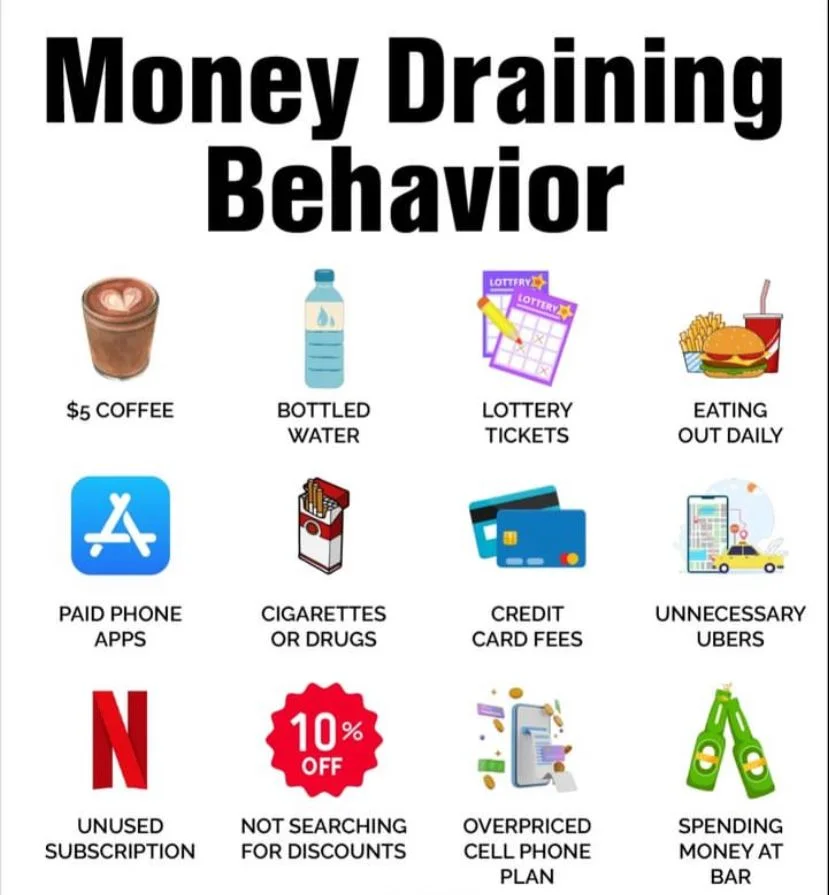

1.Rs 400 Coffee

Starbucks, the well-known global coffee chain, has become a status symbol in India. Even though prices are much higher than in the United States, many Indians are willing to pay more for a cup of coffee that they believe makes them appear cool. While the reasons for the higher prices are complex, one thing is certain: Starbucks has become a brand with which many people in India want to be associated.

Pushkar Singh, a TREMIS professional who specializes in startup advisory and investment, recently shared a detailed explanation of Startbugs overpricing on Linkedin. Singh claims that Starbucks coffee is more expensive in India than other global brands. He uses The Economist’s Big Mac Index, which measures purchasing power parity, to show that the Indian rupee is 52% undervalued against the US dollar based on the price of a Big Mac burger, which serves as a proxy for a basket of goods and services. As a result, a reasonable price for a Starbucks latte in India, which costs $3.26 in the United States, should be around Rs126. However, it is actually priced at Rs292!

According to some sources, Starbucks uses a pricing strategy that takes into account both the cost of production and the desired profit margin. For example, if the cost of producing a cup of coffee is $0.50 and the desired profit margin is 20%, Starbucks would set the price at $0.60 per cup.

The high price of Starbucks coffee in India, on the other hand, can be attributed to a variety of factors, including the cost of doing business in the country, import duties, and the fact that Starbucks is regarded as a luxury brand in India.

2.Bottled Water

That is correct. Many people pay exorbitant prices for bottled water without realizing how inflated the price is. So, let’s look at the costs of bottled water versus regular tap water and see where we can save some money.

Although service fees, state taxes, and other fees may vary, 3785.41 of tap water should cost around Rs905.05 You could fill approximately 7,570 bottles of water at 0.499 fluid ounces each with that amount of water, each bottle costing less than a penny. It’s exactly Rs0.12

Is the water starting to lose its flavor?

This doesn’t mean you should start drinking bad-tasting tap water just to save money. Fortunately, there are numerous ways to obtain sweet-tasting water without breaking the bank.

