About Fundamental analysis Course

Fundamental analysis is a method of estimating the intrinsic value of a security. Moreover, analysing numerous macroeconomic and microeconomic elements in accounting and finance. Nevertheless, Fundamental analysis' ultimate purpose is to determine a security's intrinsic value. On the contrary, The intrinsic worth of the security can then be compared to its current market price to aid investment decisions as well.

Language: English & Hindi l Time Duration: 1.5 Months l Fees: 20,000

Meanwhile, Let us give you some theoretical knowledge

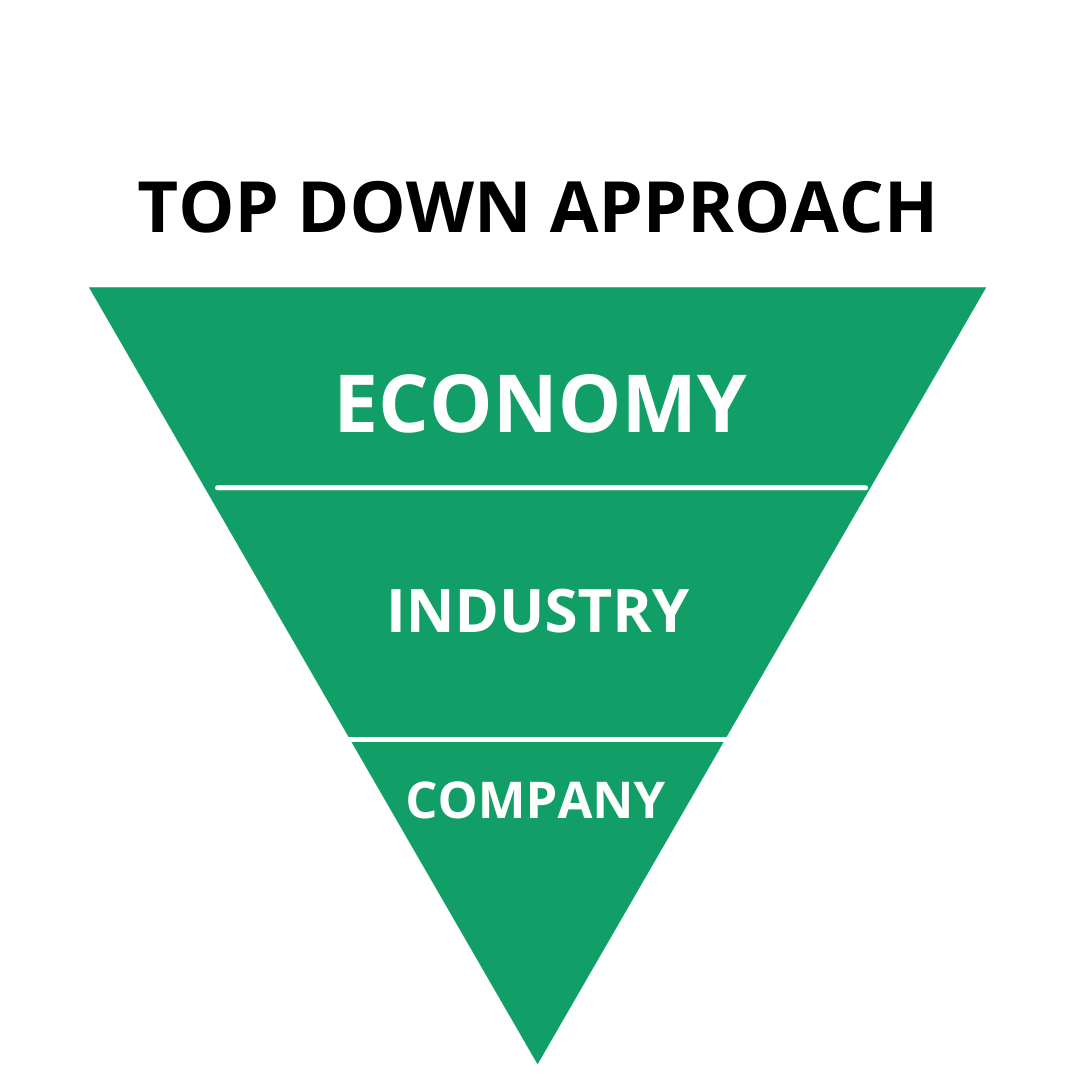

The Fundamental analysis can be performed from the top down or from the bottom up. An investor who uses the top-down technique begins their research by looking at the state of the economy as a whole. An investor attempts to assess the overall direction of the economy by examining numerous macroeconomic parameters such as interest rates, inflation, and GDP levels, and then finds the industries and sectors of the economy that offer the best investment opportunities.

