Introduction

Welcome to our comprehensive guide to stock market investing. We will provide you with valuable insights and expert advice on how to successfully navigate the world of stock market investing in this article. This guide will provide you with the knowledge and tools you need to make informed investment decisions, whether you are a novice looking to get started or an experienced investor looking to improve your strategies.

Understanding the Stock Market

What is the Stock Market?

The stock market is a marketplace where individuals and institutions can buy and sell publicly traded company shares. It allows investors to become partial owners of these businesses and potentially benefit from their growth and profitability.

Why Invest in the Stock Market?

Investing in the stock market has numerous benefits. For starters, it provides a potential avenue for wealth creation. Over time, the stock market has outperformed other investment vehicles in terms of long-term returns. Furthermore, it enables investors to diversify their portfolios by spreading their risk across various sectors and industries. Finally, investing in stocks allows you to earn dividends and participate in capital appreciation.

Getting Started with Stock Market Investment

Setting Financial Goals

It is critical to define your financial goals before entering the stock market. This step will assist you in determining an investment strategy that is compatible with your goals. Are you saving for retirement, buying a home, or paying for your children’s education? Clarifying your objectives will help you make better decisions.

Assessing Risk Tolerance

When investing in the stock market, it is critical to understand your risk tolerance. Stocks are inherently volatile, with prices fluctuating dramatically in the short term. Assessing your ability to withstand market fluctuations and potential losses will help you choose the best investment strategy.

Conducting Fundamental Analysis

The process of evaluating a company’s financial health, management team, competitive positioning, and growth prospects is known as fundamental analysis. By analyzing these factors, you can identify stocks with strong fundamentals that are likely to generate long-term returns.

