Individual stocks can be a profitable choice for investors who want to diversify their investments beyond diversified mutual funds or ETFs. However, you must learn how to evaluate the underlying businesses of individual stocks before you begin buying them.

The Securities and Exchange Commission filings of a company are a good place to start. A lot of information, including financial statements for the most recent year, will be available from these filings. Financial ratios can then be calculated to help you better understand the company and potential future direction of the stock price.

Here are some key ratios to know when looking at a stock.

1. Earnings per share (EPS)

One of the most popular ratios in use in the financial industry is earnings per share, or EPS. This figure reveals the profit generated by a company for each share of stock that is currently outstanding. A company’s net income is divided by the total number of outstanding shares to arrive at its earnings per share (EPS).

For stock investors, understanding this ratio’s limits is just as important as knowing it. The various accounting procedures that can affect net income and earnings per share are largely under the control of executives. Don’t just accept EPS at face value; ensure that you are aware of the methodology used to determine earnings.

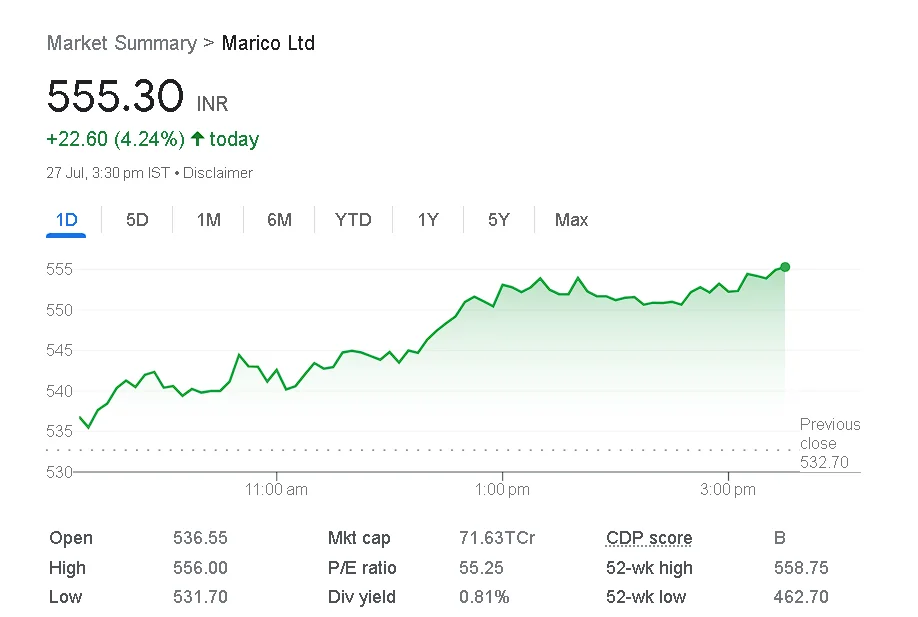

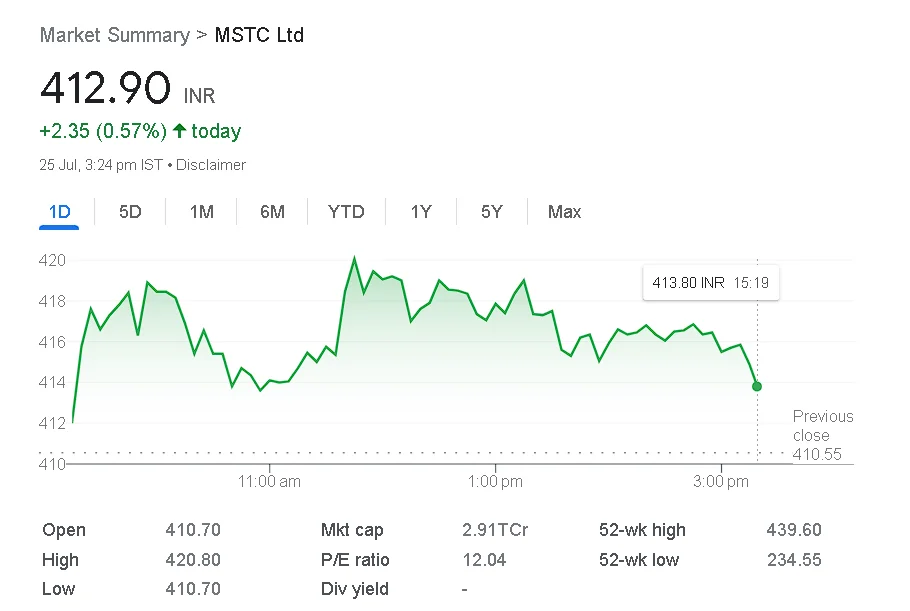

2. Price/earnings ratio (P/E)

One of the most popular ratios in use in the financial industry is earnings per share, or EPS. This figure reveals the profit generated by a company for each share of stock that is currently outstanding. A company’s net income is divided by the total number of outstanding shares to arrive at its earnings per share (EPS).

