Initial Public Offer (IPO)

Firstly, the primary market allows investors as well as, to purchase shares at a discounted price prior to the anticipated Initial Public Offer (IPO) listing price. Furthermore, individual investors benefit from reduced rates when applying for upcoming IPOs. Keeping the shares also allows you to participate in the future prosperity of these companies.

Get stock at lowest possible price

Short term profit with lower risk

Hassle free ASBA process

Meet long term goals

No brokerage while applying in New IPOs

Get stock at lowest possible price

Initial Public Offer (IPO) STATISTICS

| Issue Details | Subscription | Price | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | IPO Name | Profile | Issue Size (in crores) | QIB | HNI | RII | Total | Issue | Listing Open | Listing Close | Listing Gains(%) | CMP | Current Gains (%) |

| 26-08-22 | Syrma SGS | View | 840.13 | 42.42 | 7.13 | 2.84 | 15.59 | 220.00 | 262.00 | 313.05 | 42.3 | 308.60 | 40.27 |

| 03-06-22 | Aether Ind | View | 808.04 | 8.00 | 1.33 | 0.59 | 2.91 | 642.00 | 784.00 | 776.75 | 20.99 | 918.35 | 43.05 |

| 01-06-22 | eMudhra | View | 412.79 | 0.00 | 0.01 | 0.44 | 0.23 | 256.00 | 255.00 | 258.85 | 1.11 | 352.00 | 37.50 |

| 31-05-22 | Ethos | View | 472.29 | 0.98 | 0.76 | 0.32 | 0.61 | 878.00 | 808.10 | 805.65 | -8.24 | 1,035.10 | 17.89 |

| 24-05-22 | Delhivery | View | 5235 | 0.47 | 0.27 | 0.31 | 0.39 | 487.00 | 541.00 | 537.25 | 10.32 | 562.05 | 15.41 |

Tamilnad Mercantile Bank Ltd

SBI Capital Markets Ltd

Initial public offering of up to 15,840,000 equity shares of the face value of Rs. 10 each (Equity Shares) of Tamilnad Mercantile Bank Limited (Bank or Issuer) for cash at a price of Rs. [*] per equity share (including a share premium of Rs. [*] per equity share) (the Offer Price) aggregating up to Rs. [*] crores (the Offer) (the Offer). The offer will account for 10% of the paid-up equity share capital after the offer. Price range: Rs. 500-525 per equity share with a face value of Rs. 10 each. The floor price is 50 times the equity shares’ face value, and the cap price is 52.50 times the equity shares’ face value. Bids can be placed for as few as 28 equity shares and in multiples of 28 equity shares after that.

Issue

Open on 5 Sep 2022

Close on 7 Sep 2022

Money Payable on

Application 1025

Allotment 0

Project Cost (Cr) 0

Post Issue Equity Share Capital (Cr) 0

Issue price (D) 500

Further Multiples of 28

Projects

Promoted By

Listed At NSE

Registrar to the Issue- Link Intimate India Pvt Ltd

57 Victoria Extension

Road Thoothukundi

Tamil Nadu-628002

Phone-91-461-2325136

Fax- Email-

secretarial@tmbank.in

Website- www.tmb.in

Go Airlines Ltd

Go Airlines is an ultra-low-cost carrier (“ULCC”) focused on maintaining low unit costs and delivering compelling value to customers that drives its unit revenues. The IPO issue size is tentatively anticipated to be around ₹3,600 Crs, whereas the date of the issue is yet to be declared.

Arohan Finance Ltd

Arohan Financial Services ltd is a leading NBFC-MFI with operations in financially under-penetrated Low Income States of India. The NBFC company provides income generating loans & other financial inclusion related products. The IPO size for the IPO is tentatively stated to be around ₹1800 crores.

MobiKwik Ltd

Mobikwirk is a Fintech company which was incorporated in the year 2009. Ranked amongst one of the largest mobile wallets players in India, the company has operations divided into 3 segments. The total issue size of the latest IPO of Mobikwik Ltd is expected to be around Rs 1900 crores, which includes a fresh issue of ₹1500 crores & an OFS for ₹400 Crores.

Utkarsh Small Finance Bank

Utkarsh Small Finance Bank provides microfinance options to underserved or unserved segments, particularly in the states of Bihar and Uttar Pradesh. The main aim of Utkarsh Small Finance Bank IPO is to raise capital for further enhancements. The IPO will include a fresh issue of shares that amount to ₹750 Crores & provide an offer of ₹600 Crores for sale.

Ixigo

Ixigo is a technology company focused on empowering Indian travelers to plan, book and manage their trips across rail, air, buses and hotels. The company assists travelers in making smarter travel decisions through innovations on its OTA platforms, comprising the websites and mobile applications. The IPO issue size is estimated to be around ₹1,600 Cr, opening in early 2022.

Penna Cement

Penna Cement Industries is one of the largest privately held cement companies in India and a leading integrated cement player in terms of cement production capacity, as of March 31, 2021. The total issue size of the latest IPO of Lava International Ltd is expected to be around ₹1550 crores.

Keventer Agro

Based out of Kolkata, Keventer Agro Ltd, is a fast moving consumer goods (FMCG) company, which keeps interest in packaged, dairy, and fresh food products. The IPO will aim to raise a capital of ₹800 crores, which shall include both a fresh issue and an Offer for sale.

Paradeep Phosphates

Paradeep Phosphates, a leading fertilizer company, is primarily engaged in manufacturing, trading, distribution and sales of a variety of complex fertilizers such as di-ammonium phosphate (DAP) and NPK fertilizers. The IPO comprises a fresh issue of equity shares worth ₹1,255 crore & an offer for sale (OFS) of up to 12,00,35,800 shares.

Sterlite Power

Sterlite Power, is a leading private sector power transmission infrastructure developer and solutions provider, operating in India and Brazil. The IPO issue size of the company is anticipated to be around ₹1,250, which will include both – a fresh issue and an offer for sale.

Fincare Small Finance Bank

Headquartered in Bengaluru, Fincare Small Finance Bank is a micro-financing bank, which provides a wide range of banking services to its customers numbered over 25 lakhs. The total issue size of the latest IPO of Fincare Small Finance Bank Ltd is expected to be around ₹1330 crore, comprising a fresh issue of ₹330 crores & an OFS will stand at ₹1000 crores, as per the DRHP filed.

Seven Islands Shipping

Headquartered in Mumbai, Seven Islands Shipping Limited is a seaborne logistics company, incorporated in 2002. It is engaged in the trading of petrochemical lubricants, crude oil, and more. The company aims to raise funds worth ₹600 crores via public issue, which shall include a fresh issue of ₹400 crores.

Bajaj Energy

Bajaj Energy and Lalitpur Power Generation Company Ltd, are amongst the largest private sector thermal power generation companies in North India. The company deals in developing and financing thermal power plants in India, and aims to raise a capital of ₹5450 via IPO in the mid 2022.

Gemini Edibles and Fats Ltd

Headquartered in Hyderabad, Telangana, Gemini Edibles and Fats Ltd is one of the leading and the fastest growing edible oils and fats companies in India. According to the DRHP filed by the company, the IPO will aim to raise ₹2500 Crores, slated to go live in the mid 2022.

Medi Assist Healthcare Services Ltd

Medi Assist Healthcare Services Ltd, Bengaluru-based healthcare company, aims to raise funds via an initial public offering which aggregate upto ₹840-1,000 crore. The IPO will consist of a pure offer for sale of 2.8 crore equity shares by Dr. Vikram Jit Singh, Medimatter Health management, Bessemer Health Capital LLC, and Investcorp Pvt. ATE Equity Fund.

Inspira Enterprise India Ltd.

The company is a leading cybersecurity and digital transformation services company in India as well as globally. The company aims to raise a capital ₹800 crores via an IPO. The IPO consists of a fresh issue of ₹300 crores & an offer for sale of ₹500 crores by its existing shareholders & promoters.

Muthoot Microfin

Incorporated in 1997, Muthoot Finance Ltd is the Kerala – based largest gold financing company in India in terms of loan portfolio. The company is planning to go live with its IPO to raise a fund of ₹700 crores through 51,500,000 Equity Shares.

Chemspec Chemicals

Chemspec Chemicals is a leading manufacturer of critical additives for the FMCG ingredients used in hair and skincare products worldwide. According to the DRHP filed by the company, the IPO will aim to raise ₹700 Crores, slated to go live in the mid 2022.

VLCC Healthcare

Founded in 1996, VLCC Healthcare Ltd is a beauty and wellness company. The company operates its business through its 3 core business models – 1) Wellness & Beauty Clinic; 2) Personal care products; and 3) Institutes for skill development. The IPO will issue a fresh issue of ₹700 Crores, which will be coming out in December 2021.

Tamilnad Mercantile Bank

Tamilnad Mercantile Bank Limited is one of the oldest and leading old private sector banks in India which offers a wide range of banking & financial services primarily to micro, small & medium enterprises. The IPO will aim to raise a capital of ₹1000 crores, which shall include both a fresh issue and an Offer for sale.

HDB Financial

A subsidiary of HDFC Bank, the NBFC company is amongst the leading private sector companies in the lending business. As per the DRHP filed with SEBI, the company aims to capture a valuation of ₹60,000 to ₹65,000 crores with its IPO, the size of which is yet to be declared.

Century Metal Recycling

Century Metal Recycling Limited (CMR), is India’s largest producer of Aluminium and Zinc die-casting alloys with a combined annual capacity of over 218,000 MT. The company intends to go live with its IPO in 2022, whereas the issue size and the date are yet to be finalized.

OYO Rooms – Oravel Stays

Founded in the year 2013, Oravel Stays Ltd, styled as OYO Rooms offers a new-age technology platform that empowers the large yet highly fragmented global hospitality ecosystem. The total issue size of the IPO is expected to be ₹7000 crores issued via fresh issue. The IPO date is yet to be announced.

National Stock Exchange of India Ltd

NSE is the leading stock exchange in India & the 4th largest in the world by equity trading volume in 2015. The company owns & manages the NIFTY 50 index, a leading benchmark for the Indian capital markets. The issue size for the IPO is estimated to be around ₹10,000 crores whereas the date of issue is yet to be declared.

Delhivery

Delhivery Limited is one of the largest and fastest-growing fully-integrated logistics services players in India. With a nationwide network that spans to 71 fulfillment centers, the company plans to go live with its IPO in 2022. The company aims to raise funds of Rs 5000 via fresh issue and another sum via an offer for sale (OFS) which is yet to be declared.

Navi

Bengaluru-based Navi Group is a financial services company which provides personal loans and home loans through Navi Finserv, and health insurance through Navi General Insurance. The company plans to go public in 2022, with an undisclosed issue size.

Snapdeal

Snapdeal Limited, India’s largest pure-play value e-commerce platform. With over 200 million app installations on Google Play Store, it is the most installed pure-play value e-commerce application. The company is planning to go public with its IPO via fresh issue of ₹1250 crores and an additional capital raised through OFS.

OLA

OLA has become the largest ride-hailing aggregator in India, beating Uber. In 2021, the company also entered the electric vehicle market by manufacturing the electric two-wheeler vehicles, thereby promising a healthy start. The ride-hailing company is expected to go public in 2022, with an anticipated issue size of Rs 2000 crores.

