FLDG is a common product that fintechs use to collaborate with lenders. It assists banks and NBFCs in covering potential losses that may occur when clients fail to make payments.

When the Reserve Bank of India (RBI) announced its formal approval of the first loss default guarantee (FLDG) system last week, most lending fintechs applauded.

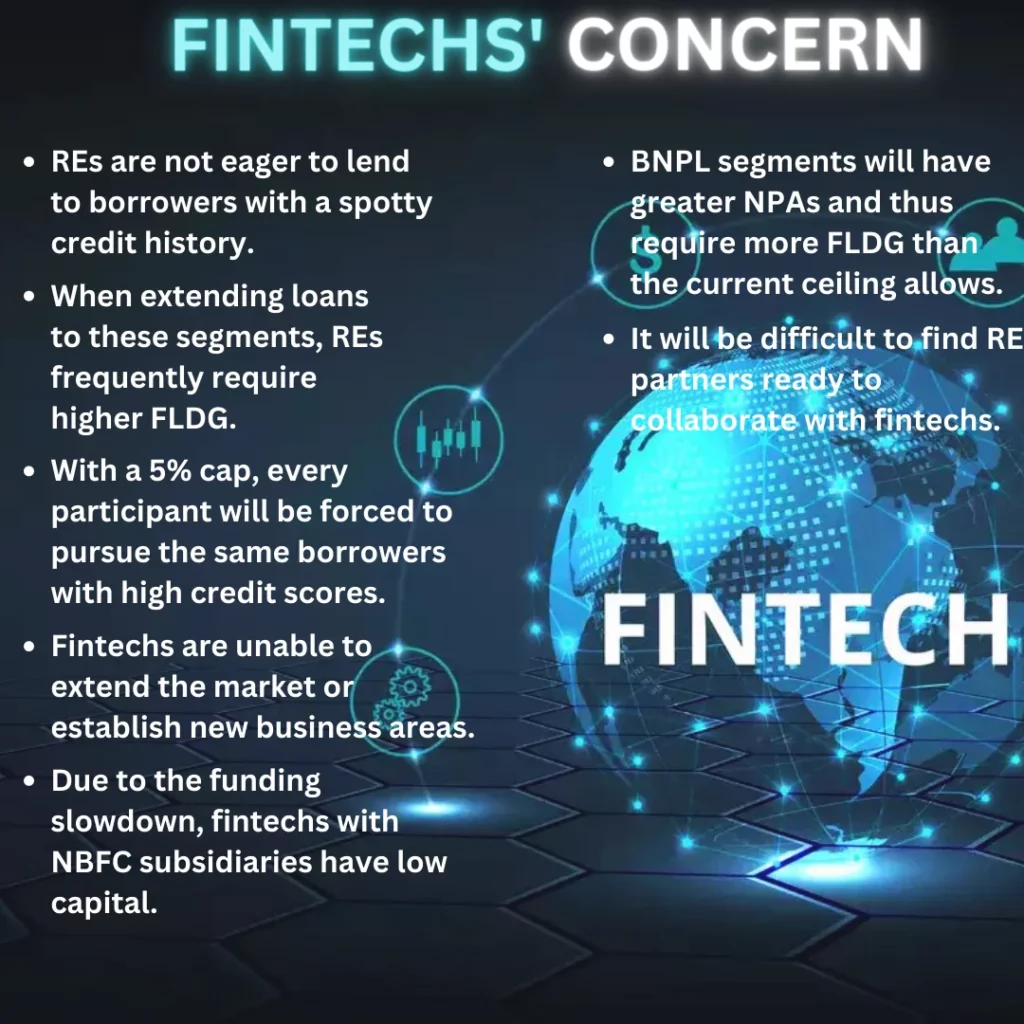

Indeed, others believe that this could harm digital lending to persons with minimal credit history, as well as the goal of bringing more people into the official credit system.

- It assists banks and NBFCs in covering potential losses that may occur when clients fail to make payments.

- There are numerous types of coverage, with fintechs often covering losses ranging from 10% to 25% of the overall loan amount.

Outside of home and personal loans, most digital lending by fintechs had a substantially higher FLDG rate, typically exceeding 10%, depending on their negotiating strength with banks and non-banking financial company (NBFC) partners.