For stock investors, understanding this ratio’s limits is just as important as knowing it. The various accounting procedures that can affect net income and earnings per share are largely under the control of executives. Don’t just accept EPS at face value; ensure that you are aware of the methodology used to determine earnings.

Both trailing earnings, or earnings that have already been earned, and forward earnings, which are estimates of potential future earnings for the company, can be used to calculate P/E ratios. Comparing the forward P/E ratio to historical earnings, which can lead to an elevated ratio for fast-growing companies, may be more helpful. However, keep in mind that projections are not always accurate, and many stocks of businesses that were once regarded as fast-growers suffered when that growth did not occur.

To determine an earnings yield, the P/E ratio can also be reversed. Investors can easily compare the yield to other investment opportunities by dividing earnings per share by the stock price.

3. Return on equity (ROE)

The return a company makes on the capital of its shareholders, or return on equity, is one of the most crucial ratios to comprehend. It serves as a gauge of a company’s efficiency in generating profit for its shareholders. If two businesses were to earn $1 million this year, but one would have needed to invest $10 million while the other only needed $5 million, it would be obvious that the second business had a better year.

Dividend on equity is calculated by dividing net income by shareholder equity in its most basic form. In general, a company’s underlying business is better if its return on equity is higher. However, these high returns often draw other businesses that also want to earn high returns, which could result in more competition. Almost always, more competition is bad for a company and can cause once-high returns on equity to drop to more typical levels.

4. Debt-to-capital ratio

You should monitor a company’s profitability in addition to learning how it is financed and whether it can support the levels of debt it is carrying. The debt-to-capital ratio, which adds short- and long-term debt and divides it by the company’s total capital, is one way to look at this. The higher the ratio, the more indebted a company is. Debt-to-capital ratios above 40% typically call for a closer examination to ensure the company can manage the debt load.

The kind of financing a company chooses will depend on the specifics of that business. Less debt financing should be used by companies with more cyclical business models to reduce the risk of defaults during economic downturns, when sales and profits are typically lower. On the other hand, companies that consistently perform well can frequently support higher levels of debt due to their more predictable nature.

5. Interest coverage ratio (ICR)

Another useful metric for determining whether a business can support its level of debt is the interest coverage ratio. Earnings before interest and taxes, or EBIT, can be divided by interest expense to determine interest coverage. This figure indicates how much of the interest payments due to bondholders are covered by earnings. The company has more coverage for its debt payments the higher the ratio.

But keep in mind that income fluctuates over time. Due to its high earnings, a cyclical company operating close to its peak might exhibit strong interest coverage, but this can disappear when earnings decline. Make sure a business can fulfill its obligations in a range of economic climates.

6. Enterprise value to EBIT

The enterprise value to EBIT ratio can be thought of as an improved P/E ratio. Both ratios allow investors to gauge how much value they are receiving in relation to the price they are paying. However, by using enterprise value rather than share price, we are able to account for any debt financing that the company may have used. This is how it goes.

The total value of all a company’s outstanding shares, known as its market capitalization, is added to its interest-bearing debt, net of cash, to determine its enterprise value. EBIT also makes it simpler to compare a company’s actual operating earnings to those of other businesses, which may have different tax rates or debt loads.

7. Operating margin

The profitability of a company’s core operations can be determined by looking at its operating margin. The amount of income produced by each dollar of sales is calculated by dividing operating profit by total revenues.

Revenue is divided by sales costs and all other operating expenses, including labor and marketing costs, to arrive at operating income. You can compare your company to others’ without having to account for variations in tax rates or debt financing by computing your operating margin.

8. Quick ratio

The quick ratio, also referred to as the “acid test,” evaluates a company’s ability to pay short-term obligations with assets that can be quickly converted into cash. The ratio is helpful for analyzing businesses in tough financial situations or in recessionary periods when profits might be scarce.

The ratio multiplies a company’s current liabilities by the sum of its cash, marketable securities, and accounts receivable. The most recent balance sheet for the company contains all of these numbers. Inventory is crucially left off the list of assets because it cannot be trusted to convert quickly to cash.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en