Timing is crucial in the Indian stock market. Your fortunes might change drastically in a single day.

So it seems to reason that you would want to get the most precise and up-to-date information about market trends.

This is where intraday trading Telegram channels come in helpful.

Finding the finest Telegram channels for intraday trading and sifting through the noise is getting more and more challenging.

The top 10 intraday Telegram channels are listed below, and they will give you all the data and analysis you need to succeed in the market.

1. Honest Stock Marketer

It is safe to say that Honest Stock Marketer has delivered honest and successful intraday trading suggestions based on its 10k+ subscribers in such a short time.

In contrast, the premium group offers various advantages, such as 3–4 Stock Option and Stock Future Calls, Live Guidance and Support, and Daily 6-7 Sure Bank Nifty Trades.

- 10,100+ subscribers

- Budget-friendly premium channel

- 90 to 95% accuracy stated in the bio.

Join for the best free intraday tips Telegram channel “Honest Stock Marketer” here: https://telegram.me/honeststockmarketer

2. Trade Onomics

TradeOnomics offers “INTRADAY EDUCATIONAL TRADES ON STOCKS/INDEX” with the goal of generating steady earnings. The trading tactics presented here include Nifty, Bank Nifty, and Stock Options Trades.

During live market hours, TradeOnomics offers live support for risk management. You can also seek the opinions of experts on the stocks you are interested in as well as your portfolio.

- The @TradeOnomics_Support channel offers live assistance.

- 7800+ subscribers

- Obtain comprehensive transaction reports during trading hours.

You can access TradeOnonmics at this link: https://telegram.me/TradeOnomics

3.Intraday Equity Trade

Intraday Equity Trade is where knowledge and technology come together. The algorithm used by the founders was created specifically to identify potential market trends before they materialised.

Here, you get flashes of unidirectional commerce. This specially created algorithm functions on everything and everything. You name it, they have it—from futures to commodities and money.

“Trade using ALGO and without feeling!” This channel states as much in its introduction, and it still holds true today.

- Best for trading with less risk

- thorough investigation for each call

- 2,447+ readers

Sign up to trade equity intraday here: https://telegram.me/IntradayEquityTrade

4. Trade On Data Institute

A project of a team that works there for the subscribers and has various seasoned traders and investors,

For new investors who are unsure of how the market operates and how profits are made, administrators have primarily concentrated on providing educational courses.

The Trade on Data Institute is unique in that it has a dedicated Twitter account for its team called Trade on Data Team (@TradeOnDataTeam), which investors and traders may use to ask the team any questions for free.

- With more than 45,500 subscribers

- Doubt clearing live sessions

- provided are programmes and courses for learning.

Click the hyperlink: https://telegram.me/BankNifty_Nifty_ProTraders

5.Stock Tips Intraday

Stock Tips Intraday has a sizable community of more than 106K+ students, seasoned traders, and novice investors. It has recently received many favourable ratings, making it one of the finest intraday tips suppliers on Telegram.

Even though the channel only has a few recommendations to offer for free, you still get real-time updates and advice that is helpful for intraday trading beginners.

- Free calls inside the day on Telegram

- Accurate analytics-based stock information

- No additional fees

The channel can be found at https://t.me/stock_tips_intradays

6.Stock Master

The Stock Master bundle is all-inclusive for new users. Every trading day, you receive two to three sizable intraday calls, and in recent months, your accuracy rate has improved to a respectable 95%.

Additionally, the professionals here offer trade levels for both the buy and sell sides. One of the greatest Telegram channels for intraday calls is Stock Master, which is also secure for beginners.

- Approximately 75,000 followers

- Expert trading analysis

- using the premium edition of F&O Trade Setups

Here is a link to the Stock Master channel: https://telegram.me/Stock_Masters

7.Shree Ganesh Stocks and Investments

Shree Ganesh Stocks and Investments, an authorised and reputable sub-broker with the well-known IIFL Securities portfolio management service provider, has built a responsive community on its Telegram channel.

Both short-term and long-term investment advice is provided on the channel. You can select from a variety of premium channels here that are divided into many categories, including

- Options on equity

- Futures

- Stocks

- Indices

COMMODITY CURRENCY

Beginners in the industry can get assistance opening a Demat account, as well as answers to all of their questions about investing, in addition to intraday trading advice.

