Introduction

We will delve into the concept of fixed exchange rates in this comprehensive guide and provide you with a thorough understanding of its implications, benefits, and challenges. As a leading authority in international finance, our goal is to provide you with the knowledge you need to navigate the complexities of fixed exchange rates.

What is a Fixed Exchange Rate?

A fixed exchange rate monetary system is one in which the value of one currency is tied to the value of another currency, a basket of currencies, or even a commodity such as gold. A fixed exchange rate, as opposed to a floating exchange rate, which fluctuates based on market forces, remains relatively stable over time.

Advantages of Fixed Exchange Rates

Price Stability

The assurance of price stability in international trade is one of the primary benefits of a fixed exchange rate. Businesses and individuals involved in cross-border transactions can forecast and plan their financial activities with greater certainty if the exchange rate remains consistent. This stability fosters market trust and confidence, thereby stimulating economic growth.

Facilitates Trade

Fixed exchange rates can help international trade by lowering the risk of currency fluctuations. Businesses that export or import goods and services can rely on stable exchange rates to calculate accurate costs and devise competitive pricing strategies. This predictability encourages trade partnerships and fosters international economic cooperation.

Monetary Discipline

A fixed-rate regime frequently necessitates stricter monetary policies. To keep the pegged value, governments must follow responsible fiscal policies, such as controlling inflation and keeping healthy foreign exchange reserves. Long-term benefits of this discipline include increased investor confidence and economic stability.

Challenges of Fixed Exchange Rates

Limited Monetary Policy Flexibility

Countries have limited flexibility in implementing monetary policies to address domestic economic challenges under a fixed exchange rate system. The central bank cannot freely adjust interest rates or intervene in the foreign exchange market to stabilize the currency because the exchange rate is fixed. A country’s ability to respond effectively to economic shocks can be hampered by a lack of flexibility.

Speculative Attacks

Fixed exchange rate systems are vulnerable to currency traders’ speculative attacks. Traders may engage in large-scale speculative transactions to force a currency devaluation if they believe it is overvalued or under significant pressure. Such attacks can cause financial instability and disrupt an economy’s normal operation.

Economic Divergence

Countries with different economic fundamentals may experience diverging economic outcomes in a fixed exchange rate system. Maintaining a fixed exchange rate, for example, can create imbalances and hinder competitiveness if one country has higher inflation or slower economic growth than its trading partners. This can lead to trade deficits, unemployment, and other economic difficulties.

Comparison with Floating Exchange Rates

To appreciate the implications of each system, it is critical to understand the key differences between fixed and floating exchange rates. While fixed exchange rates provide stability, floating exchange rates provide greater flexibility and can assist countries in adjusting to economic shocks. The decision between these systems is influenced by a country’s specific circumstances, economic goals, and policy preferences.

Advantage and Disadvantage of Fixed Exchange Rate:-

Advantage:-

- Price Stability: Fixed exchange rates provide certainty and stability in international trade, allowing businesses to more accurately plan and forecast.

- Trade Facilitation: Stable exchange rates promote trade by reducing uncertainty and exchange rate risk, as well as encouraging partnerships and economic cooperation among nations.

- Monetary Discipline: Maintaining a fixed exchange rate frequently necessitates responsible fiscal policies, such as inflation control and the accumulation of foreign exchange reserves, which can lead to long-term economic stability.

Disadvantage:-

- Limited Monetary Policy Flexibility: Fixed exchange rates limit a country’s ability to implement independent monetary policies, limiting a country’s options for addressing domestic economic challenges.

- Vulnerability to Speculative Attacks: Fixed exchange rate systems can be vulnerable to speculative attacks by currency traders, potentially causing financial instability and disrupting economic functioning.

- Economic Divergence: Countries with different economic fundamentals may face difficulties in maintaining a fixed exchange rate, resulting in imbalances, trade deficits, and other economic problems.

Conclusion

Finally, for businesses, policymakers, and individuals involved in international finance, a thorough understanding of fixed exchange rates is critical. While fixed exchange rates provide price stability and facilitate international trade, they also have drawbacks such as limited monetary policy flexibility and vulnerability to speculative attacks. To determine the best approach for a given economy, it is critical to weigh the benefits and drawbacks of fixed exchange rates versus alternative systems such as floating exchange rates.

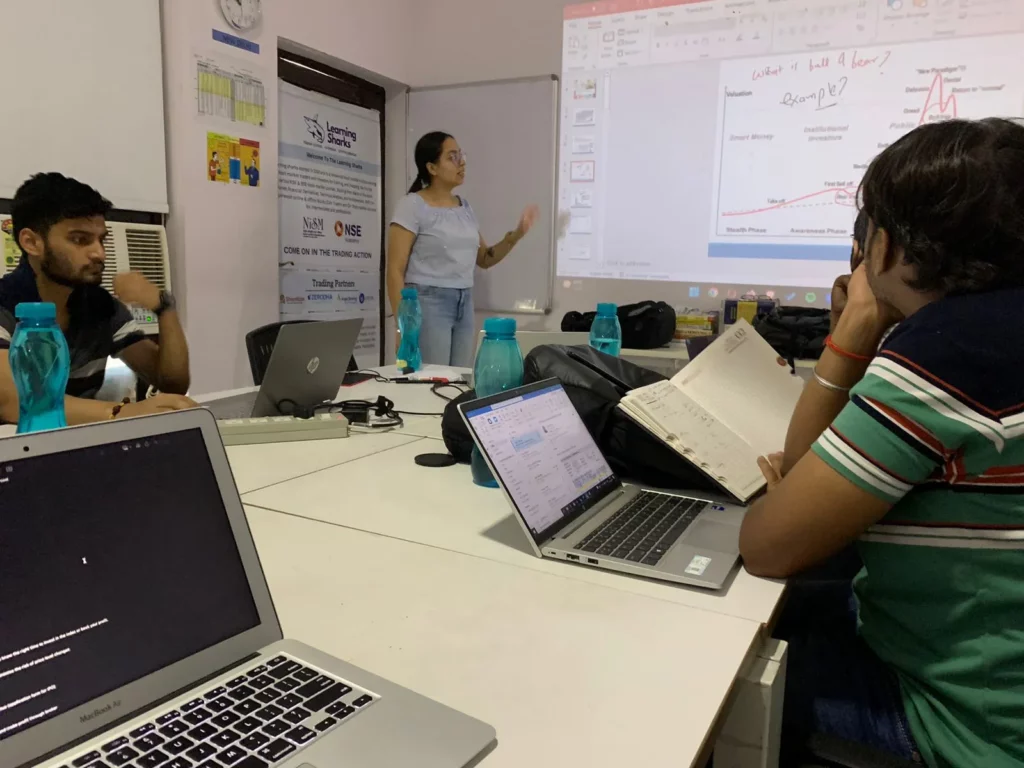

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en