3.Lottery Ticket

Don’t play the lottery if you truly want to strike it rich. This is a surefire way to spend money quickly — and rich habits don’t include a weekly trip to the convenience store lotto line. According to the World Lottery Association’s 2017 Global Compendium, a total of $293.4 billion was earned by selling lottery tickets worldwide that year. The remaining 29% was used for social welfare programs, while 71% was spent on prize money and costs.

Lotteries are legal in many countries worldwide. However, lotteries are illegal in India. Online lotteries are included. Most Indian states allow people to purchase lottery tickets. Some states, however, outright prohibit the sale of lottery tickets.

In India, there are strict laws prohibiting the operation of lottery schemes. For example, anyone found guilty of running a lottery scheme under Section 419A of the Indian Penal Code faces up to ten years in prison. Online lotteries, on the other hand, are permitted. Mega Millions, Powerball, Lotto, Euro millions, Lucky Dip, and other similar games are available.

The government earns a lot of money from lottery sales through taxation. According to estimates, the government earns about 1 INR billion per month from lottery ticket sales.

India is one of the world’s largest markets for lottery tickets. Indian lotteries are played by over 3.5 billion people. This figure is expected to rise to 4.2 billion by 2023.

4.Eating out daily

Eating out on a regular basis, especially fast food, is not the healthiest habit. It’s simply impossible to resist! This is due to the convenience and familiarity associated with fast food restaurants and fast food chains. We just want to relax at home after a long day at work and not waste time cooking dinner. With a few taps on an app, ordering a box of pizza or a bowl of ramen has never been easier!

Despite the great deals offered by fast food restaurants, eating out is more expensive than cooking your own meals. A five-dollar meal may not appear to be costly, but the costs add up. If you eat out every day, you can spend between S$35 and S$100 in a week. Plan your meals ahead of time and prepare on-the-go snacks (such as sliced apples or fruit-filled yogurts) to save money.

5.Paid Phone app

For almost as long as smartphones have existed, there have been apps that require payment or subscription. We were hesitant to spend large sums of money on apps in the beginning, but that has changed dramatically in recent years, particularly during the pandemic. According to reports, $133 billion will be spent on apps by all smartphone users in 2021, a significant increase from the previous year.

A new SensorTower report sheds some light on how much money users spend on in-app purchases, premium apps, and subscriptions. By the end of the year, Google Play users will have spent approximately $47.9 billion on app purchases through 2021, up from $38.8 billion in 2020. This represents a 23.5% increase year on year.

On the Apple side, the App Store earned $85.1 billion in 2021, up from $72.3 billion in 2020. Growth is statistically lower, at 17.7% — still an improvement, but not as large as Google’s.

Google One is the most profitable app on Google Play — it turns out that 15GB of free Drive storage is insufficient for many people. Piccoma (a Japanese manga subscription service) and Disney+ are close behind.

We haven’t yet discussed games, which, predictably, account for the majority of spending. Users spent $37.3 billion on games on Google Play, accounting for 77.87% of all app purchases. Coin Master, Garena Free Fire, and Genshin Impact are among the top-grossing games on the platform.

6.Cigarettes or Drugs

Smoking increases your chances of developing serious health issues such as stroke, heart disease, emphysema, and cancer. Cigarette smoking, according to the Centers for Disease Control and Prevention, harms nearly every organ in the body. Take care of your health by reducing or quitting smoking.

Let’s start with the average cigarette price. In Singapore last year, the average retail price for a 20-stick pack of cigarettes was S$13.08. A pack-a-day habit will cost you approximately S$4774.02 per year. Think about how much money you can save or invest in a year! When asked how many Indian cigarettes they smoked per day, 38% of Indian respondents said “1 to 5 cigarettes.” In 2022, 1,402 consumers participated in an online survey.

Quitting smoking eliminates the financial and health costs. It is, however, easier said than done. There are several methods for quitting smoking, including cold turkey and cognitive behavioral therapy. Stopping cold turkey means stopping abruptly. According to WebMD, approximately 90% of smokers who attempt to quit use this method. Unfortunately, the majority of them fail. Using this method may cause your body to experience nicotine withdrawal symptoms. Let’s look at the other method. Cognitive Behavioral Therapy (CBT) employs the power of your thoughts, feelings, and mental processing to help you quit smoking. People who are open to counselling and psychotherapy benefit the most from this.