BYJU’s

BYJU’s The largest online education company in India, BYJU’s current valuation stands at $15 Billion, making it one of the most valued companies in India. With online learning modules flourishing, the company aims to provide another booster to its business by going public this year.

Swiggy

BYJU’s Indian food delivery company Swiggy, which is backed by SoftBank Group, has started preparations to raise at least $800 million in an IPO early next year. The food delivery company doubled its valuation to $10.7 billion in its latest funding round in January 2022. Swiggy’s grocery delivery service Instamart is an addition to its food delivery business, spanning its control over the delivery-related sector in India.

AGS Transact Technologies Ltd

One of the largest integrated omni-channel payment solutions providers in India, AGS Transact Technologies Ltd went public on 21st Jan 2022. The IPO was subscribed over 3.25 times in the retail category and closed at Rs 160.5, experiencing a fall of 8.29%

Adani Wilmar Ltd

The company is one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat, flour, rice, pulses, etc. The company went public on 31st Jan 2022 and was subscribed over 4 times in the retail category to close at Rs 267.35, experiencing a gain of 16.24%

Vedant Fashion Ltd

Vedant Fashion Ltd is India’s leading company in the men’s Indian wedding and celebration wear sector. The company went public on 8th February 2022 and was subscribed over 2.57 times overall to close at Rs 943.05, experiencing a gain of 8.90%

| Issue Details | Subscription | Price | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | IPO Name | Profile | Issue Size (in crores) | QIB | HNI | RII | Total | Issue | Listing Open | Listing Close | Listing Gains(%) | CMP | Current Gains (%) |

| 26-08-22 | Syrma SGS | View | 840.13 | 42.42 | 7.13 | 2.84 | 15.59 | 220.00 | 262.00 | 313.05 | 42.3 | 308.60 | 40.27 |

| 03-06-22 | Aether Ind | View | 808.04 | 8.00 | 1.33 | 0.59 | 2.91 | 642.00 | 784.00 | 776.75 | 20.99 | 918.35 | 43.05 |

| 01-06-22 | eMudhra | View | 412.79 | 0.00 | 0.01 | 0.44 | 0.23 | 256.00 | 255.00 | 258.85 | 1.11 | 352.00 | 37.50 |

| 31-05-22 | Ethos | View | 472.29 | 0.98 | 0.76 | 0.32 | 0.61 | 878.00 | 808.10 | 805.65 | -8.24 | 1,035.10 | 17.89 |

| 24-05-22 | Delhivery | View | 5235 | 0.47 | 0.27 | 0.31 | 0.39 | 487.00 | 541.00 | 537.25 | 10.32 | 562.05 | 15.41 |

| 24-05-22 | Venus Pipes | View | 165.42 | 6.01 | 6.59 | 10.90 | 8.58 | 326.00 | 352.00 | 351.75 | 7.9 | 400.30 | 22.79 |

| 20-05-22 | Prudent Advisor | View | 538.61 | 1.23 | 0.74 | 0.61 | 0.81 | 630.00 | 502.10 | 562.70 | -10.68 | 606.50 | -3.73 |

| 17-05-22 | LIC India | View | 21000 | 1.70 | 1.39 | 1.14 | 1.64 | 949.00 | 867.20 | 875.45 | -7.75 | 664.90 | -29.94 |

| 10-05-22 | Rainbow Child | View | 1595.59 | 16.40 | 1.37 | 0.71 | 5.26 | 542.00 | 506.00 | 450.10 | -16.96 | 620.70 | 14.52 |

| 09-05-22 | Campus Active | View | 1400.14 | 84.22 | 10.68 | 4.73 | 28.55 | 292.00 | 355.00 | 378.60 | 29.66 | 495.15 | 69.57 |

| 13-04-22 | Hariom Pipe | View | 130.05 | 0.70 | 2.68 | 6.92 | 3.57 | 153.00 | 214.00 | 224.70 | 46.86 | 273.45 | 78.73 |

| 11-04-22 | Veranda Learn | View | 200 | 1.61 | 2.09 | 5.68 | 2.24 | 137.00 | 171.00 | 160.40 | 17.08 | 318.15 | 132.23 |

| 07-04-22 | Uma Exports | View | 60 | 0.00 | 0.00 | 0.00 | 0.00 | 68.00 | 80.00 | 84.00 | 23.53 | 52.15 | -23.31 |

| 16-02-22 | Vedant Fashions | View | 3149 | 7.49 | 1.07 | 0.39 | 2.57 | 866.00 | 950.00 | 934.85 | 7.95 | 1,295.75 | 49.62 |

| 08-02-22 | Adani Wilmar | View | 3600 | 5.73 | 56.30 | 3.92 | 17.37 | 230.00 | 274.00 | 265.20 | 15.3 | 676.10 | 193.96 |

| 31-01-22 | AGS Transact | View | 716.87 | 2.68 | 25.61 | 3.08 | 7.79 | 175.00 | 176.00 | 161.30 | -7.83 | 85.10 | -51.37 |

| 31-12-21 | CMS Info System | View | 1100 | 1.98 | 1.45 | 2.15 | 1.95 | 216.00 | 242.95 | 237.40 | 9.91 | 260.70 | 20.69 |

| 28-12-21 | Supriya Lifesci | View | 700 | 31.83 | 161.22 | 56.01 | 71.51 | 274.00 | 425.00 | 390.35 | 42.46 | 354.60 | 29.42 |

| 27-12-21 | HP Adhesives | View | 125.96 | 1.82 | 19.04 | 81.24 | 20.96 | 274.00 | 319.00 | 334.95 | 22.24 | 458.60 | 67.37 |

| 24-12-21 | Data Patterns | View | 601.2 | 190.86 | 254.22 | 23.14 | 119.62 | 585.00 | 864.00 | 754.85 | 29.03 | 1,069.95 | 82.90 |

| 22-12-21 | Metro Brands | View | 1376.63 | 8.49 | 3.02 | 1.13 | 3.64 | 500.00 | 436.00 | 493.55 | -1.29 | 793.90 | 58.78 |

| 21-12-21 | C. E. Info Syst | View | 1039.61 | 196.36 | 424.69 | 15.20 | 154.71 | 1033.00 | 1581.00 | 1394.55 | 35 | 1,343.10 | 30.02 |

| 20-12-21 | Shriram Prop | View | 600 | 1.85 | 4.82 | 12.72 | 4.60 | 118.00 | 94.00 | 99.40 | -15.76 | 82.05 | -30.47 |

| 17-12-21 | Rategain Travel | View | 1354 | 8.42 | 42.04 | 8.08 | 17.41 | 425.00 | 364.80 | 340.50 | -19.88 | 295.15 | -30.55 |

| 14-12-21 | Anand Rathi | View | 660 | 2.50 | 25.42 | 7.76 | 9.78 | 550.00 | 584.45 | 583.50 | 6.09 | 648.40 | 17.89 |

| 13-12-21 | Tega Industries | View | 619.23 | 215.45 | 666.19 | 29.44 | 219.04 | 453.00 | 753.00 | 725.50 | 60.15 | 565.25 | 24.78 |

| 10-12-21 | Star Health | View | 7318.15 | 1.03 | 0.19 | 1.10 | 0.79 | 900.00 | 903.00 | 906.85 | 0.76 | 742.60 | -17.49 |

| 26-11-21 | Tarsons Product | View | 1030.22 | 1.06 | 3.40 | 2.49 | 2.27 | 662.00 | 700.00 | 840.00 | 26.89 | 770.95 | 16.46 |

| 23-11-21 | Latent View | View | 622.11 | 145.48 | 850.66 | 119.44 | 326.49 | 197.00 | 530.00 | 488.60 | 148.02 | 388.00 | 96.95 |

| 18-11-21 | One 97 Paytm | View | 18915.9 | 2.79 | 0.24 | 1.66 | 1.89 | 2150.00 | 1955.00 | 1564.15 | -27.25 | 727.55 | -66.16 |

| 18-11-21 | Sapphire Foods | View | 2073 | 3.11 | 2.34 | 5.25 | 3.29 | 1180.00 | 1311.00 | 1216.05 | 3.06 | 1,349.60 | 14.37 |

| 15-11-21 | SJS Enterprises | View | 816.57 | 1.42 | 2.32 | 1.38 | 1.59 | 542.00 | 514.00 | 509.85 | -5.93 | 524.05 | -3.31 |

| 15-11-21 | PB Fintech | View | 6273.5 | 9.83 | 2.58 | 1.67 | 6.48 | 980.00 | 1444.00 | 1202.90 | 22.74 | 483.05 | -50.71 |

| 15-11-21 | Sigachi Ind | View | 0 | 42.15 | 78.82 | 41.26 | 49.56 | 163.00 | 575.00 | 603.75 | 270.4 | 298.10 | 82.88 |

| 12-11-21 | Fino Payments | View | 1209 | 1.65 | 0.21 | 5.92 | 2.03 | 577.00 | 548.00 | 545.25 | -5.5 | 262.20 | -54.56 |

| 10-11-21 | FSN E-Co Nykaa | View | 5375 | 91.18 | 112.02 | 12.24 | 81.78 | 1125.00 | 2001.00 | 2206.70 | 96.15 | 1,363.35 | 21.19 |

| 11-10-21 | ABSL AMC | View | 2768 | 4.10 | 2.60 | 1.68 | 2.43 | 712.00 | 697.50 | 699.65 | -1.73 | 473.95 | -33.43 |

| 01-10-21 | Paras Defence | View | 181.13 | 90.48 | 435.14 | 61.42 | 150.07 | 175.00 | 475.00 | 498.75 | 185 | 694.80 | 297.03 |

| 24-09-21 | Sansera Eng | View | 1282 | 26.47 | 11.37 | 3.15 | 11.47 | 744.00 | 845.05 | 818.70 | 10.04 | 717.50 | -3.56 |

| 14-09-21 | AMI Organics | View | 571.96 | 86.64 | 154.81 | 13.36 | 64.54 | 610.00 | 902.00 | 934.55 | 53.2 | 995.70 | 63.23 |

| 14-09-21 | Vijaya Diagnost | View | 1895.04 | 13.07 | 1.32 | 1.09 | 4.54 | 531.00 | 542.30 | 619.30 | 16.63 | 380.70 | -28.31 |

| 06-09-21 | APTUS VALUE | View | 2790 | 32.41 | 33.91 | 1.35 | 17.20 | 353.00 | 360.00 | 374.05 | 5.96 | 352.15 | -0.24 |

| 24-08-21 | CHEMPLAST SANMA | View | 3929.91 | 2.70 | 1.03 | 2.29 | 2.17 | 541.00 | 570.00 | 534.90 | -1.13 | 420.80 | -22.22 |

| 23-08-21 | Nuvoco Vistas | View | 5089.29 | 0.10 | 0.02 | 0.24 | 0.15 | 570.00 | 471.00 | 531.30 | -6.79 | 355.00 | -37.72 |

| 20-08-21 | CarTrade Tech | View | 2998 | 0.55 | 0.09 | 0.81 | 0.58 | 1618.00 | 1600.00 | 1500.10 | -7.29 | 645.00 | -60.14 |