Following that, the investor evaluates specific prospects and prospective opportunities within the industries and sectors that have been identified. Finally, they look at and choose specific stocks from the most promising industries.

The problem with defining the word fundamentals is that it can cover anything related to the economic well-being of a company. They obviously include numbers like revenue and profit, but they can also include anything from a company’s market share to the quality of its management.

Quantitative – “focused with data that can be represented in numbers and amounts.”

Qualitative -“Relating to the nature or standard of something rather than its amount,” says the dictionary.

Qualitative Fundamentals

What exactly does the company do? This is the business model. This isn’t quite as simple as it appears. Is it making money if a company’s business plan is built on selling fast-food chicken? Is it only surviving on royalties and franchise fees?

A company’s capacity to maintain a competitive advantage—and keep it—is critical to its long-term success. A moat around a firm, such as Coca-brand Cola’s name or Microsoft’s dominance of the personal computer operating system, allows it to keep competitors at bay while growing and profiting. When a business is able to gain a competitive advantage, its shareholders can benefit for decades.

Some people believe that the most significant factor for investing in a company is management. It makes sense: even the strongest business concept will fail if the company’s management fail to execute it properly. While it’s difficult for ordinary investors to meet and really evaluate managers, you can look at the company’s website and review the top executives’ and board members’ resumes. How did they perform in previous positions? Is it true that they’ve been selling off a lot of their stock recently?

Corporate governance refers to the policies in place inside a company that define management’s, directors’, and stakeholders’ relationships and duties. The company charter and bylaws, as well as corporate laws and regulations, establish and regulate these policies. You want to work with a company that operates with integrity, fairness, transparency, and efficiency. Take special attention of whether management adheres to shareholder rights and interests. Ensure that their shareholder communications are transparent, clear, and understood. It’s likely that you won’t get it because they don’t want you to.

A balance sheet is a document that shows a company’s assets, liabilities, and equity at a certain point in time. The balance sheet gets its name from the fact that a company’s financial structure balances out as follows:

Liabilities + Shareholders’ Equity = Assets Equity

At any given time, assets represent the resources that the company owns or controls. Cash, inventory, machinery, and structures are all examples of this. The entire worth of the funding the corporation used to acquire such assets is shown on the other side of the equation. Liabilities or equity provide the basis for financing. Liabilities reflect debt (which must be repaid), whereas equity represents the total amount of money invested in the business by the owners, including retained earnings.

The income statement examines a company’s success over a certain time period, whereas the balance sheet takes a snapshot approach to assessing a corporation. Technically, a balance sheet might be for a month or even a day, but public corporations only report quarterly and annually.

The income statement shows how much money was made, how much was spent, and how much profit was made over that time period as a result of the company’s operations.

The statement of cash flows is a chart that shows a company’s cash inflows and outflows over time. A statement of cash flows usually concentrates on the following cash-related activities:

- Cash used to invest in assets, as well as revenues from the sale of other firms, equipment, or long-term assets (cash from investing, or CFI).

- CFF (cash from financing): Cash received or paid as a result of the issuance and borrowing of funds

- Operating Cash Flow (OCF) is the cash flow created by day-to-day operations.

Intrinsic Value like a Concept

One of the key assumptions of fundamental analysis is that the present stock market price does not always accurately reflect the company’s value as backed by publicly available data. The value reflected in the company’s fundamental data is more likely to be closer to the genuine worth of the stock, according to a second assumption.

The inherent value is a term used by analysts to describe this potential genuine value. However, it’s worth noting that the term “intrinsic value” has a different meaning in stock valuation than it does in other situations, such as options trading. The intrinsic value of a stock is calculated using a standard formula in option pricing; however, analysts employ a variety of complicated models to arrive at the intrinsic value for a stock.

Criticisms

The other main type of security study is technical analysis. Simply said, technical analysts’ investments (or, more correctly, trades) are exclusively based on stock price and volume fluctuations. They trade on momentum, ignoring the fundamentals, using charts and other instruments.

The market discounts everything, according to one of the basic concepts of technical analysis. Every piece of news regarding a firm has already been included into the stock price. As a result, the stock’s price swings provide more information than the company’s core fundamentals.