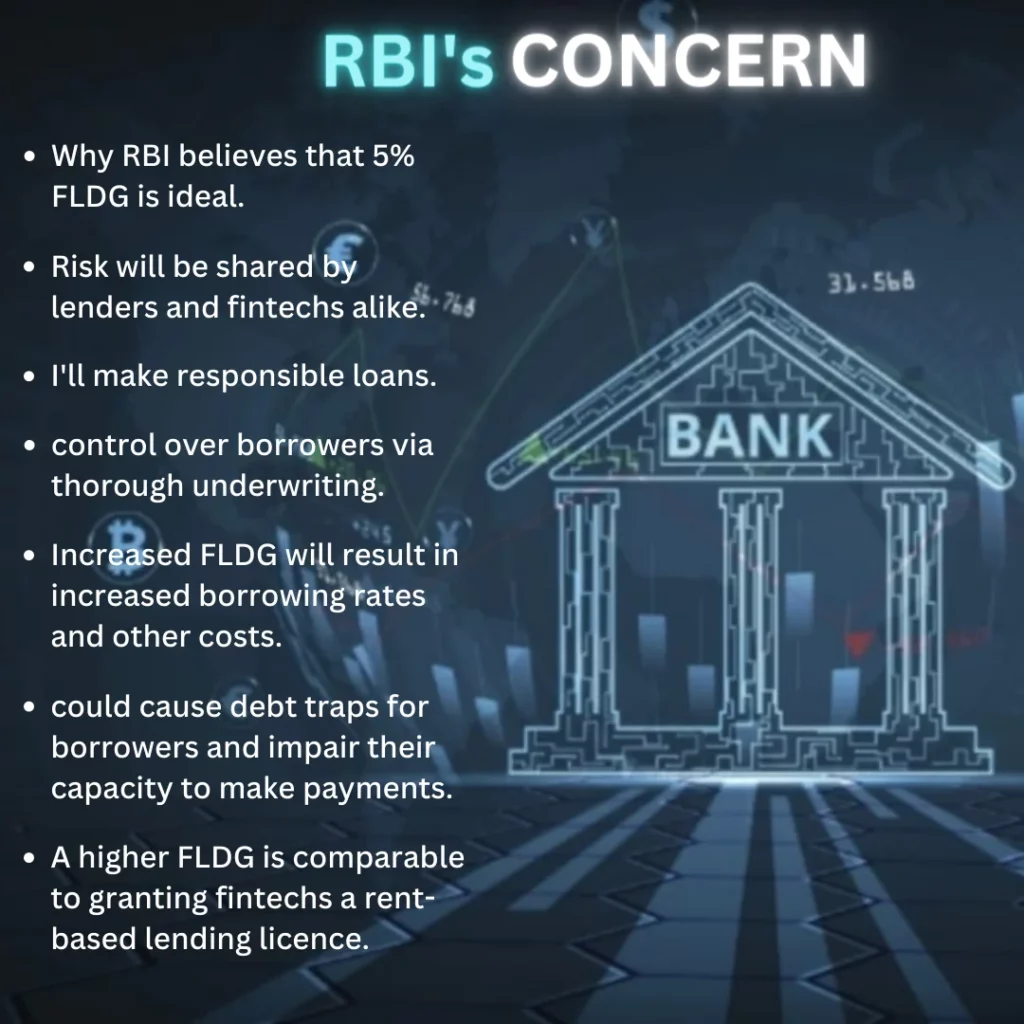

The RBI has emphasised that the sum must be paid upfront as a bank guarantee or cash to minimise any systemic risks resulting from fintechs going bankrupt or failing to make good on the FLDG promise.

- This decreases the risks for REs, because a slowdown in startup funding could have an impact on lenders if the loan portfolio has a high default rate.

- While this will help a few fintechs, most will fail,” says a senior executive of a private sector bank that deals with fintechs.

- according to the CEO, will end up lending to customers with good credit scores, which are highly sought after by all financial institutions.

“Because lenders will have to share the risk with a lower FLDG rate, they will be cautious about who fintechs lend to, “the creator says.

What is the significance of FLDG’s 5%?

“With the guidelines taking effect immediately, we anticipate a drop in volumes in segments with relatively higher FLDG as the industry adjusts to the new normal.”

- Director of CRISIL Ratings, “the market may see sourcing lenders adapting their business models to align with the revised regulations.”

- some asset classes to counteract the impact of the FLDG cover cap. However, it is possible that the situation will take some time to stabilise.

- FLDG allowed for this, and REs requested higher FLDGs when they considered the segments were riskier.

- Even with a 4% cost of operations and an industry typical of 1.5-2 percent non-performing asset (NPA), the profit margin might be 6%.

A stake in the game

According to the RBI, REs have no incentives to determine if the borrower has the potential to repay and to carry out underwriting correctly.

“The RBI is clearly concerned about creating a culture in which REs engage in irresponsible lending,” says a former banker who now works as a consultant for fintechs.

There are high-quality fintechs that bring clients to banks at a fraction of their normal sales costs.

Furthermore, keeping FLDG at 5% means that lenders will be cautious not to lend to persons who do not have a Cibil (credit) score. These included, among other things, payday loans, consumer durable loans for shopping and electronics, and short-term personal loans for routine expenses.

“We estimate that a substantial proportion of partnership/co-lending arrangements — particularly those with unsecured personal loans and business loan lenders — currently carry a FLDG cover of above 5%.”

digital lending guidelines were released last year. When combined with a funding slowdown that has put an end to any ambitions of giving a higher FLDG, the new 5% cap might effectively kill the business.

As a starting point, use 5%.

Even as the RBI was cracking down on fintechs with several restrictions last year, a few of the startups were shifting to Second Loss Default Guarantees and performance guarantees.

- The fintech founder quoted above feels that the RBI has not mentioned anything about performance guarantees and bonuses for good performance and the profits or losses can be shared by the partners.

- “Market and risk will be priced using a variety of methods, including interest rates and other methods, which will also be determined by the customer profile.”

That is not the culture the RBI wishes to encourage, according to the senior expert quoted above.

Look at more info: https://learningsharks.in/

Follow us on insta”http://learningsharks/