| 16-08-21 | Windlas Biotech | View | 405.95 | 24.40 | 15.73 | 24.27 | 22.47 | 460.00 | 439.00 | 406.70 | -11.59 | 221.00 | -51.96 |

| 16-08-21 | Exxaro Tiles | View | 161.09 | 17.67 | 5.36 | 40.10 | 22.68 | 120.00 | 126.00 | 132.25 | 10.21 | 114.80 | -4.33 |

| 16-08-21 | Devyani Int | View | 1858 | 95.27 | 213.06 | 39.52 | 116.71 | 90.00 | 141.00 | 123.35 | 37.06 | 182.00 | 102.22 |

| 16-08-21 | Krsnaa Diagnost | View | 1222 | 49.83 | 116.30 | 42.04 | 64.40 | 954.00 | 1025.00 | 990.75 | 3.85 | 483.65 | -49.30 |

| 09-08-21 | Rolex Rings | View | 732.27 | 143.58 | 360.11 | 24.49 | 130.44 | 900.00 | 1249.00 | 1166.55 | 29.62 | 1,872.05 | 108.01 |

| 06-08-21 | Glenmark Life | View | 1513 | 0.98 | 0.87 | 4.61 | 2.78 | 720.00 | 752.00 | 748.20 | 3.92 | 439.20 | -39.00 |

| 29-07-21 | Tatva Chintan | View | 500 | 2.55 | 9.78 | 13.36 | 9.50 | 1083.00 | 2111.80 | 2310.25 | 113.32 | 2,442.30 | 125.51 |

| 23-07-21 | Zomato | View | 9375 | 51.79 | 32.96 | 7.45 | 38.25 | 76.00 | 115.00 | 125.85 | 65.59 | 59.70 | -21.45 |

| 19-07-21 | Clean Science | View | 1546 | 156.37 | 206.43 | 9.00 | 93.41 | 900.00 | 1784.40 | 1585.20 | 76.13 | 1,755.40 | 95.04 |

| 19-07-21 | G R Infra | View | 963.28 | 93.18 | 73.01 | 4.89 | 43.48 | 837.00 | 1700.00 | 1746.80 | 108.7 | 1,350.00 | 61.29 |

| 07-07-21 | India Pesticide | View | 800 | 2.64 | 1.36 | 4.40 | 3.25 | 296.00 | 360.00 | 335.45 | 13.33 | 279.25 | -5.66 |

| 05-07-21 | Krishna Inst. | View | 2146 | 5.26 | 1.89 | 2.90 | 3.86 | 825.00 | 1009.00 | 1096.80 | 32.95 | 1,267.35 | 53.62 |

| 28-06-21 | Dodla Dairy | View | 521 | 84.88 | 73.26 | 11.34 | 45.62 | 428.00 | 550.00 | 609.10 | 42.31 | 553.15 | 29.24 |

| 24-06-21 | Sona BLW | View | 5550 | 1.57 | 0.22 | 0.66 | 1.04 | 291.00 | 302.40 | 362.85 | 24.69 | 523.50 | 79.90 |

| 24-06-21 | Shyam Metalics | View | 909 | 62.18 | 172.51 | 5.29 | 56.56 | 306.00 | 380.00 | 375.85 | 22.83 | 296.40 | -3.14 |

| 14-05-21 | PowerGrid InvIT | View | 7734.99 | 0.00 | 0.00 | 0.00 | 0.00 | 100.00 | 104.00 | 102.98 | 2.98 | 137.70 | 37.70 |

| 19-04-21 | Macrotech Dev | View | 2500 | 3.05 | 1.44 | 0.40 | 1.36 | 486.00 | 439.00 | 463.15 | -4.7 | 1,090.05 | 124.29 |

| 07-04-21 | Barbeque Nat | View | 453.6 | 0.00 | 0.00 | 0.00 | 0.00 | 500.00 | 492.00 | 590.40 | 18.08 | 1,147.75 | 129.55 |

| 30-03-21 | Nazara | View | 582.91 | 52.82 | 148.42 | 34.49 | 75.04 | 1101.00 | 1971.00 | 788.40 | -28.39 | 665.70 | -39.54 |

| 26-03-21 | Kalyan Jeweller | View | 1175 | 1.18 | 0.97 | 1.47 | 1.28 | 87.00 | 73.90 | 75.30 | -13.45 | 84.80 | -2.53 |

| 26-03-21 | Suryoday Small | View | 582.34 | 2.18 | 1.31 | 3.09 | 2.37 | 305.00 | 274.75 | 276.20 | -9.44 | 100.85 | -66.93 |

| 25-03-21 | Craftsman | View | 823.7 | 0.56 | 0.05 | 1.04 | 0.69 | 1490.00 | 1440.00 | 1433.00 | -3.83 | 2,650.00 | 77.85 |

| 25-03-21 | Laxmi Organic | View | 600 | 1.13 | 0.73 | 4.41 | 2.68 | 130.00 | 173.00 | 164.60 | 26.62 | 327.05 | 151.58 |

| 24-03-21 | Anupam Rasayan | View | 760 | 30.80 | 62.06 | 4.62 | 23.86 | 555.00 | 534.70 | 525.90 | -5.24 | 766.70 | 38.14 |

| 19-03-21 | Easy Trip | View | 510 | 0.00 | 2.79 | 14.48 | 3.39 | 187.00 | 182.00 | 104.15 | -44.3 | 382.50 | 104.55 |

| 15-03-21 | MTAR Tech | View | 596.41 | 52.01 | 522.35 | 12.78 | 133.18 | 575.00 | 990.05 | 1082.25 | 88.22 | 1,664.70 | 189.51 |

| 05-03-21 | Heranba | View | 60 | 25.98 | 108.72 | 4.82 | 33.13 | 627.00 | 900.00 | 812.25 | 29.55 | 561.95 | -10.37 |

| 26-02-21 | Railtel | View | 819.24 | 22.03 | 51.40 | 7.08 | 20.68 | 94.00 | 109.00 | 121.40 | 29.15 | 100.90 | 7.34 |

| 25-02-21 | Nureca | View | 100 | 0.24 | 17.10 | 74.29 | 17.98 | 400.00 | 634.95 | 666.65 | 66.66 | 990.00 | 147.50 |

| 05-02-21 | Stove Kraft | View | 412.63 | 8.02 | 32.72 | 26.04 | 18.03 | 385.00 | 498.00 | 445.95 | 15.83 | 622.90 | 61.79 |

| 03-02-21 | Home First | View | 1153.72 | 52.53 | 39.00 | 6.59 | 26.66 | 518.00 | 612.15 | 527.40 | 1.81 | 930.95 | 79.72 |

| 02-02-21 | Indigo Paints | View | 1170.56 | 96.21 | 115.76 | 6.50 | 54.84 | 1490.00 | 2607.50 | 3118.65 | 109.31 | 1,592.30 | 6.87 |

| 29-01-21 | IRFC | View | 4633 | 0.89 | 0.52 | 1.59 | 1.16 | 26.00 | 25.00 | 24.85 | -4.42 | 22.00 | -15.38 |

| 01-01-21 | Antony Waste | View | 300.53 | 0.64 | 0.28 | 7.22 | 3.85 | 315.00 | 430.00 | 407.25 | 29.29 | 356.35 | 13.13 |

| 24-12-20 | Bectors Food | View | 540.54 | 176.85 | 620.86 | 29.33 | 198.02 | 288.00 | 501.00 | 595.55 | 106.79 | 344.55 | 19.64 |

| 14-12-20 | Restaurant Bran | View | 796.5 | 86.64 | 354.11 | 68.15 | 156.65 | 60.00 | 115.35 | 138.40 | 130.67 | 130.65 | 117.75 |

| 20-11-20 | Gland | View | 6479.55 | 6.40 | 0.51 | 0.24 | 2.06 | 1500.00 | 1710.00 | 1820.45 | 21.36 | 2,566.25 | 71.08 |

| 02-11-20 | Equitas Bank | View | 517.6 | 3.91 | 0.22 | 2.08 | 1.95 | 33.00 | 31.00 | 32.75 | -0.76 | 45.75 | 38.64 |

| 12-10-20 | UTI AMC | View | 2159.88 | 3.34 | 0.93 | 2.32 | 2.31 | 554.00 | 476.20 | 476.60 | -13.97 | 850.25 | 53.47 |

| 12-10-20 | Mazagon Dock | View | 443.69 | 89.71 | 678.88 | 35.63 | 157.41 | 145.00 | 216.25 | 173.00 | 19.31 | 397.55 | 174.17 |

| 05-10-20 | Angel One | View | 600 | 5.74 | 0.69 | 4.31 | 3.94 | 306.00 | 275.00 | 275.85 | -9.85 | 1,327.95 | 333.97 |

| 01-10-20 | CAMS | View | 2244.33 | 73.18 | 111.85 | 5.55 | 46.99 | 1230.00 | 1535.00 | 1401.60 | 13.95 | 2,304.40 | 87.35 |

| 01-10-20 | Chemcon Special | View | 318 | 113.54 | 449.14 | 41.21 | 149.33 | 340.00 | 731.00 | 584.80 | 72 | 403.25 | 18.60 |

| 21-09-20 | Route | View | 600 | 89.76 | 192.81 | 12.67 | 73.30 | 350.00 | 708.00 | 651.10 | 86.03 | 1,439.45 | 311.27 |

| 17-09-20 | Happiest Minds | View | 702.02 | 77.43 | 351.46 | 70.94 | 150.98 | 166.00 | 351.00 | 371.00 | 123.49 | 1,022.25 | 515.81 |

| 23-07-20 | Rossari | View | 496.25 | 2.75 | 4.34 | 2.51 | 2.97 | 425.00 | 670.00 | 742.35 | 74.67 | 977.90 | 130.09 |

| 16-03-20 | SBI Card | View | 10286.2 | 57.18 | 45.23 | 2.50 | 26.54 | 755.00 | 658.00 | 683.20 | -9.51 | 932.25 | 23.48 |

| 30-12-19 | Prince Pipes | View | 500 | 3.54 | 1.21 | 1.89 | 2.21 | 178.00 | 160.00 | 166.60 | -6.4 | 590.90 | 231.97 |

| 12-12-19 | Ujjivan Small | View | 750 | 110.72 | 473.00 | 49.09 | 165.68 | 37.00 | 58.75 | 55.90 | 51.08 | 20.85 | -43.65 |

| 04-12-19 | CSB Bank | View | 409.68 | 38.85 | 45.49 | 9.01 | 35.24 | 195.00 | 275.00 | 300.10 | 53.9 | 216.55 | 11.05 |

| 14-10-19 | IRCTC | View | 635.04 | 108.79 | 354.52 | 14.94 | 111.95 | 320.00 | 644.00 | 145.72 | -54.46 | 712.80 | 122.75 |

| 20-08-19 | Sterling Wilson | View | 3125 | 1.02 | 0.89 | 0.30 | 0.85 | 780.00 | 700.00 | 725.35 | -7.01 | 302.05 | -61.28 |

| 04-07-19 | Indiamart Inter | View | 474.12 | 30.83 | 62.13 | 14.07 | 36.21 | 973.00 | 1180.00 | 1302.55 | 33.87 | 4,756.20 | 388.82 |

