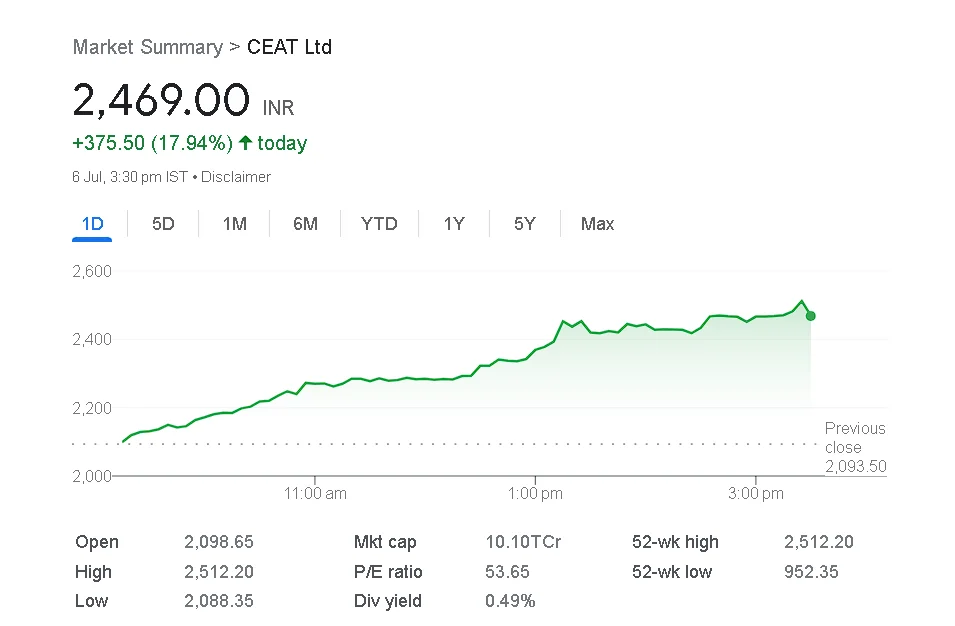

CEAT share price: The company gained 19.40 per cent to achieve a 52-week high of Rs 2,498.10 over its previous close of Rs 2,092.30. The counter’s turnover was Rs 31.15 crore, with a market capitalisation (m-cap) of Rs 9,882.77 crore. The stock has gained 28.48 percent in the last month and 49.45 percent year to date (YTD).

INTRODUCTION

CEAT shares surged to a one-year high in Thursday’s trading. The stock increased 19.40% from its previous close of Rs 2,092.30 to a 52-week high of Rs 2,498.10.

- The counter’s turnover was Rs 31.15 crore, with a market capitalisation (m-cap) of Rs 9,882.77 crore. The stock has risen 28.48 percent in the last month and 49.45 percent.

- The current increase can be attributed to new luxury vehicle introductions, according to a person familiar with the situation. CEAT received the most attention when the stock reached a 52-week high.

- The increase is more likely a beneficial spillover impact on tyre stocks, according to an industry source who requested anonymity.

“CEAT is planning to increase exports in FY24-25,” stated Ravi Singh, Vice-President and Head of Research at Share India.

It is bullish and trading above the 50 and 200-day moving averages, with an RSI of 70. In the short run, the stock might reach Rs 2,600.”

- “CEAT is bullish but overbought on the daily charts,” said AR Ramachandran of Tips2trades, Investors should take profits now or hold till the daily support of Rs 2,168 is broken on a closing basis.”

- The 14-day relative strength index (RSI) for the stock was 87.29. A value less than 30 is considered oversold, while a value more than 70 is considered overbought.

The stock of the corporation has a price-to-earnings (P/E) ratio of 32.28. It has a price-to-book ratio (P/B) of 2.05.

CONCLUSION

FOR MORE INDO CLICK THIS

SITE: https://learningsharks.in/

FOLLOW OUR