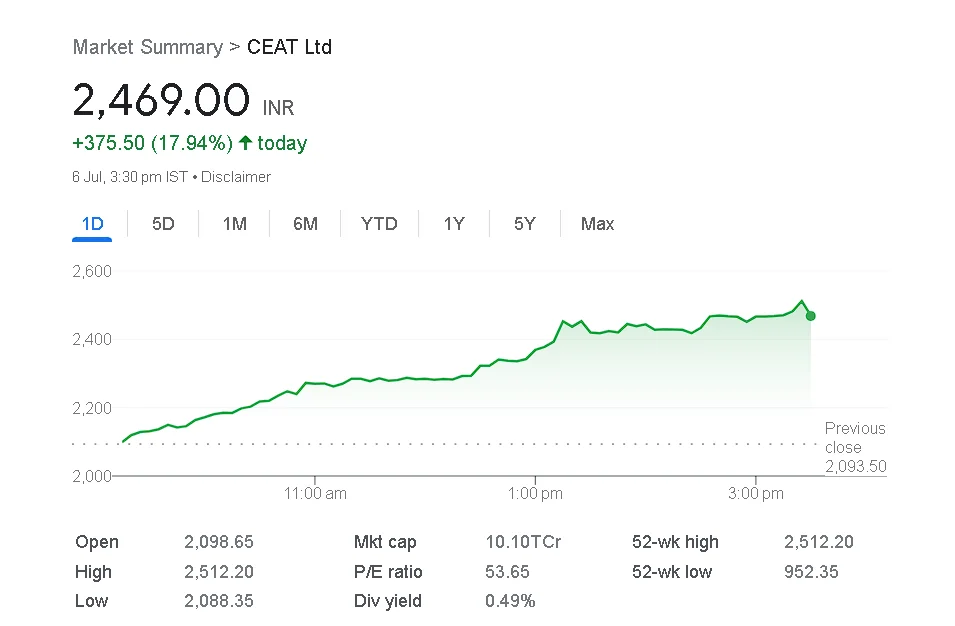

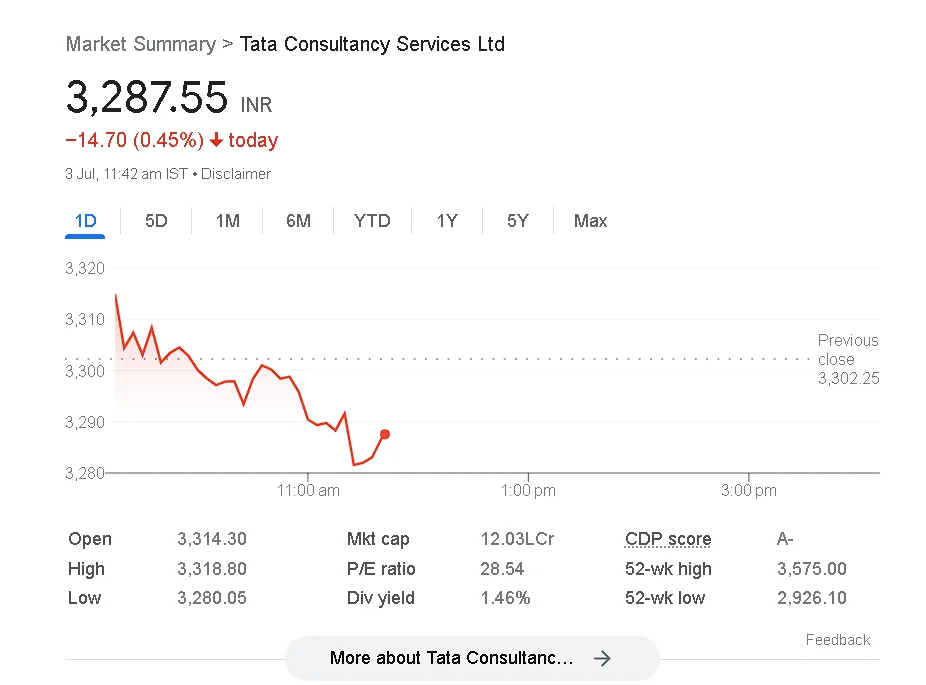

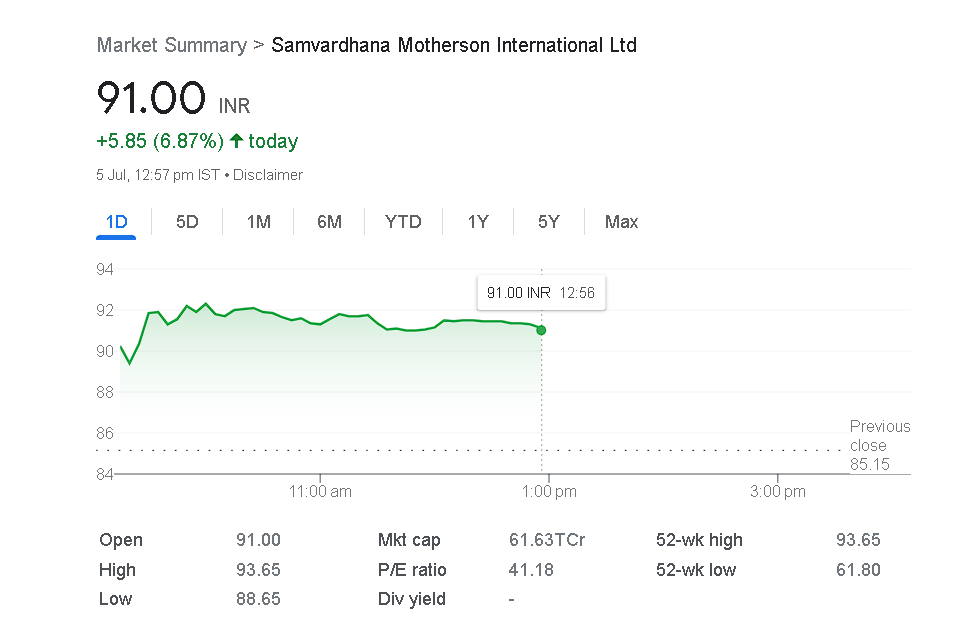

Technical Analysis and Market Trends

Technical analysis is the study of past price patterns and market trends in order to forecast future stock price movements. Based on patterns, support and resistance levels, and other indicators, it assists investors in making informed decisions.

