The value of a company’s stock is greatly influenced by share prices in the quick-paced world of the financial markets. As traders, investors, and financial enthusiasts, we are aware that keeping a close eye on share prices is crucial to reaching our financial objectives and making wise decisions. We will examine the idea of share price, its importance in trading, and how it affects investment decisions in this thorough guide.

Share Price Definition and Basics

The price at which one share of a company’s stock is currently trading on the open market is referred to as the share price, also known as the stock price or equity price. It reflects how the market views a company’s overall performance, potential for growth, and prospects for the future. Based on a number of variables, such as supply and demand on the market, company earnings, prevailing economic conditions, and industry trends, the price may change frequently.

The Dynamics of Share Price Movement

Share prices fluctuate frequently, going up and down in response to market factors and investor sentiment. Numerous factors affect how share prices move, so it’s critical for traders to understand these dynamics in order to make wise choices.

1. Company Performance

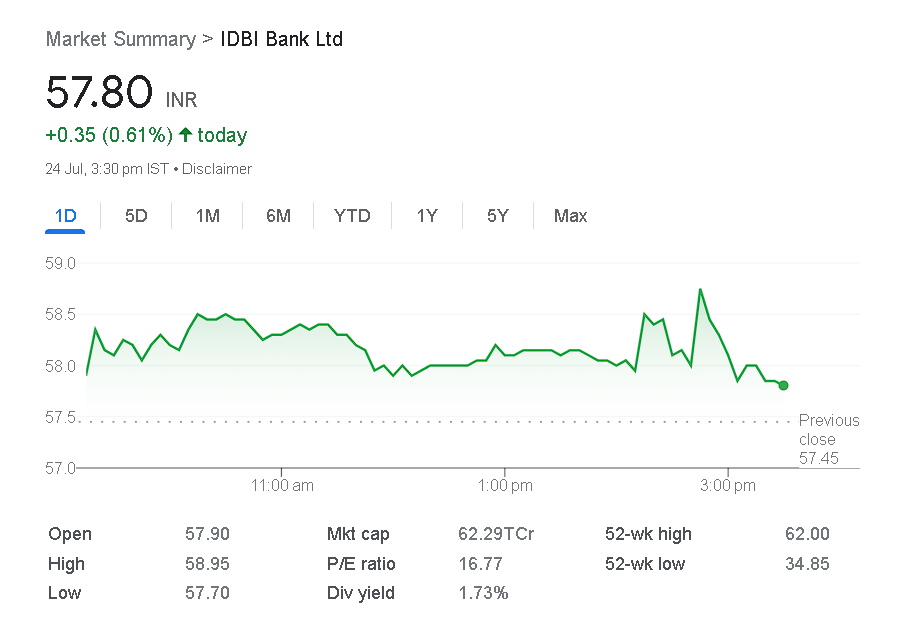

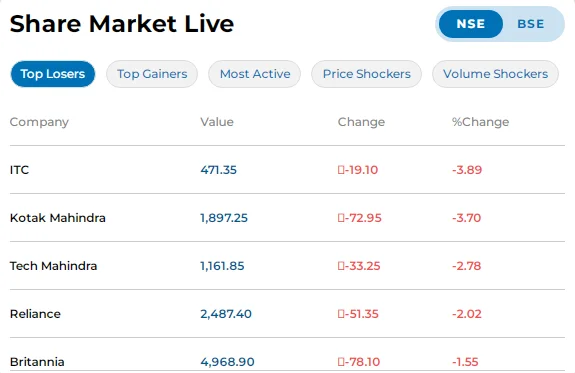

The share price of a company is directly impacted by its performance and financial health. Share prices frequently rise as a result of positive earnings reports, rising sales, and successful business tactics. In contrast, disappointing financial results or unfavorable news may result in a decline in share prices.

2. Market Sentiment

Share prices are significantly influenced by investor perception and sentiment. Share prices can rise in response to good news, market optimism, and favorable economic conditions, while they can fall in response to unfavorable sentiments or general market downturns.

3. Demand and Supply

Share prices are influenced by the fundamental concepts of supply and demand, just like any other tradable asset. The share price typically increases when investors want to buy a particular stock more than they want to sell it, and vice versa.

4. Dividend Payments

The dividend yield and consistency of payouts for businesses that distribute dividends to their shareholders can impact share prices. Increased demand for the stock and higher dividend yields may draw in investors, driving up the price of the stock.

5. Industry and Market Trends

Share prices of businesses within a given sector can be impacted by both market trends as a whole and industry-specific factors. For instance, technological advancements may boost the share prices of tech companies, whereas a downturn in the energy industry may harm stocks related to the energy industry.

The Significance of Share Price in Trading

Share prices have a big impact on investors, traders, and the business itself. Making informed trading decisions requires having a solid understanding of share prices.

1. Investment Decisions

Share prices are an important factor for both individual investors and fund managers to take into account when choosing securities for their portfolios. The objective is to locate undervalued stocks with room for growth or overvalued stocks that are ready to be sold.

2. Portfolio Valuation

A portfolio of investments’ overall value is greatly influenced by share prices. Investors continuously assess gains and losses on the basis of current share prices while tracking the performance of their holdings.

3. Market Timing

In order to spot patterns and trends that may be used to forecast potential market turning points, traders frequently examine share price movements. Making profitable buy and sell decisions can result from effective market timing.

4. Investor Sentiment

Investor sentiment and confidence in a company can be impacted by share prices. A rising share price might indicate success and draw in more investors, whereas a falling share price might cause anxiety and decrease investor interest.

5. Capital Raising

When companies raise money through secondary offerings, share prices are crucial. A high share price might make it easier for the business to raise money, whereas a low share price might put off potential investors.

Using Share Price Information Wisely

We must approach share price information as traders and investors with caution and critical analysis. While share prices provide insightful information, they shouldn’t be the only thing we consider when making decisions.

The company’s foundations, financial statements, competitive positioning, and industry outlook must all be thoroughly researched. Additionally, having a broad perspective on geopolitical developments and global economic trends can help you interpret changes in share prices.

In conclusion, share prices are a fundamental component of trading and investing, influencing market participants’ choices and sculpting the financial landscape. Our ability to make wise investment decisions and successfully negotiate the complexities of the financial markets depends on our ability to comprehend the dynamics of share price movement and its significance.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en