Cost-effective premium options with 85%+ accuracy and more than 1500 active traders

Follow this link to sign up for Shree Ganesh Stocks and Investments: https://telegram.me/shreeganeshstocksandinvestments

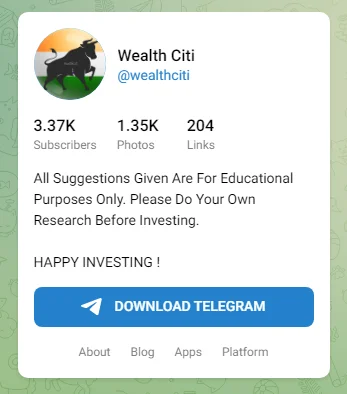

8.Wealth Citi

On all days with busy trading, Wealth Citi shares two to three trading suggestions per day. As Wealth Citi was developed to assist newcomers in learning the art of minimising losses and maximising returns in the intraday setup, here you will find all trading-based educational advice.

With more than 5.8K followers, this educational trading advice channel also provides new users with exclusive Demat account opening packages.

- Offers specific to trading apps

- Swing Trade Formations

- Very few fees for a premium account

Start here to gain knowledge about trading with Wealth Citi: https://telegram.me/s/wealthciti

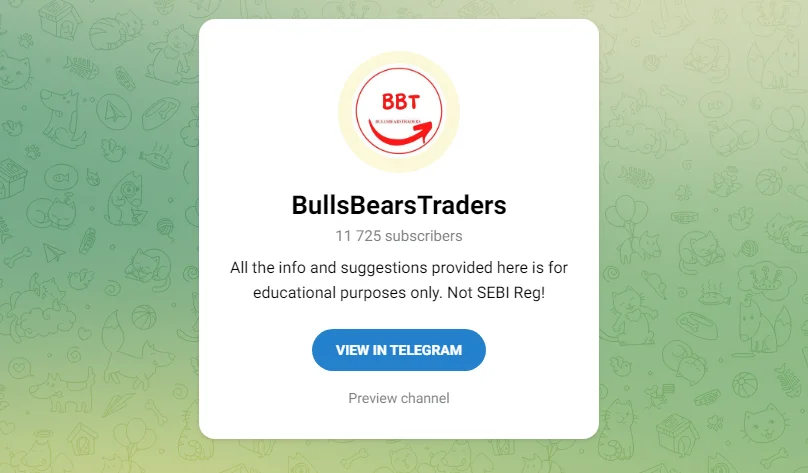

9. Bulls Bears Traders

Bulls Bears Traders, one of the most trustworthy names on this list, is an NIFM-certified intraday trading source that has consistently ranked highly on intraday trading telegram group rankings.

For intraday investors of all skill levels and backgrounds, the channel offers free calls. Bulls Bears Traders is the greatest intraday trading advisor in its class thanks to its outstanding 90% accuracy rate.

You can also choose the premium jackpot channel, which costs just Rs. 5999 for 90 days of trading.

- There are several trade and instructional lessons.

- 8400+ subscribers

- Offer both decent option calls and hero zero calls.

Here is the link to join Bulls Bears Traders’ intraday Telegram group: https://telegram.me/bullsbearstraders

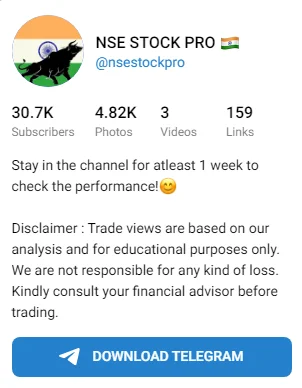

10.NSE STOCK PRO

On its Telegram channel, NSE Stock Pro has a solid track record of offering intraday trading advice and educational content.

With around 130K followers, this is a well-known analytics-driven Telegram group for investors and intraday trading. The premium club offers advantages like Daily Bank Nifty Trades, F&O Trades, and more for a low price of Rs. 5k.

- Customised assistance for paying customers

- 2–6 intraday trades per day

- Individual trading solutions

Click the following link to join the NSE STOCK PRO Telegram channel: https://telegram.me/s/nsestockpro

FOLLOW OUR WEBSITE: https://learningsharks.in/

FOLLOW OUR PAGE: https://www.instagram.com/learningsharks/