Price of Reliance Infrastructure stock: The 14-day relative strength index (RSI) for the stock was 54.20. Oversold is defined as a value below 30, and overbought as a value beyond 70. In comparison to a price-to-book (P/B) ratio of 0.50, the company’s stock has a negative price-to-equity (P/E) ratio of 1.56.

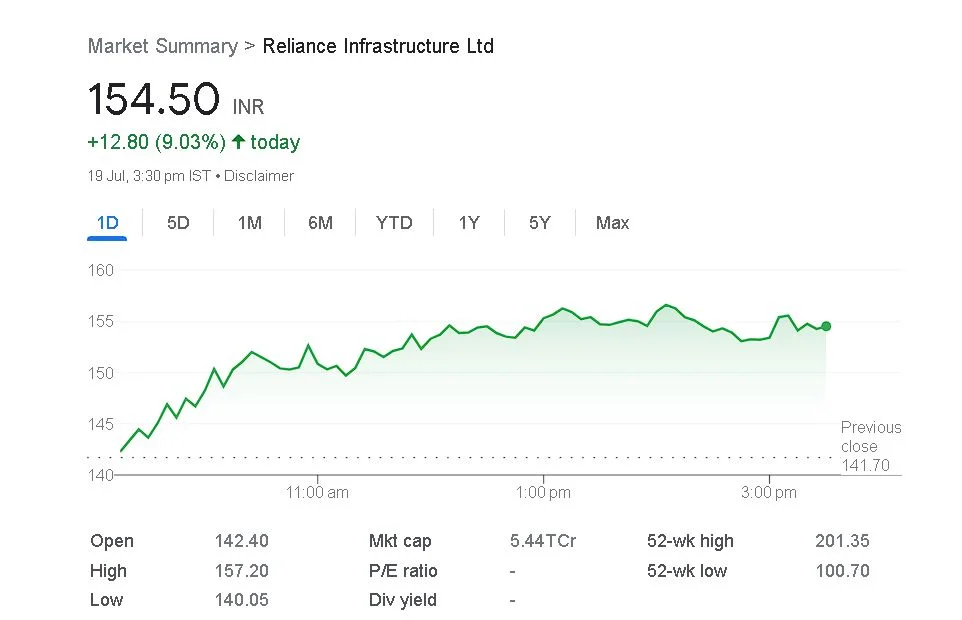

In Wednesday’s trading, Reliance Infrastructure Ltd. shares increased significantly amid high volume. The stock increased 10.75% from its previous closing of Rs 141.90 to a day high of Rs 157.15.

- Approximately 34.20 lakh shares were traded on the BSE today, a significant increase from the 2.94 lakh share average for the prior two weeks.

- The counter’s turnover was Rs 49.72 crore, and it had a Rs 5,398.22 crore market capitalization (m-cap).

The stock was down 21.95% from its 52-week high of Rs 201.35, reached on September 2, 2022, at the day’s high price of Rs 157.15. Despite this, it has increased in value by 55.98% since reaching a low of Rs. 100.75 on July 19 of last year.

- “The stock has witnessed a decent spurt in the last two sessions from Rs 134 levels to touch the peak zone of Rs 157,” said Vaishali Parekh, Vice President of Technical Research at Prabhudas Lilladher. It encounters resistance close to Rs 158.

- “The risk reward ratio is looking favourable and long-term investors can hold the stock,” said Milan Sharma, founder of 35North Ventures. The companies’ assets are quite valuable, and their cash flow is solid and predictable. Over the next 12 months, investors can purchase it with a target price of Rs 220.

The 14-day relative strength index (RSI) for the counter was 54.20. Oversold is defined as a value below 30, and overbought as a value beyond 70. In comparison to a price-to-book (P/B) ratio of 0.50, the company’s stock has a negative price-to-equity (P/E) ratio of 1.56.

CONCLUSION

By providing customers with an easy and reasonable option to participate in the financial markets, discount brokers have transformed the way people invest. By offering affordable fee rates, user-friendly trading platforms, and a variety of investment choices, these brokers help people and organisations take control of their portfolios and achieve their financial goals. Before choosing the discount broker whose offers most closely fit your financial objectives, carefully examine each one’s offerings. Use cost-effective trading to your advantage and begin your investment adventure as soon as possible with a trustworthy discount broker.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en