7.Credit card fees

A credit card is similar to eating ice cream from a tub: you may feel guilty for overindulging afterwards, but it’s just too convenient. Sure, it’s simple to swipe the plastic — but you won’t find wealthy people amassing large amounts of credit card interest. They are well aware that it is a waste of money. To avoid interest, only buy what you know you can pay for when your bill arrives. Transfer or consolidate your debt to a credit card with a zero percent introductory APR if you have a balance. Just make certain that you pay off your balance before the promotional period expires.

8.Unnecessary Uber

Ride-hailing apps are luring riders away from public transportation and increasing traffic congestion in many cities. But this does not have to be the case.

Ridership on public transportation has been declining in the United States over the last half-decade. The number of vehicle miles traveled in cars is increasing, and traffic congestion in many US cities is worsening. Simultaneously, the century-old taxi industry is in trouble, with many taxi companies going bankrupt.

Are ride-hailing services like Lyft and Uber to blame? What effect have they had, and what should be done?

While ride-hailing threatens public transportation, it is also critical to its future success – but only if smart policies and price signals are implemented. We have been studying transportation trends for decades as researchers working at the intersection of energy, the environment, and public policy, and we have seen remarkably little innovation. We are now on the verge of major changes. We see ride-hailing through the lens of Daniel Sperling’s new book, Three Revolutions: Navigating the Future of Automated, Shared, and Electric Vehicles.

9.Unused subscription

According to a survey, 42% of consumers are still paying for a subscription they no longer use. Many of these occur as a result of being enticed by a free trial for an online streaming service or a monthly subscription service for clothing or personal items, and then failing to cancel it when the trial period expires. If you have to enter a credit or bank card to get the free trial, keep in mind that if you do not cancel, you will be charged.

Most subscription services have an automatic renewal if you agree to a contract for a set period of time.

“It’s always a good idea to check your bank statements or credit card statements to make sure you’re not getting charged for subscriptions that you don’t want anymore that you don’t use anymore because then you’re just throwing money away,” BBB of Eastern North Carolina’s Meredith Radford said.

You should also be aware that scammers frequently impersonate online subscription services such as Netflix or Spotify, sending you emails or texts claiming your password has been compromised and requesting you to click on a link to verify your account. Never, ever do that. To determine whether you need to take action, always go directly to the company’s website and log in to your account.

10.Not searching for Discount

Some people are not searching for discount and paid sometime over the price. Here are benefits of discount

As previously stated, discounts can benefit both customers and businesses. However, it’s critical to avoid overusing discounts, especially when it comes to businesses. Businesses that offer back-to-back discounts are always taking a risk.

You should be aware that some customers may become accustomed to paying lower prices for items in your store. This is why using discounts on a regular basis is not a good idea. In other words, you should avoid offering discounts too frequently or too frequently. This is especially true if you only offer a few products or a single service. When you do this, these discounts can have an impact on your overall sales, so it’s critical to consider why discounts are necessary.

However, discounts have several advantages, including attracting new customers to purchase your products or services. As a result, offering discounts makes sense if you want to attract and retain new customers. Remember that new customers can bring new opportunities for selling your items, which can help your bottom line in the long run. Above all, discounts can be used to show appreciation to current customers.

11.Overpriced cell phone plan

Overprices cell phone plan like Prepaid connections are typically less expensive than postpaid connections because they provide the same services at a lower cost. Another reason is the inclusion of GST in the Postpaid bill, which raises the postpaid’s overall cost. Here are some additional reasons why postpaid connections cost more than prepaid connections.

Bill Shock is common among postpaid users and can affect almost all of them at some point. When a user receives a bill that is significantly higher than the postpaid plan they are using, this is referred to as bill shock. This could be due to a number of factors, such as incurring roaming charges while away from home or exceeding your postpaid plan’s data limit.

12.Spending Money at Bar

Alcohol is usually not inexpensive, especially in bars and restaurants. According to the Bureau of Labor Statistics, Americans spend about 1% of their gross income on booze, which includes beer, wine, and other hard liquors. This can amount to tens of thousands of dollars over the course of a decade. If you consume alcohol, consider giving yourself a dry week once a month. When out with friends, choose a beer over an expensive cocktail or wine.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en