| 08-05-19 | Neogen | View | 131.48 | 30.49 | 113.88 | 16.06 | 41.18 | 0.00 | 251.00 | 263.55 | 0 | 1,531.30 | |

| 15-04-19 | Metropolis | View | 1200.18 | 8.88 | 3.03 | 2.21 | 5.84 | 880.00 | 960.00 | 959.55 | 9.04 | 1,409.70 | 60.19 |

| 11-04-19 | Rail Vikas | View | 430.88 | 1.36 | 0.80 | 2.92 | 1.82 | 19.00 | 19.00 | 19.05 | 0.26 | 32.70 | 72.11 |

| 01-04-19 | Embassy Office | View | 4750 | 2.15 | 3.09 | 0.31 | 2.57 | 300.00 | 300.00 | 314.10 | 4.7 | 365.76 | 21.92 |

| 29-03-19 | MSTC | View | 213.81 | 1.13 | 2.15 | 2.95 | 1.46 | 128.00 | 111.00 | 114.20 | -10.78 | 269.85 | 110.82 |

| 07-02-19 | Chalet Hotels | View | 1628.84 | 4.66 | 1.10 | 0.03 | 1.57 | 280.00 | 291.00 | 290.40 | 3.71 | 334.30 | 19.39 |

| 04-02-19 | Xelpmoc Design | View | 23 | 1.24 | 7.69 | 2.64 | 3.25 | 66.00 | 56.00 | 58.80 | -10.91 | 169.00 | 156.06 |

| 08-10-18 | AAVAS Financier | View | 1729.2 | 2.77 | 0.26 | 0.25 | 0.97 | 821.00 | 758.00 | 773.15 | -5.83 | 2,274.10 | 176.99 |

| 23-08-18 | CreditAccess Gr | View | 1126.44 | 5.52 | 0.98 | 0.88 | 2.22 | 422.00 | 393.00 | 420.80 | -0.28 | 992.65 | 135.23 |

| 30-07-18 | TCNS Clothing C | View | 1121.98 | 13.47 | 5.08 | 0.67 | 5.27 | 716.00 | 715.00 | 657.80 | -8.13 | 663.50 | -7.33 |

| 02-07-18 | Fine Organics | View | 597.87 | 12.86 | 21.01 | 1.62 | 8.99 | 783.00 | 815.00 | 822.80 | 5.08 | 6,159.90 | 686.70 |

| 02-07-18 | RITES | View | 453.6 | 71.72 | 194.56 | 15.74 | 67.24 | 185.00 | 190.00 | 170.16 | -8.02 | 298.70 | 61.46 |

| 21-05-18 | Indostar Capita | View | 1844 | 16.08 | 6.91 | 1.48 | 6.80 | 572.00 | 600.60 | 585.50 | 2.36 | 182.50 | -68.09 |

| 05-04-18 | ICICI Securitie | View | 4016 | 0.54 | 0.05 | 0.39 | 0.36 | 520.00 | 435.00 | 444.90 | -14.44 | 499.75 | -3.89 |

| 04-04-18 | Mishra Dhatu Ni | View | 438.38 | 1.96 | 0.12 | 0.72 | 1.21 | 0.00 | 93.10 | 90.00 | 0 | 201.75 | |

| 28-03-18 | Hindustan Aeron | View | 4229 | 1.73 | 0.03 | 0.39 | 0.99 | 1215.00 | 1159.00 | 1128.35 | -7.13 | 2,369.90 | 95.05 |

| 27-03-18 | Bandhan Bank | View | 4473 | 38.67 | 13.89 | 1.20 | 14.63 | 375.00 | 485.00 | 477.20 | 27.25 | 276.15 | -26.36 |

| 23-03-18 | Bharat Dynamics | View | 960.94 | 1.50 | 0.50 | 1.41 | 1.30 | 428.00 | 360.00 | 390.70 | -8.71 | 833.25 | 94.68 |

| 09-03-18 | HG Infra Engg | View | 457.7 | 8.37 | 4.97 | 3.08 | 4.98 | 270.00 | 270.00 | 270.05 | 0.02 | 599.00 | 121.85 |

| 26-02-18 | Aster DM Health | View | 980.14 | 2.10 | 0.55 | 1.18 | 1.31 | 190.00 | 182.00 | 179.85 | -5.34 | 231.60 | 21.89 |

| 08-02-18 | Galaxy Surfacta | View | 937.09 | 54.67 | 6.96 | 6.00 | 20.00 | 1480.00 | 1525.00 | 1698.10 | 14.74 | 3,250.00 | 119.59 |

| 30-01-18 | Amber Enterpris | View | 600 | 174.99 | 519.26 | 11.65 | 165.42 | 859.00 | 1175.00 | 1237.25 | 44.03 | 2,251.65 | 162.12 |

| 29-01-18 | Newgen Software | View | 424.62 | 15.62 | 5.52 | 5.18 | 8.25 | 245.00 | 256.00 | 253.00 | 3.27 | 396.95 | 62.02 |

| 22-01-18 | Apollo Micro Sy | View | 156 | 101.93 | 958.07 | 40.19 | 248.51 | 275.00 | 478.00 | 454.10 | 65.13 | 148.50 | -46.00 |

| 29-12-17 | Astron Paper & | View | 70 | 103.35 | 396.99 | 77.93 | 243.29 | 50.00 | 120.75 | 119.70 | 139.4 | 38.25 | -23.50 |

| 18-12-17 | Future Supply | View | 649.69 | 12.36 | 11.15 | 3.28 | 7.56 | 664.00 | 674.00 | 685.80 | 3.28 | 27.10 | -95.92 |

| 15-12-17 | Shalby | View | 504.8 | 4.34 | 0.42 | 2.98 | 2.82 | 248.00 | 237.00 | 239.25 | -3.53 | 128.65 | -48.13 |

| 17-11-17 | HDFC Life | View | 8695.01 | 16.60 | 2.29 | 0.90 | 4.89 | 290.00 | 313.00 | 344.25 | 18.71 | 574.90 | 98.24 |

| 14-11-17 | Khadim India | View | 493.06 | 2.45 | 0.18 | 2.34 | 1.90 | 750.00 | 727.00 | 688.50 | -8.2 | 263.10 | -64.92 |

| 10-11-17 | Mahindra Logist | View | 829.36 | 15.61 | 2.07 | 6.11 | 7.90 | 429.00 | 425.00 | 429.15 | 0.03 | 485.90 | 13.26 |

| 06-11-17 | Nippon | View | 1542 | 118.41 | 209.44 | 5.23 | 81.33 | 252.00 | 289.00 | 284.00 | 12.7 | 291.50 | 15.67 |

| 25-10-17 | General Insuran | View | 11372 | 2.25 | 0.22 | 0.63 | 1.38 | 912.00 | 870.40 | 435.20 | -52.28 | 123.70 | -86.44 |

| 23-10-17 | IEX | View | 1000.7 | 2.56 | 0.85 | 2.61 | 2.28 | 1650.00 | 1500.00 | 54.22 | -96.71 | 157.95 | -90.43 |

| 16-10-17 | Godrej Agrovet | View | 1157.31 | 150.96 | 236.04 | 7.67 | 95.41 | 460.00 | 615.00 | 595.55 | 29.47 | 520.75 | 13.21 |

| 05-10-17 | Prataap Snacks | View | 481.94 | 76.89 | 101.15 | 7.62 | 46.97 | 938.00 | 1250.00 | 1178.30 | 25.62 | 800.00 | -14.71 |

| 03-10-17 | SBI Life Insura | View | 8400 | 12.56 | 0.70 | 0.81 | 3.55 | 700.00 | 735.00 | 708.00 | 1.14 | 1,288.65 | 84.09 |

| 27-09-17 | ICICI Lombard | View | 5700.94 | 8.93 | 0.83 | 1.23 | 2.98 | 661.00 | 651.00 | 681.55 | 3.11 | 1,257.55 | 90.25 |

| 25-09-17 | Capacite Infra | View | 400 | 131.32 | 638.05 | 17.57 | 183.03 | 250.00 | 360.00 | 342.40 | 36.96 | 167.00 | -33.20 |

| 21-09-17 | Matrimony.com | View | 501.07 | 1.88 | 0.41 | 18.16 | 4.44 | 985.00 | 985.00 | 901.20 | -8.51 | 703.05 | -28.62 |

| 18-09-17 | Bharat Road Net | View | 600.65 | 1.33 | 1.63 | 5.16 | 1.75 | 205.00 | 205.00 | 208.15 | 1.54 | 33.75 | -83.54 |

| 18-09-17 | Dixon Technolog | View | 599.28 | 134.66 | 345.62 | 9.46 | 117.27 | 1766.00 | 2725.00 | 578.56 | -67.24 | 4,106.65 | 132.54 |

| 04-09-17 | Apex Frozen | View | 152.25 | 1.91 | 7.82 | 8.53 | 6.14 | 175.00 | 202.00 | 209.85 | 19.91 | 327.35 | 87.06 |

| 11-08-17 | Cochin Shipyard | View | 1454 | 63.51 | 288.87 | 8.12 | 76.06 | 432.00 | 461.00 | 522.00 | 20.83 | 379.30 | -12.20 |

| 10-08-17 | SIS | View | 362.25 | 5.64 | 1.65 | 18.67 | 6.92 | 815.00 | 875.00 | 378.35 | -53.58 | 452.20 | -44.52 |

| 25-07-17 | Salasar Techno | View | 35.87 | 0.00 | 487.18 | 58.59 | 277.28 | 108.00 | 259.45 | 27.21 | -74.81 | 31.95 | -70.42 |

| 10-07-17 | AU Small Financ | View | 1912.51 | 78.77 | 143.51 | 3.52 | 53.60 | 358.00 | 544.00 | 270.60 | -24.41 | 644.95 | 80.15 |

| 04-07-17 | GTPL Hathway | View | 484.8 | 1.48 | 2.48 | 0.99 | 1.53 | 170.00 | 170.00 | 171.65 | 0.97 | 175.30 | 3.12 |

| 30-06-17 | CDSL | View | 523.99 | 148.71 | 563.03 | 23.83 | 170.16 | 149.00 | 250.00 | 261.60 | 75.57 | 1,248.50 | 737.92 |

| 29-06-17 | Eris Life | View | 1741.1 | 4.68 | 0.45 | 3.51 | 3.29 | 603.00 | 612.00 | 601.05 | -0.32 | 692.00 | 14.76 |

| 27-06-17 | Tejas Networks | View | 326.69 | 2.16 | 0.48 | 3.10 | 1.88 | 257.00 | 257.70 | 263.30 | 2.45 | 652.30 | 153.81 |

| 06-06-17 | IndiGrid InvIT | View | 2250 | 1.14 | 1.60 | 0.00 | 1.35 | 100.00 | 99.70 | 95.08 | -4.92 | 143.65 | 43.65 |

| 29-05-17 | PSP Projects | View | 211.68 | 8.38 | 10.39 | 6.47 | 8.58 | 210.00 | 195.00 | 208.95 | -0.5 | 594.00 | 182.86 |

| 19-05-17 | HUDCO | View | 1224 | 55.45 | 330.36 | 10.79 | 79.53 | 58.00 | 76.50 | 72.50 | 25 | 41.65 | -28.19 |

