecom company set the ex-date for the demerger of its financial services division on this day (JFS shares later debuted on August 21).

- Nomura India stated this week that it reiterated its “Buy” rating for RIL because it is best-positioned to profit from a strong refining construct and that there are potential upside risks to its conservative refining margin assumptions of $12 per barrel for FY24.

- Morgan Stanley stated in a letter on September 20 that investments in new growth areas are accelerating and that Reliance’s monetisation cycles are getting shorter (2-3 years as opposed to 5-6 years in the past).

“E-commerce has gained momentum, and consumer retail is enjoying good traction with store additions. A $20 billion NAV increase from sustainable energy is what we predict. RIL is on the verge of a monetisation cycle and a capex peak in the upcoming quarters, the report stated.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en