Building an Investment Portfolio

Diversification

Diversification is an important aspect of successful investing. You can reduce the impact of individual stock volatility and minimize risk by diversifying your investments across asset classes, sectors, and geographic regions. A well-diversified portfolio can provide a good mix of stability and growth.

Asset Allocation

The distribution of your investments across various asset classes, such as stocks, bonds, and cash, is referred to as asset allocation. It is determined by your risk tolerance, time horizon, and financial objectives. Proper asset allocation ensures that your portfolio is well-positioned to withstand market volatility.

Long-Term Investing

Investing in stocks requires a long-term commitment. Short-term trading or attempting to time the market can be dangerous and unpredictable. You can benefit from the power of compounding and ride out market fluctuations by taking a long-term investment approach.

Risk Management and Investor Protection

Setting Stop-Loss Orders

Stop-loss orders are critical tools for risk management in the stock market. They enable you to set a fixed price at which you will sell a stock in order to limit potential losses. This strategy protects your investment from significant market downturns.

Stay Informed and Monitor Investments

It is critical to stay informed about the companies in which you invest as well as the overall market conditions. Review your portfolio on a regular basis, analyze financial statements, and stay current on relevant news and market trends. This proactive approach will allow you to make necessary adjustments to your investment strategy in a timely manner.

Investor Protection and Regulations

It is critical to understand investor protection measures and regulations in order to protect your investments. Familiarize yourself with governing bodies such as the Securities and Exchange Commission (SEC), as well as fraud prevention and reporting mechanisms.

Advantage and Disadvantage

Advantage:-

- Potential for High Returns: Historically, the stock market has provided higher returns than other investment options such as bonds or savings accounts. Investing in high-performing stocks has the potential to provide significant capital appreciation over time.

- Diversification: The stock market provides a diverse range of investment opportunities in a variety of sectors and industries. You can spread your risk by diversifying your portfolio with stocks from various companies and industries. Diversification reduces the impact of a single company’s or industry’s poor performance on your overall investment.

- Dividend Income: Many businesses pay out a portion of their profits to shareholders in the form of dividends. You can earn a regular income stream in addition to potential capital gains by investing in dividend-paying stocks. Dividends can be especially beneficial for investors looking for a consistent source of income.

- Liquidity: The stock market is a liquid market, which means that you can buy and sell stocks relatively easily. This liquidity gives you flexibility, allowing you to make investment decisions and access your funds when necessary. Stocks provide greater liquidity than other investments with longer lock-in periods.

- Ownership and Voting Rights: When you buy stocks, you become a part-owner in the company. This ownership confers certain rights, including the ability to vote in some cases. As a shareholder, you have the right to vote on corporate decisions and potentially influence the company’s direction.

Disadvantage:-

- Volatility and Risk: Stock prices can be highly volatile, and the value of your investments can fluctuate significantly in the short term. Market downturns can cause significant losses. Investing in the stock market entails some risk, and it’s critical to be prepared for potential fluctuations in portfolio value.

- Market Uncertainty: A variety of factors influence the stock market, including economic conditions, political events, and investor sentiment. These factors can create uncertainty and make it difficult to accurately predict market movements. Market volatility can have an impact on the performance of your investments.

- Time and Effort: Successful stock market investing necessitates time and effort spent conducting research, analyzing companies, and staying current on market trends. Continuously monitoring your portfolio and making informed investment decisions can be time-consuming. Stock investing may not be suitable for those who prefer a more passive or hands-off approach to investing.

- No Guaranteed Returns: Stocks, unlike certain fixed-income investments, do not guarantee a specific rate of return. Stock prices can fall, resulting in losses. Investing in the stock market necessitates a long-term mindset as well as the ability to weather short-term market fluctuations.

- Emotional Factors: Emotions such as fear and greed can have an impact on stock market investing. Emotional decision-making can lead to rash buying or selling that is inconsistent with a sound investment strategy. It is critical to control one’s emotions and make rational investment decisions based on thorough analysis rather than short-term market fluctuations.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en