| 09-05-17 | S Chand and Co | View | 325 | 44.27 | 204.65 | 6.07 | 59.49 | 670.00 | 675.85 | 675.85 | 0.87 | 186.15 | -72.22 |

| 05-04-17 | Shankara Buildi | View | 232.96 | 51.62 | 90.68 | 15.35 | 41.88 | 460.00 | 545.00 | 632.80 | 37.57 | 794.55 | 72.73 |

| 31-03-17 | CL Educate | View | 238.95 | 3.65 | 0.21 | 1.63 | 1.90 | 500.00 | 398.00 | 208.95 | -58.21 | 178.00 | -64.40 |

| 21-03-17 | Avenue Supermar | View | 1870 | 144.61 | 277.74 | 7.30 | 104.48 | 299.00 | 604.00 | 640.75 | 114.3 | 4,576.15 | 1430.48 |

| 17-03-17 | Music Broadcast | View | 488.53 | 39.78 | 109.13 | 9.85 | 39.67 | 333.00 | 413.00 | 59.70 | -82.07 | 24.60 | -92.61 |

| 03-02-17 | BSE Limited | View | 1243 | 48.64 | 159.03 | 6.48 | 51.22 | 806.00 | 1085.00 | 356.40 | -55.78 | 646.80 | -19.75 |

| 19-12-16 | Laurus Labs | View | 560.7 | 10.54 | 3.57 | 1.58 | 4.53 | 428.00 | 489.90 | 96.10 | -77.55 | 569.60 | 33.08 |

| 09-12-16 | Sheela Foam | View | 178.5 | 14.51 | 3.35 | 0.44 | 5.09 | 730.00 | 860.00 | 1032.00 | 41.37 | 3,270.15 | 347.97 |

| 08-11-16 | Varun Beverages | View | 1114 | 4.94 | 0.42 | 0.82 | 1.86 | 445.00 | 430.00 | 136.93 | -69.23 | 1,029.55 | 131.36 |

| 07-11-16 | PNB Housing Fin | View | 3000 | 37.33 | 86.17 | 1.32 | 29.53 | 775.00 | 860.00 | 890.60 | 14.92 | 378.95 | -51.10 |

| 19-10-16 | Endurance Techn | View | 1161 | 1.70 | 0.13 | 0.82 | 0.92 | 472.00 | 572.00 | 647.70 | 37.22 | 1,512.85 | 220.52 |

| 04-10-16 | HPL Electric & | View | 361 | 5.77 | 22.20 | 3.31 | 8.06 | 202.00 | 190.00 | 189.05 | -6.41 | 72.00 | -64.36 |

| 29-09-16 | ICICI Prudentia | View | 6057 | 11.83 | 28.55 | 1.42 | 10.48 | 334.00 | 329.00 | 297.65 | -10.88 | 592.50 | 77.40 |

| 27-09-16 | GNA Axles | View | 130.41 | 17.18 | 217.47 | 11.84 | 54.88 | 207.00 | 252.00 | 233.45 | 12.78 | 724.45 | 249.98 |

| 23-09-16 | L&T Technology | View | 900 | 5.01 | 1.03 | 1.74 | 2.52 | 860.00 | 900.00 | 865.10 | 0.59 | 3,639.00 | 323.14 |

| 31-08-16 | RBL Bank | View | 1100 | 85.08 | 198.06 | 5.70 | 69.62 | 225.00 | 274.40 | 299.30 | 33.02 | 122.00 | -45.78 |

| 12-08-16 | S P Apparels | View | 215 | 1.00 | 0.45 | 0.54 | 0.66 | 268.00 | 275.00 | 295.00 | 10.07 | 447.80 | 67.09 |

| 11-08-16 | Dilip Buildcon | View | 430 | 0.00 | 0.00 | 0.00 | 0.00 | 219.00 | 240.00 | 251.95 | 15.05 | 242.45 | 10.71 |

| 01-08-16 | Advanced Enzyme | View | 60 | 94.03 | 393.10 | 11.67 | 116.02 | 896.00 | 1210.00 | 235.66 | -73.7 | 269.25 | -69.95 |

| 21-07-16 | L&T Infotech | View | 1242 | 19.91 | 10.76 | 7.39 | 11.69 | 710.00 | 667.00 | 697.65 | -1.74 | 4,523.95 | 537.18 |

| 12-07-16 | Quess Corp | View | 400 | 59.02 | 392.21 | 31.23 | 143.99 | 317.00 | 500.00 | 503.00 | 58.68 | 567.00 | 78.86 |

| 01-07-16 | Mahanagar Gas | View | 1039.64 | 72.84 | 191.61 | 6.82 | 64.54 | 421.00 | 540.00 | 519.90 | 23.49 | 870.10 | 106.67 |

| 19-05-16 | Parag Milk Food | View | 764.3 | 1.15 | 3.08 | 2.12 | 1.83 | 215.00 | 230.00 | 247.80 | 15.26 | 114.75 | -46.63 |

| 10-05-16 | Ujjivan Financi | View | 358.16 | 33.84 | 135.45 | 4.02 | 40.68 | 210.00 | 231.90 | 231.60 | 10.29 | 198.35 | -5.55 |

| 09-05-16 | Thyrocare Techn | View | 479.21 | 73.18 | 225.30 | 8.73 | 73.55 | 446.00 | 662.00 | 618.10 | 38.59 | 623.45 | 39.79 |

| 21-04-16 | Equitas Holding | View | 2159 | 14.93 | 57.29 | 1.40 | 17.21 | 110.00 | 145.10 | 135.25 | 22.95 | 102.40 | -6.91 |

| 01-04-16 | Bharat Wire Rop | View | 70 | 1.01 | 2.02 | 2.08 | 1.21 | 45.00 | 47.25 | 45.40 | 0.89 | 99.35 | 120.78 |

| 18-02-16 | Quick Heal Tech | View | 450 | 4.34 | 36.69 | 3.82 | 10.80 | 321.00 | 305.00 | 254.45 | -20.73 | 216.15 | -32.66 |

| 12-02-16 | TeamLease Ser. | View | 273.68 | 26.97 | 185.24 | 10.61 | 66.02 | 850.00 | 860.00 | 1021.95 | 20.23 | 3,326.00 | 291.29 |

| 08-02-16 | Precision Camsh | View | 410 | 2.62 | 0.73 | 2.01 | 1.91 | 186.00 | 165.00 | 177.25 | -4.7 | 123.00 | -33.87 |

| 06-01-16 | Narayana Hruda | View | 613 | 0.01 | 0.01 | 0.13 | 0.07 | 250.00 | 291.00 | 336.70 | 34.68 | 711.00 | 184.40 |

| 23-12-15 | Dr Lal PathLab | View | 638 | 63.56 | 61.28 | 4.24 | 33.41 | 550.00 | 717.00 | 824.15 | 49.85 | 2,442.80 | 344.15 |

| 23-12-15 | Alkem Lab | View | 1349.6 | 57.19 | 129.96 | 3.17 | 44.29 | 1050.00 | 1380.00 | 1381.45 | 31.57 | 2,969.70 | 182.83 |

| 16-11-15 | S H Kelkar | View | 200 | 0.00 | 0.00 | 0.00 | 0.00 | 180.00 | 216.00 | 207.30 | 15.17 | 142.30 | -20.94 |

| 10-11-15 | Interglobe Avi | View | 3000 | 17.80 | 3.57 | 0.92 | 6.15 | 765.00 | 868.00 | 878.45 | 14.83 | 2,020.00 | 164.05 |

| 02-11-15 | Coffee Day | View | 1150 | 4.39 | 0.54 | 0.90 | 1.82 | 328.00 | 313.00 | 270.15 | -17.64 | 50.80 | -84.51 |

| 21-09-15 | Prabhat Dairy | View | 300 | 0.88 | 1.42 | 0.34 | 0.77 | 115.00 | 113.00 | 116.35 | 1.17 | 99.65 | -13.35 |

| 16-09-15 | Sadbhav Infra | View | 425 | 3.04 | 1.66 | 1.69 | 2.24 | 103.00 | 111.00 | 106.15 | 3.06 | 6.98 | -93.22 |

| 10-09-15 | Pennar Eng | View | 156.19 | 0.00 | 0.04 | 0.11 | 0.07 | 178.00 | 177.95 | 157.50 | -11.52 | 63.85 | -64.13 |

| 10-09-15 | Shree Pushkar | View | 70 | 0.97 | 2.09 | 1.54 | 1.34 | 65.00 | 60.05 | 63.00 | -3.08 | 253.90 | 290.62 |

| 09-09-15 | Navkar Corp | View | 600 | 6.47 | 0.90 | 1.62 | 2.85 | 155.00 | 152.00 | 166.40 | 7.35 | 63.20 | -59.23 |

| 26-08-15 | Power Mech | View | 273.22 | 27.53 | 133.22 | 3.42 | 38.12 | 640.00 | 600.00 | 585.75 | -8.48 | 1,362.90 | 112.95 |

| 11-08-15 | Syngene Intl | View | 550 | 51.47 | 90.24 | 4.78 | 32.05 | 250.00 | 295.00 | 155.20 | -37.92 | 592.45 | 136.98 |

| 09-07-15 | Manpasand Bever | View | 400 | 1.99 | 0.38 | 1.16 | 1.40 | 320.00 | 291.00 | 163.43 | -48.93 | 6.14 | -98.08 |

| 26-05-15 | PNC Infratech | View | 488 | 4.51 | 0.65 | 0.28 | 1.56 | 378.00 | 381.00 | 72.04 | -80.94 | 287.10 | -24.05 |

| 14-05-15 | UFO Moviez | View | 600 | 4.49 | 1.17 | 1.02 | 2.04 | 625.00 | 600.00 | 598.80 | -4.19 | 118.40 | -81.06 |

| 06-05-15 | MEP Infra | View | 324 | 1.02 | 1.51 | 0.97 | 1.11 | 63.00 | 63.00 | 60.95 | -3.25 | 16.60 | -73.65 |

| 30-04-15 | VRL Logistics | View | 473.88 | 58.22 | 250.86 | 7.92 | 74.26 | 205.00 | 288.00 | 293.30 | 43.07 | 623.00 | 203.90 |

| 09-04-15 | Inox Wind | View | 700 | 35.68 | 35.38 | 2.15 | 18.60 | 325.00 | 400.00 | 438.00 | 34.77 | 125.05 | -61.52 |

| 06-04-15 | Imagicaaworld | View | 467 | 1.17 | 0.49 | 1.37 | 1.11 | 180.00 | 167.95 | 191.25 | 6.25 | 40.40 | -77.56 |

| 19-03-15 | Ortel Comm | View | 240 | 1.01 | 0.09 | 0.39 | 0.75 | 181.00 | 181.00 | 171.95 | -5 | 1.12 | -99.38 |

| 19-12-14 | Monte Carlo | View | 342.28 | 13.96 | 1.71 | 6.96 | 7.83 | 645.00 | 585.00 | 566.40 | -12.19 | 818.00 | 26.82 |