The Efficient Market Hypothesis is a theory that claims that markets are efficient.

The efficient market hypothesis (EMH) advocates, on the other hand, frequently disagree with both fundamental and technical analysts.

According to the efficient market theory, beating the market using fundamental or technical research is nearly impossible. Because the market efficiently prices all stocks on a continuous basis, any possibilities for excess returns are quickly eaten away by the market’s many participants, making it nearly impossible for anybody to meaningfully beat the market over time.

1.1What is the fundamental analysis?

1.2 Why is fundamental analysis relevant for investing?

1.3 Efficient Market Hypothesis (EMH)

1.4 Arguments against EMH

1.5 So, does fundamental analysis work?

1.6 Steps in Fundamental Analysis

1.7Difference between technical & fundamental analysis

1.8Features & benefits of Fundamental analysis

Analysis of the Economy and the Industry

•Company Analysis •Interpretation of a company’s financial statements (Balance Sheet, P&L, Cash Flow, etc.)

•Ratio Analysis (Multiple Ratios) •Fund Flow Analysis

•Time Value of Money & Valuation of Equity •Economic Value Add (EVA)

•How to evaluate events/news and data and co-relate the data for trading in stocks, currency, and commodities

Brushing Up the Basics

- Concept of “Time value of Money”

- Interest Rates and Discount Factors

- Opportunity Cost

- Risk-free Rate

- Equity Risk

- Premium

- The Beta

- Risk-Adjusted Return (Sharpe Ratio).

•Economic Analysis

•Industry Analysis

•Company analysis

- Where can one find financial statements?

- The Director’s Report

- The Auditor’s Report

- Financial Statements

- Balance Sheet

- Income Statement

3.7 Schedules and Notes to the Accounts

ECONOMIC DATA ANALYSIS

PMI, Unemployment Claims and Non Farm Employment

New Homes Sales, Building Permits and Industrial Production

PPI – Producer Price Index and CPI – Consumer Price Index

Inventory and Retail Sales

Consumer Confidence

Core durable Goods Order

ADP Non Farm employment

Crude Oil Inventory

Trade Balance

GLOBAL & DOMESTIC RESEARCH including events

Government Budget

Political events (including Election Results)

Central Bank Meet (including Central Bank events)

Wars or Terrorist Attacks

OPEC Meeting

Weather effects

India VIX effect

Rating agencies

Controversies and Rumours

Country Rating and Debt

Insider Trading and Deals

- Oil & Gas Sector

- Telecom Sector

- Power Sector

- Banking Sector

- IT Sector

- Metal Sector

- Paint Sector

- Cement Sector

- Real Estate Sector

- Automobile Sector

- Aviation Industry

- Pharma & FMCG Sector

- Gems & Jewellery Sector

- Open Interest

- Promoters Holding

- Moving Average

- Beta

- Market Cap

- P/E

- Book Value

- Price to Book Value

- Volume

- Management

- DEBT

- Profit Ratios

- Dividend

- Cash Flow

- EPS

- EBITDA

Financial Statement Analysis and Forensic Accounting

Comparative and Common-size Financial Statements

Financial Ratios

Du-Pont Analysis

Cash Conversion Cycle

The Satyam Case and Need for Forensic Accounting

Who Is Eligible to Take a Fundamental analysis Market Course?

10+2, BA. B.com. B.Sc., MBA & BBA/CA/CS/CPT Students, Portfolio managers, Stock brokers and sub-brokers, Traders and Investors, Entrepreneurs and house wives.

Who Uses Fundamental Analysis?

Fundamental analysis is mostly employed by long-term or value investors to uncover undervalued stocks with promising futures. Fundamental analysis will also be used by equity analysts to produce price goals and client recommendations (e.g., buy, hold, or sell).

Financial analysis will also be used by corporate managers and financial accountants to examine and improve a corporation’s operating efficiency and profitability, as well as to compare the firm to the competition. Fundamental analysis is promoted by Warren Buffett, one of the world’s most known value investors.

Is Fundamental Analysis Always Beneficial?

No. Fundamental analysis, like any other financial strategy or tool, does not always work. The fact that a stock’s fundamentals indicate it is undervalued does not guarantee that its shares will rise to their true value very soon. Things aren’t always as simple as they appear. In actuality, a number of factors influence real price behavior, putting fundamental analysis to the test.

Other courses

Mutual funds