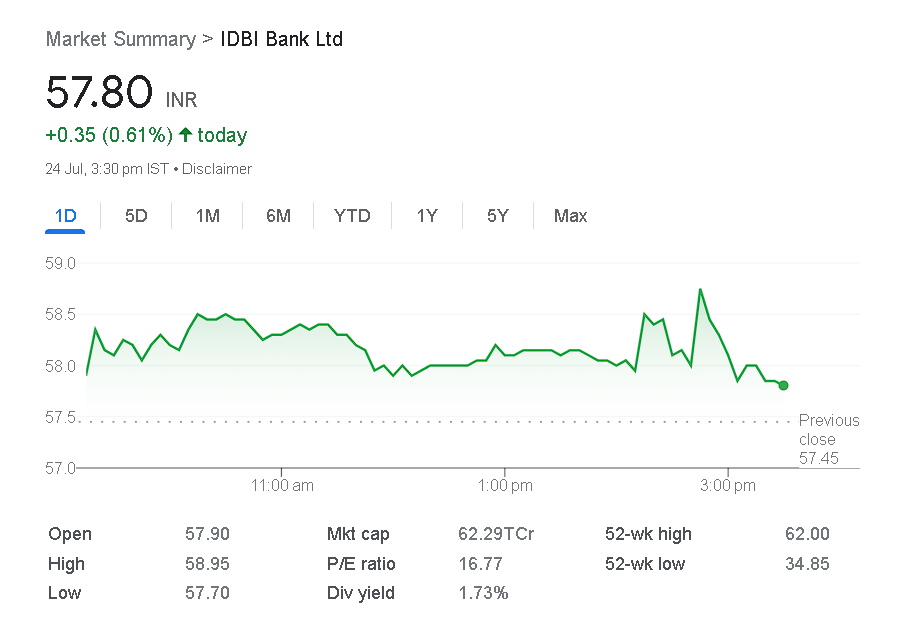

Shares of IDBI Bank increased by 2.45% to Rs 58.85 on the BSE from their previous close of Rs 57.44. The company’s market value increased to Rs 62,729 crore.

INTRODUCTION

After the LIC-owned lender reported a 62% increase in consolidated profit for the quarter ended in June 2023, shares of IDBI Bank Ltd. increased by more than 2% today.

- Compared to the same quarter the prior year, the net profit increased to Rs 1224 crore in the first quarter, from Rs 756 crore.

- Comparing the June quarter to the first quarter of the previous fiscal, operating profit increased 47% to Rs 3,019 crore.

- The IDBI Bank’s net interest income increased 61% in the most recent quarter to Rs 3,998 crore from Rs 2,488 crore in Q1 2023.

In the first quarter of the current fiscal year, net interest margins (NIM) increased 178 basis points to 5.80% from 4.02% in the first quarter of 2023, indicating that IDBI Bank’s asset quality has improved.

The bank’s gross non-performing assets (NPAs) ratio decreased to 5.05% as of June 30, 2023 from 19.90% as of June 30, 2022, and its net NPA ratio also decreased to 0.44% from 1.26% as of June 30, 2022.

- As of June 30, 2023, net advances increased 20% YoY to Rs 165,403 crore from Rs 1,38,223 crore the previous year.

- the Provision Coverage Ratio (including technical write-offs) increased to 98.99% from 97.78% as of June 30, 2022.

- Following the release of the Q1 results, shares of IDBI Bank increased 2.45% to Rs. 58.85 from their previous close of Rs. 57.44 on the BSE.

- With today’s surge, the price of IDBI Bank has increased 6% so far this year. On the BSE, a total of 5.49 lakh shares were exchanged for a turnover of Rs 3.20 crore.

On July 27, 2022, the price of IDBI Bank stock reached a 52-week low of Rs 34.85 and a 52-week high of Rs 62 on January 1, 2023.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en