| 01-10-14 | Shemaroo Ent | View | 120 | 5.69 | 8.64 | 7.79 | 7.39 | 170.00 | 180.00 | 171.00 | 0.59 | 136.55 | -19.68 |

| 23-09-14 | Sharda Crop | View | 352 | 32.06 | 251.35 | 5.85 | 59.97 | 156.00 | 254.10 | 231.45 | 48.37 | 517.20 | 231.54 |

| 12-09-14 | Snowman Logist | View | 197.4 | 16.98 | 221.79 | 41.26 | 59.75 | 47.00 | 75.00 | 78.75 | 67.55 | 37.80 | -19.57 |

| 09-05-14 | Wonderla | View | 181.25 | 16.71 | 159.04 | 7.56 | 38.06 | 125.00 | 164.75 | 157.60 | 26.08 | 361.75 | 189.40 |

| 05-06-13 | Just Dial | View | 950 | 10.12 | 22.34 | 3.53 | 11.63 | 530.00 | 590.00 | 611.45 | 15.37 | 605.70 | 14.28 |

| 01-04-13 | Repco Home | View | 270.38 | 3.39 | 0.35 | 0.51 | 1.65 | 172.00 | 159.95 | 160.85 | -6.48 | 241.95 | 40.67 |

| 28-12-12 | INDUS TOWERS | View | 4533.6 | 2.84 | 0.10 | 0.06 | 1.21 | 220.00 | 200.00 | 191.20 | -13.09 | 198.45 | -9.80 |

| 27-12-12 | PC Jeweller | View | 609.3 | 7.33 | 18.12 | 1.68 | 6.85 | 135.00 | 137.00 | 74.50 | -44.81 | 72.20 | -46.52 |

| 26-12-12 | CARE Ratings | View | 539.98 | 45.80 | 110.96 | 6.18 | 40.98 | 750.00 | 940.00 | 923.95 | 23.19 | 507.70 | -32.31 |

| 06-12-12 | Tara Jewels | View | 0 | 1.49 | 3.10 | 2.05 | 1.98 | 230.00 | 242.00 | 229.95 | -0.02 | 0.76 | -99.67 |

| 18-07-12 | VKS Projects | View | 55 | 1.15 | 0.38 | 1.13 | 1.03 | 55.00 | 55.80 | 1.57 | -97.15 | 0.04 | -99.93 |

| 30-05-12 | Speciality Rest | View | 181.96 | 4.68 | 2.19 | 0.55 | 2.54 | 150.00 | 153.00 | 160.65 | 7.1 | 214.95 | 43.30 |

| 09-05-12 | Tribhovandas | View | 210 | 1.29 | 1.91 | 0.68 | 1.15 | 120.00 | 115.00 | 111.20 | -7.33 | 75.00 | -37.50 |

| 12-04-12 | MT Educare | View | 99 | 6.01 | 8.00 | 2.17 | 4.80 | 80.00 | 86.05 | 90.35 | 12.94 | 8.87 | -88.91 |

| 12-04-12 | NBCC (India) | View | 127.2 | 7.07 | 1.70 | 3.40 | 4.93 | 106.00 | 100.00 | 6.47 | -93.9 | 34.30 | -67.64 |

| 28-03-12 | Olympic Cards | View | 25 | 0.00 | 3.43 | 1.36 | 0.99 | 30.00 | 29.95 | 28.50 | -5 | 3.04 | -89.87 |

| 09-03-12 | MCX India | View | 663.31 | 49.12 | 150.35 | 24.14 | 54.13 | 1032.00 | 1387.00 | 1297.05 | 25.68 | 1,277.50 | 23.79 |

| 02-11-11 | Indo Thai Secu | View | 33.6 | 0.00 | 0.02 | 3.31 | 1.16 | 74.00 | 76.00 | 23.00 | -68.92 | 166.95 | 125.61 |

| 24-10-11 | Vaswani Ind | View | 49 | 0.16 | 11.29 | 6.82 | 4.16 | 49.00 | 33.45 | 17.75 | -63.78 | 21.55 | -56.02 |

| 20-10-11 | Ujaas Energy | View | 93 | 1.03 | 1.56 | 2.35 | 1.57 | 186.00 | 180.00 | 31.76 | -82.92 | 3.18 | -98.29 |

| 19-10-11 | Taksheel Solut | View | 82.5 | 0.24 | 4.70 | 6.18 | 2.99 | 150.00 | 157.40 | 58.15 | -61.23 | 3.85 | -97.43 |

| 19-10-11 | Flexituff Ventu | View | 104.63 | 0.51 | 1.55 | 1.55 | 1.03 | 155.00 | 155.00 | 166.40 | 7.35 | 29.05 | -81.26 |

| 17-10-11 | Onelife Capital | View | 36.85 | 1.02 | 0.93 | 2.32 | 1.51 | 110.00 | 115.00 | 145.90 | 32.64 | 13.52 | -87.71 |

| 04-10-11 | Setubandhan Inf | View | 60 | 0.31 | 2.76 | 4.68 | 2.21 | 138.00 | 145.00 | 22.95 | -83.37 | 2.05 | -98.51 |

| 26-09-11 | PG Electroplast | View | 120.65 | 0.98 | 1.84 | 1.64 | 1.34 | 210.00 | 200.00 | 411.65 | 96.02 | 882.05 | 320.02 |

| 16-09-11 | SRS | View | 227.5 | 0.74 | 5.00 | 0.29 | 1.22 | 58.00 | 55.00 | 16.83 | -70.98 | 0.19 | -99.67 |

| 08-09-11 | TD Power System | View | 227 | 6.52 | 0.32 | 0.36 | 2.72 | 256.00 | 251.60 | 274.80 | 7.34 | 599.00 | 133.98 |

| 05-09-11 | Brooks Labs | View | 63 | 0.00 | 2.82 | 3.36 | 1.60 | 100.00 | 110.00 | 50.20 | -49.8 | 141.65 | 41.65 |

| 26-08-11 | Tree House | View | 112.06 | 1.02 | 1.68 | 2.76 | 1.85 | 135.00 | 132.80 | 116.55 | -13.67 | 14.67 | -89.13 |

| 12-08-11 | L&T Finance | View | 1245 | 1.93 | 6.18 | 9.61 | 5.34 | 52.00 | 53.85 | 46.46 | -10.65 | 78.55 | 51.06 |

| 04-08-11 | Inventure Grow | View | 81.9 | 0.25 | 9.49 | 8.66 | 4.58 | 117.00 | 119.00 | 5.20 | -95.56 | 2.87 | -97.55 |

| 28-07-11 | Bharatiya Glob | View | 55.1 | 0.00 | 1.94 | 5.06 | 2.06 | 82.00 | 84.00 | 30.95 | -62.26 | 2.90 | -96.46 |

| 13-07-11 | Kridhan Infra | View | 34.75 | 0.03 | 1.37 | 4.18 | 1.68 | 108.00 | 115.00 | 13.29 | -87.69 | 4.00 | -96.30 |

| 07-07-11 | Birla Pacific | View | 65.18 | 1.04 | 0.17 | 1.82 | 1.18 | 10.00 | 10.10 | 25.35 | 153.5 | 0.28 | -97.20 |

| 07-07-11 | Rushil Decor | View | 40.64 | 0.23 | 1.35 | 6.57 | 2.62 | 72.00 | 81.25 | 104.49 | 45.12 | 627.45 | 771.46 |

| 22-06-11 | Timbor Home | View | 23.25 | 0.65 | 3.22 | 14.22 | 5.78 | 63.00 | 72.00 | 91.20 | 44.76 | 2.21 | -96.49 |

| 14-06-11 | VMS Industries | View | 25.75 | 0.00 | 1.11 | 3.41 | 1.36 | 40.00 | 43.95 | 28.50 | -28.75 | 12.63 | -68.43 |

| 27-05-11 | Dr Datson Labs | View | 120 | 0.14 | 2.65 | 1.84 | 1.11 | 234.00 | 218.00 | 311.25 | 33.01 | 6.29 | -97.31 |

| 23-05-11 | Sanghvi Forging | View | 36.9 | 0.00 | 1.82 | 2.93 | 1.30 | 85.00 | 88.00 | 111.75 | 31.47 | 16.50 | -80.59 |

| 13-05-11 | Innoventive Ind | View | 219.58 | 0.85 | 1.94 | 1.48 | 1.24 | 117.00 | 110.00 | 93.60 | -20 | 4.20 | -96.41 |

| 12-05-11 | Servalakshmi | View | 60 | 0.34 | 4.21 | 1.90 | 1.47 | 29.00 | 30.00 | 19.00 | -34.48 | 1.33 | -95.41 |

| 10-05-11 | Future Consumer | View | 750 | 0.26 | 7.81 | 0.61 | 1.52 | 10.00 | 9.50 | 8.30 | -17 | 1.65 | -83.50 |

| 09-05-11 | Paramount Print | View | 45.83 | 0.33 | 3.28 | 9.31 | 3.92 | 35.00 | 35.00 | 26.65 | -23.86 | 0.82 | -97.66 |

| 06-05-11 | Muthoot Finance | View | 901.25 | 25.01 | 60.94 | 8.50 | 24.55 | 175.00 | 176.45 | 176.25 | 0.71 | 1,032.90 | 490.23 |

| 08-04-11 | Shilpi Cable | View | 55.88 | 1.04 | 6.39 | 5.74 | 3.48 | 69.00 | 78.35 | 23.80 | -65.51 | 1.10 | -98.41 |

| 30-03-11 | PTC India Fin | View | 438.76 | 2.85 | 0.22 | 1.18 | 1.70 | 28.00 | 28.00 | 24.90 | -11.07 | 15.35 | -45.18 |

| 24-03-11 | Lovable Lingeri | View | 93.28 | 21.87 | 99.87 | 20.84 | 35.21 | 205.00 | 261.50 | 249.20 | 21.56 | 164.95 | -19.54 |

| 11-03-11 | Fineotex Chem | View | 30.32 | 0.00 | 0.22 | 4.38 | 1.57 | 70.00 | 80.00 | 14.09 | -79.87 | 329.50 | 370.71 |

| 11-03-11 | Sudar Ind | View | 69.98 | 0.17 | 4.47 | 2.27 | 1.55 | 77.00 | 74.00 | 113.10 | 46.88 | 1.02 | -98.68 |

| 10-03-11 | Acropetal Tech | View | 170 | 1.12 | 2.00 | 1.21 | 1.28 | 90.00 | 130.00 | 98.45 | 9.39 | 1.67 | -98.14 |

| 10-02-11 | Omkar Special | View | 79.38 | 0.82 | 5.27 | 9.90 | 4.67 | 98.00 | 95.00 | 46.20 | -52.86 | 20.40 | -79.18 |

| 20-01-11 | C Mahendra Expo | View | 165 | 1.02 | 3.92 | 4.82 | 2.78 | 110.00 | 111.00 | 55.43 | -49.61 | 1.79 | -98.37 |

| 30-12-10 | Punjab & Sind | View | 480 | 49.80 | 22.91 | 8.38 | 47.20 | 120.00 | 146.10 | 127.05 | 5.87 | 15.60 | -87.00 |

| 23-12-10 | A2Z Infra Eng | View | 675 | 0.70 | 4.25 | 0.33 | 0.96 | 400.00 | 390.00 | 328.90 | -17.78 | 12.35 | -96.91 |

