Introduction

Being a large trader as a prominent player in the financial market provides numerous benefits and opportunities. In this article, we will look at the advantages of being a large trader, such as increased market influence, access to exclusive opportunities, and increased profitability. We’ll look at the strategies and practices that can help you become a successful large trader and outperform your competitors in the financial industry.

Enhanced Market Influence

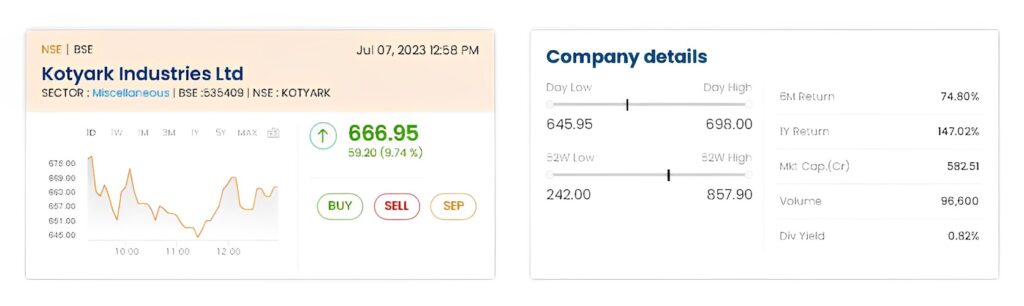

The ability to wield significant influence in the financial market is one of the primary benefits of being a large trader. Large traders have significant capital and trade volumes, allowing them to make significant transactions that can move markets. Other market participants closely monitor their actions, and their positions can have a significant impact on prices, trends, and overall market sentiment.

Large traders can influence investor sentiment, shape market trends, and even drive the direction of specific assets or sectors by actively participating in the market. Because large traders can attract liquidity, enjoy better execution prices, and benefit from increased market transparency, this influence can result in favorable trading conditions.

Access to Exclusive Opportunities

Large traders frequently have access to exclusive opportunities that smaller market participants do not have. Investment banks, hedge funds, and institutional investors frequently offer one-of-a-kind investment options designed specifically for large traders. Participation in private placements, exclusive investment vehicles, and privileged access to pre-IPO shares are examples of these opportunities.

Large traders also frequently have access to cutting-edge trading technologies, cutting-edge research, and specialized market insights. These resources give them a competitive advantage in the financial market, allowing them to identify profitable trading opportunities before others do.

Improved Profitability

Because of economies of scale, the financial market rewards large traders with increased profitability. With higher trading volumes, they can negotiate lower transaction costs, such as lower commissions and spreads. Furthermore, large traders can take advantage of bulk trading discounts provided by brokers, resulting in significant savings in transaction costs.

Furthermore, being a large trader improves one’s ability to diversify investment portfolios across different asset classes and geographies. This diversification reduces risk and increases the possibility of generating consistent profits over time. Large traders can maximize risk-adjusted returns and achieve better overall portfolio performance by diversifying their investments across markets and sectors.

Strategies for Becoming a Successful Large Trader

Being a successful large trader necessitates a strategic approach as well as a thorough understanding of the financial market. Consider the following key strategies:

- Build a Strong Capital Base

To become a large trader, you must first amass a substantial capital base. This provides the financial resources required to execute large trades and weather potential market fluctuations. Saving and reinvesting profits on a regular basis can help your capital grow over time, allowing you to expand your trading activities. - Develop a Robust Risk Management Plan

To protect their capital and investments, large traders must have a well-defined risk management plan in place. This plan should include risk tolerance guidelines, position sizing guidelines, and strategies for dealing with potential losses. Large traders can protect their capital and run a profitable trading business by effectively managing risk. - Make use of technology and data analytics

Large traders must leverage technology and data analytics in today’s digital age. Advanced trading platforms, algorithmic trading systems, and real-time market data can provide useful insights and aid in the identification of profitable trading opportunities. Using these tools can help you make better decisions and improve your trading performance. - Develop Strong Relationships

Large traders must cultivate strong relationships within the financial industry. Developing relationships with brokers, institutional investors, and industry professionals can lead to exclusive opportunities, market intelligence, and potential collaborations. Networking and attending industry conferences and events can help you develop these important relationships.

Conclusion

Being a large trader in the financial market provides numerous benefits, including increased market influence, access to exclusive opportunities, and increased profitability. Aspiring large traders can position themselves for success by capitalizing on these advantages and implementing effective strategies. Remember to establish a solid capital base, create a solid risk management strategy, embrace technology, and cultivate strong industry relationships. This allows you to confidently navigate the financial market, outrank competitors, and achieve long-term profitability.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en