In the June quarter, Ashish Kacholia had 2,31,683 shares or 2.02 percent of Raghav Productivity Enhancers. This comes as another investor, Rekha Jhunjhunwala, reduced her holdings in this multibagger stock.

![It carries out repeated surveys; it has enabled an Artificial Intelligence (AI) bot to have “HR [Human resources] conversations”](https://learningsharks.in/wp-content/uploads/2023/07/axis-bank.webp)

Introduction

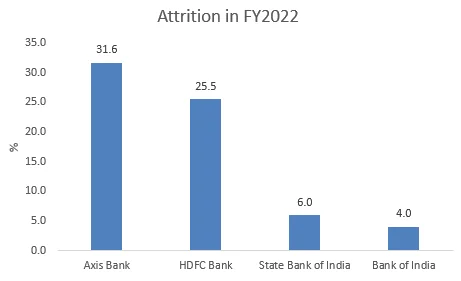

In terms of the third component of the new tagline, “Winning,” Axis has undoubtedly won the prize for consumer complaints in banks (as mentioned in my piece), and perhaps it has also won the award for staff attrition.

Similar lofty statements about customer satisfaction stated in the bank’s FY2022 annual report eventually proven false, as Axis Bank emerged as the private sector market leader in customer complaints.

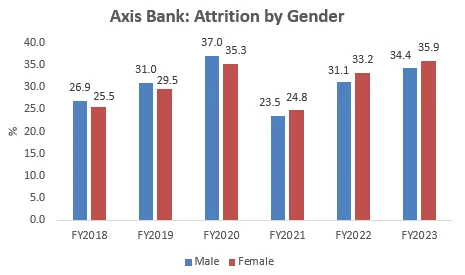

Similarly, records from the bank’s FY2023 annual report show that, far from demonstrating loyalty, Axis employees continued to quit in droves throughout the year. Staff churn rose to 34.8% in FY2023, up from 31.6% in FY2022.

In FY2023, the bank’s attrition rate is the second highest since FY2018. With record client complaints in FY2022 and such significant staff churn, primarily at the entry and mid-management levels, the bank’s entire retail strategy could be jeopardised.

What is less notable is that female worker attrition has been higher than male attrition over the last three years. Apparently, female employees at Axis Bank are dissatisfied for several reasons. Female attrition is at its highest since fiscal year 2018.

From FY2018 to FY2022, Axis Bank was an industry leader in voluntarily disclosing data on employees and attrition. Stakeholders could calculate attrition in various categories such as age bucket, management cadre, gender, and even new hires.

The Securities and Exchange Board of India (SEBI) had mandated attrition disclosure in annual reports beginning in FY2023, and this analyst had believed that Axis Bank would continue to provide such thorough information.

As a result, stakeholders are unaware of the alarming 41% and 58% attrition rates in frontline sales and among the youngest age groups (those under 30), which were recorded in FY2022.

| Attrition | Employees at Year End | |

| < 30 yrs | 14,584 | 35,580 |

| 30-50 yrs | 11,322 | 49,435 |

| > 50 yrs | 54 | 800 |

| Total | 25,960 | 85,815 |

| Top Management | 0 | 9 |

| Senior Management | 21 | 218 |

| Middle Management | 1,002 | 8,909 |

| Junior Management | 8,742 | 37,766 |

| Sales Channels | 16,195 | 38,913 |

| Total | 25,960 | 85,815 |

Freshmen typically take the bank 9 months to break even, but when turnover is this high, the fees become an expense.

The continually high turnover in these categories is a result of the bank’s recruitment team’s subpar selection procedures, insufficient training, and a toxic work environment.

Additionally, stakeholders are made aware that one of the seven observations and actions the board of the bank’s performance evaluation for FY2022 was “oversight on actionables relating to attrition and customer complaints.”

The causes should be made public because increasing turnover causes inconvenience, unhappy customers, and greater employee hiring and training costs. Shareholders must request an explanation from the board of directors at the bank’s annual general meeting, which is set for July 28, 2023.

Confidence in the bank and its board of directors is damaged when a bank makes bold statements in its annual report that are refuted by facts in its own disclosures.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en