| 20-12-10 | Claris Life | View | 300 | 1.31 | 2.03 | 1.60 | 1.50 | 228.00 | 224.40 | 205.85 | -9.71 | 396.55 | 73.93 |

| 15-12-10 | MOIL | View | 1260 | 0.00 | 0.00 | 0.00 | 0.00 | 375.00 | 551.00 | 233.25 | -37.8 | 169.55 | -54.79 |

| 06-12-10 | RPP Infra Proj | View | 48.75 | 0.16 | 7.27 | 5.60 | 2.97 | 75.00 | 75.00 | 52.00 | -30.67 | 43.00 | -42.67 |

| 16-11-10 | Gravita India | View | 45 | 6.04 | 182.52 | 37.34 | 42.88 | 125.00 | 218.75 | 42.08 | -66.34 | 325.50 | 160.40 |

| 04-11-10 | Coal India | View | 15475 | 24.70 | 25.40 | 2.31 | 15.28 | 245.00 | 300.00 | 342.35 | 39.73 | 229.20 | -6.45 |

| 27-10-10 | BS Limited | View | 197.36 | 0.52 | 3.16 | 1.04 | 1.10 | 248.00 | 251.00 | 18.93 | -92.37 | 0.33 | -99.87 |

| 27-10-10 | Gyscoal Alloys | View | 54.67 | 1.54 | 33.44 | 8.00 | 8.59 | 71.00 | 76.60 | 8.16 | -88.51 | 2.85 | -95.99 |

| 27-10-10 | Prestige Estate | View | 1200 | 4.32 | 0.24 | 0.08 | 2.26 | 183.00 | 190.00 | 192.55 | 5.22 | 481.15 | 162.92 |

| 20-10-10 | Oberoi Realty | View | 1028.61 | 22.15 | 3.61 | 0.94 | 12.13 | 260.00 | 280.00 | 282.95 | 8.83 | 1,020.00 | 292.31 |

| 18-10-10 | Jupiter Wagons | View | 172.41 | 3.68 | 0.34 | 0.38 | 2.07 | 127.00 | 122.80 | 112.25 | -11.61 | 78.40 | -38.27 |

| 14-10-10 | Bedmutha Ind | View | 91.8 | 0.67 | 29.19 | 8.51 | 7.69 | 102.00 | 114.40 | 180.80 | 77.25 | 71.20 | -30.20 |

| 14-10-10 | Ashoka Buildcon | View | 225 | 25.52 | 13.91 | 3.46 | 15.94 | 324.00 | 333.55 | 73.33 | -77.37 | 85.10 | -73.73 |

| 14-10-10 | Sea TV Network | View | 50.2 | 1.66 | 40.94 | 7.45 | 9.58 | 100.00 | 120.00 | 106.00 | 6 | 4.07 | -95.93 |

| 13-10-10 | Va Tech Wabag | View | 472.6 | 36.13 | 100.98 | 8.55 | 36.22 | 1310.00 | 1655.00 | 341.88 | -73.9 | 269.25 | -79.45 |

| 12-10-10 | Tecpro Systems | View | 268.03 | 27.99 | 62.48 | 9.07 | 24.47 | 355.00 | 399.40 | 407.85 | 14.89 | 4.53 | -98.72 |

| 12-10-10 | Cantabil Retail | View | 105 | 1.71 | 3.83 | 2.63 | 2.35 | 135.00 | 133.80 | 104.75 | -22.41 | 1,493.90 | 1006.59 |

| 08-10-10 | Orient Green | View | 900 | 2.09 | 0.64 | 0.18 | 1.07 | 47.00 | 45.70 | 44.90 | -4.47 | 9.58 | -79.62 |

| 08-10-10 | Electrosteel St | View | 0 | 5.86 | 28.58 | 6.19 | 8.23 | 11.00 | 11.15 | 11.25 | 2.27 | 31.05 | 182.27 |

| 08-10-10 | Ramky Infra | View | 530 | 4.52 | 1.45 | 0.99 | 2.89 | 450.00 | 450.00 | 387.35 | -13.92 | 203.55 | -54.77 |

| 06-10-10 | Eros Intl | View | 350 | 25.79 | 73.40 | 11.95 | 26.51 | 175.00 | 213.55 | 190.05 | 8.6 | 43.35 | -75.23 |

| 06-10-10 | Career Point | View | 115 | 47.45 | 101.93 | 31.74 | 47.39 | 310.00 | 461.00 | 632.35 | 103.98 | 133.00 | -57.10 |

| 05-10-10 | Sasta Sundar | View | 147.5 | 5.91 | 35.88 | 11.04 | 12.20 | 118.00 | 135.10 | 110.90 | -6.02 | 358.55 | 203.86 |

| 01-10-10 | Tirupati Inks | View | 51.5 | 1.78 | 23.18 | 12.59 | 8.77 | 43.00 | 53.95 | 36.65 | -14.77 | 1.59 | -96.30 |

| 29-09-10 | Indosolar | View | 357 | 1.44 | 1.30 | 1.81 | 1.55 | 29.00 | 29.75 | 23.70 | -18.28 | 3.21 | -88.93 |

| 09-09-10 | Gujarat Pipavav | View | 500 | 13.20 | 85.70 | 9.15 | 19.94 | 46.00 | 56.25 | 54.05 | 17.5 | 87.15 | 89.46 |

| 25-08-10 | Prakash Steelag | View | 68.75 | 1.27 | 10.91 | 6.62 | 4.53 | 110.00 | 118.55 | 18.80 | -82.91 | 5.85 | -94.68 |

| 18-08-10 | Bajaj Consumer | View | 297 | 20.19 | 53.49 | 6.62 | 19.29 | 660.00 | 730.00 | 151.65 | -77.02 | 162.00 | -75.45 |

| 16-08-10 | Bharat Fin | View | 1653.97 | 20.38 | 18.26 | 2.81 | 13.69 | 985.00 | 1036.00 | 1088.58 | 10.52 | 898.20 | -8.81 |

| 28-07-10 | Shri Aster | View | 53.1 | 0.01 | 12.46 | 7.41 | 4.47 | 118.00 | 127.70 | 199.10 | 68.73 | 1.28 | -98.92 |

| 21-07-10 | Hindustan Media | View | 270 | 8.98 | 3.39 | 1.00 | 5.43 | 166.00 | 177.95 | 189.20 | 13.98 | 59.95 | -63.89 |

| 16-07-10 | Technofab Engg | View | 71.76 | 4.28 | 48.85 | 10.03 | 12.78 | 240.00 | 265.00 | 295.65 | 23.19 | 6.85 | -97.15 |

| 01-07-10 | Parabolic Drugs | View | 200 | 1.48 | 1.20 | 0.40 | 1.04 | 75.00 | 76.00 | 64.80 | -13.6 | 5.70 | -92.40 |

| 21-05-10 | Jaypee Infra | View | 1650 | 1.77 | 1.15 | 0.61 | 1.24 | 102.00 | 98.00 | 91.30 | -10.49 | 2.71 | -97.34 |

| 20-05-10 | SJVN | View | 1079 | 9.03 | 3.39 | 3.12 | 6.64 | 26.00 | 27.10 | 25.05 | -3.65 | 31.20 | 20.00 |

| 19-05-10 | GB Global | View | 107.9 | 7.97 | 10.52 | 2.81 | 6.32 | 130.00 | 131.00 | 133.65 | 2.81 | 9.80 | -92.46 |

| 18-05-10 | Tarapur Trans | View | 63.75 | 0.03 | 5.08 | 2.74 | 1.74 | 75.00 | 75.00 | 56.90 | -24.13 | 4.65 | -93.80 |

| 13-05-10 | NEL HOLDINGS SO | View | 405 | 2.54 | 0.22 | 0.16 | 1.16 | 54.00 | 50.00 | 50.95 | -5.65 | 3.07 | -94.31 |

| 10-05-10 | Talwalkars Fitn | View | 77.44 | 35.43 | 51.48 | 8.43 | 28.39 | 128.00 | 138.00 | 162.60 | 27.03 | 1.45 | -98.87 |

| 16-04-10 | Goenka Diamond | View | 145 | 0.78 | 2.99 | 0.66 | 1.07 | 135.00 | 130.00 | 12.79 | -90.53 | 1.89 | -98.60 |

| 12-04-10 | Intrasoft Tech | View | 53.65 | 21.97 | 21.60 | 13.51 | 18.95 | 145.00 | 140.00 | 159.35 | 9.9 | 165.10 | 13.86 |

| 09-04-10 | Shree Ganesh | View | 385.29 | 1.38 | 6.13 | 1.39 | 1.96 | 260.00 | 258.85 | 163.25 | -37.21 | 0.82 | -99.68 |

| 06-04-10 | Persistent | View | 168.01 | 144.43 | 107.73 | 21.69 | 93.60 | 310.00 | 400.00 | 204.00 | -34.19 | 3,412.90 | 1000.94 |

| 05-04-10 | Pradip Overseas | View | 116.6 | 8.57 | 45.35 | 10.53 | 14.08 | 110.00 | 120.00 | 89.29 | -18.83 | 1.14 | -98.96 |

| 30-03-10 | ILandFS Trans | View | 700 | 52.61 | 39.39 | 4.56 | 33.42 | 258.00 | 287.00 | 253.68 | -1.67 | 4.40 | -98.29 |

| 29-03-10 | DQ Entertain | View | 128.38 | 93.86 | 272.88 | 19.45 | 86.33 | 80.00 | 135.00 | 108.55 | 35.69 | 1.03 | -98.71 |

| 18-03-10 | United Bank | View | 330 | 47.08 | 39.15 | 9.80 | 33.38 | 66.00 | 77.00 | 68.80 | 4.24 | 4.48 | -93.21 |

| 11-03-10 | Man Infra | View | 142 | 96.06 | 104.57 | 10.26 | 62.53 | 252.00 | 335.00 | 46.43 | -81.58 | 98.80 | -60.79 |

| 10-03-10 | Texmo Pipes | View | 45 | 1.02 | 30.50 | 7.26 | 7.48 | 90.00 | 92.80 | 137.25 | 52.5 | 61.45 | -31.72 |

| 03-03-10 | ARSS Infra | View | 103 | 49.34 | 124.53 | 18.55 | 47.62 | 450.00 | 640.00 | 736.30 | 63.62 | 21.00 | -95.33 |

| 25-02-10 | Hathway Cable | View | 735.4 | 1.43 | 4.29 | 0.28 | 1.36 | 240.00 | 246.00 | 41.56 | -82.68 | 18.15 | -92.44 |

| 24-02-10 | DB Realty | View | 1500 | 1.35 | 1.21 | 0.01 | 0.85 | 468.00 | 452.10 | 455.40 | -2.69 | 72.90 | -84.42 |

| 24-02-10 | Emmbi Ind | View | 43.08 | 0.43 | 5.55 | 0.46 | 1.20 | 45.00 | 46.00 | 28.65 | -36.33 | 98.70 | 119.33 |

| 23-02-10 | Aqua Logistics | View | 150 | 0.26 | 5.07 | 3.00 | 1.94 | 220.00 | 225.00 | 24.46 | -88.88 | 1.40 | -99.36 |

| 19-02-10 | Thangamayil | View | 0 | 0.52 | 1.52 | 2.26 | 1.12 | 75.00 | 70.00 | 71.10 | -5.2 | 1,121.00 | 1394.67 |

| 15-02-10 | Vascon Engineer | View | 199.8 | 1.12 | 3.65 | 0.62 | 1.22 | 165.00 | 155.90 | 146.38 | -11.28 | 26.25 | -84.09 |

| 15-02-10 | Syncom Health | View | 56.25 | 0.99 | 16.60 | 6.25 | 5.17 | 75.00 | 88.00 | 87.85 | 17.13 | 4.06 | -94.59 |

| 08-02-10 | Jubilant Food | View | 328.7 | 59.39 | 51.95 | 3.79 | 31.11 | 145.00 | 160.00 | 22.90 | -84.21 | 606.65 | 318.38 |

| 03-02-10 | Infinite Comp | View | 189.8 | 48.44 | 106.02 | 11.08 | 43.22 | 165.00 | 178.35 | 184.51 | 11.82 | 473.75 | 187.12 |

BEST/WORST PERFORMING IPOS

BEW Engineering Ltd

Kotyark Industries Ltd

Sigma Solve Ltd

Bombay Metrics Supply Chain Ltd

Dynamic Services & Security Ltd

Suryoday Small Finance Bank Ltd

One 97 Communications Ltd

Cartrade Tech Ltd

How an Initial Public Offer (IPO) Works

A corporation is deemed private prior to an IPO. As a pre-IPO private company, the company has grown with a small number of shareholders, including early investors such as the founders, family, and friends, as well as professional investors such as venture capitalists or angel investors.

An IPO is a significant milestone for a company since it allows it to raise a large sum of money. This increases the company’s ability to grow and expand. The enhanced openness and share listing legitimacy may also aid in obtaining better terms when seeking borrowed capital.

When a firm believes it is mature enough for the rigours of SEC laws, as well as the rewards and responsibilities of public shareholders, it will begin to market its interest in going public.

What Is the IPO Process?

The IPO procedure is divided into two sections. The first is the offering’s pre-marketing phase, and the second is the initial public offering itself. When a firm decides to go public, it will either advertise to underwriters by asking for private bids or make a public declaration to create interest.

The underwriters are picked by the firm to lead the IPO process. A business may select one or more underwriters to manage various aspects of the IPO process cooperatively. Underwriters participate in all aspects of the IPO, including due diligence, document preparation, filing, marketing, and issuance.

- One of the most significant benefits is that the company gains access to investment from the broader investing public in order to raise funds. This makes acquisition negotiations (share conversions) easier and boosts the company’s exposure, reputation, and public image, which can help sales and profitability.

- The increased transparency that comes with compulsory quarterly reporting can usually assist a firm get better credit borrowing conditions than a private company.

- Companies may face various disadvantages from going public and may opt for alternative options. Some of the key downsides include the fact that Initial Public Offer (IPO) are expensive, and the costs of operating a public company are ongoing and often unrelated to other business costs.

- Share price fluctuations can be a distraction for managers, who may be compensated and assessed based on stock performance rather than actual financial results. Furthermore, the organisation must publish financial, accounting, tax, and other business information. It may have to publicly share secrets and business processes that could aid competitors during these disclosures.

A loan facility known as “Initial Public Offer (IPO) funding” is essentially what many non-bank financial corporations offer (NBFCs). If money is tight, you can utilise this loan to apply for the IPO of your choice and make sure you don’t miss the chance to make money. With many financial institutions providing the facility to regular investors, High Net Worth (HNI) individuals, corporate entities, and partnership firms, margin funding in IPO have grown to be quite popular over the years.

A typical Initial Public Offer (IPO) has three unique phases that make up its life cycle: pre-IPO transformation, IPO transaction, and post-IPO transaction. The company must comply with all processes, procedures, and regulatory obligations during the pre-IPO transformation phase. The issue is finally placed up for subscription during the IPO transaction phase, during which time public investors submit applications for an IPO. It also entails allocating shares to investors who submitted applications for the IPO. When the shares are eventually listed on stock exchanges and investors can freely purchase and sell them, the post-IPO transaction period begins.

No doubt. Up until the Initial Public Offer (IPO) closing date, you can change or cancel your IPO subscription application. Simply log into the Motilal Oswal trading portal and go to the IPO area, where you can choose to edit the order or cancel it entirely, to accomplish this.

The book-building process is frequently used by businesses seeking an Initial Public Offer (IPO) as a way to determine the price. The book-building process in an IPO means this. In an effort to determine the price at which its shares should be issued, a corporation uses the book-building method. To that end, the business often sets a price range, and investors who wish to apply for the IPO must bid at the price they believe the shares are worth. And the final IPO price is set at the level at which the greatest number of bids are received.

Any person, business, or partnership firm may invest in an Initial Public Offer (IPO). You need an active Demat account as the only requirement to invest in one.

An initial public offering, or Initial Public Offer (IPO), is the procedure through which a business initially makes its shares available for purchase by the general public. This is the standard definition of an IPO. A company’s shares get listed on a stock exchange and can be freely traded once they have been distributed to the general public, which includes institutional and individual investors.

You must first register a trading and Demat account with Motilal Oswal in order to apply for an online Initial Public Offer (IPO) with us. Once it is open, use the login information provided to you to access the Motilal Oswal trading platform and choose the Initial Public Offer (IPO) that you want to invest in. After choosing it, fill out the order form with all the necessary information. The end of that. Online IPO investment is very simple and quick with Motilal Oswal.

The total number of shares and the total price of the shares the firm is offering for sale are represented by the Initial Public Offer (IPO) issue size. The minimum number of shares for which you must submit an order, however, is the IPO lot size.

An application form for a New Fund Offer (NFO) or an impending IPO can be obtained in a number of different ways. Here’s a brief glance. You can obtain it via Motilal Oswal’s trading portal, where you can also submit an online application for the impending IPO. A physical copy of the application form is available at any Motilal Oswal branch office. The application form is available at a few banks and from vendors outside stock exchanges. Finally, the main managers of the IPO offering will also sell it to you.

All you have to do to find out when a public offering will begin is look at the Motilal Oswal website’s IPO calendar. It also provides information about the future Initial Public Offer (IPO) list, as well as

An Initial Public Offer (IPO) is essentially a huge company’s fundraising approach in which the company sells its shares to the public for the first time. Following an initial public offering, the company’s shares are traded on a stock exchange. Some of the primary reasons for launching an IPO are to raise funds through the sale of shares, provide liquidity to firm founders and early investors, and capitalise on a greater value.

A new Initial Public Offer (IPO) will frequently have more demand than supply. As a result, there is no certainty that all interested investors will be able to purchase shares in an IPO. Those interested in investing in an IPO may be able to do so through their brokerage firm, albeit access to an IPO may be limited to a firm’s larger clients in some cases. Another alternative is to invest in an IPO-focused mutual fund or other investment instruments.

Initial Public Offer (IPO) typically generate a lot of media attention, some of which is intentionally generated by the firm going public. IPOs are popular among investors in general because they induce volatile price swings on the day of the IPO and shortly thereafter. This can result in enormous gains on occasion, but it can also result in large losses. Finally, investors should evaluate each IPO based on the prospectus of the company going public, as well as their financial situation and risk tolerance.

When a company goes public, it must set an initial price for its new shares. This is handled by the underwriting banks who will market the transaction. The fundamentals and growth potential of the company determine the company’s value in large part. Because Initial Public Offer (IPO) are often from newer companies, they may not yet have a track record of profitability. Comparables can be utilised instead. However, in the days running up to the IPO, supply, and demand for the IPO shares will also play a role.

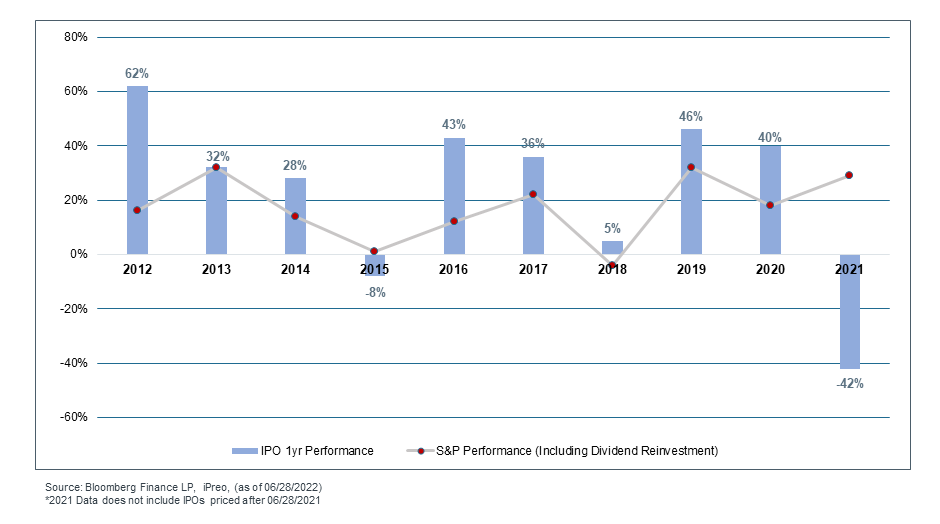

Historical returns of IPOs

It is also crucial to remember that after a stock begins trading on a public stock exchange, there is no assurance that it will continue to trade at or above its initial offering price. However, most people participate in Initial Public Offer (IPO) for the ability to invest in a company early in its life cycle and profit from potential future growth.

An examination of historical data dating back to 2012 reveals that annual returns on Initial Public Offer (IPO) have fluctuated greatly from year to year.

Investing in a freshly public firm can be financially profitable; nevertheless, there are numerous dangers involved, and returns cannot be guaranteed. If you’re new to Initial Public Offer (IPO), make sure you read through all of our educational materials before investing.

Appreciation

Undoubtedly, learning sharks institute works hard to maintain this list of share market Training courses up to date. However, In the event of a dispute between the programmes mentioned in the Learning sharks Academic Calendar and this list, the Calendar will take precedence nevertheless. In addition, Please contact the Enrollment Desk if you have any further questions about admissions or programme offerings. Nevertheless, Please contact us at feedback@learninghsharks.in to edit a programme listing. Alternatively, you can reach us directly for any course queries. On the contrary, one can call our number 8595071711.

Even so, we launch new stock market integrated trading programmes every 6 months. In spite of stock market trends and conditions. While we have you here. Of course, we do not want to miss asking you to share a review. Clearly, It is necessary and appreciated. our Trading community has been growing evidently. Surely, the credit goes to our mentors and our hard-working trading students. For this reason, we keep coming out with discounts and concessions on our programmes. Besides, We believe each citizen has the right to learn about the market.

Because we believe each student should be successful. Since our program is so powerful. So, we encourage and invite more applications, therefore. Of course, we feel proud to invite the differently abled students too. Moreover, the stock market does not care about any race, religion, family background or religion also. Then, again, We are there to assist you with the best education. Finally, head over to our contact page to speak to our counsellor. For one thing, we do not want our students to fail, which is why give regular and repeated classes too