Introduction

We offer a strategic overview of investing in top fintech companies in this in-depth guide. The way we manage and invest our money has been revolutionized by fintech, also known as financial technology. Fintech businesses have greatly expanded the opportunities available to investors with their inventive solutions and ground-breaking technologies. You can learn all about the nuances of investing in this exciting industry by reading this article.

Understanding the Fintech Landscape

Understanding the fintech landscape is essential before making any investments. Peer-to-peer lending, payment processing, blockchain technology, digital banking, and other services are all included in the broad category of fintech. You can make wiser investment choices if you understand the various fintech sectors.

Key Sectors in Fintech

- Digital Banking: Fintech has reshaped traditional banking, making it more accessible and convenient. Mobile banking apps, digital payment platforms, and online-only banks are part of this sector.

- Peer-to-Peer Lending: Fintech platforms have disrupted traditional lending institutions by connecting borrowers and lenders directly. These platforms offer competitive interest rates and streamlined lending processes.

- Blockchain Technology: Blockchain is at the heart of cryptocurrencies like Bitcoin. It also has applications in supply chain management, smart contracts, and more.

- Payment Processing: Payment gateways and processors facilitate secure online transactions. Investing in companies that enhance payment processing can be lucrative.

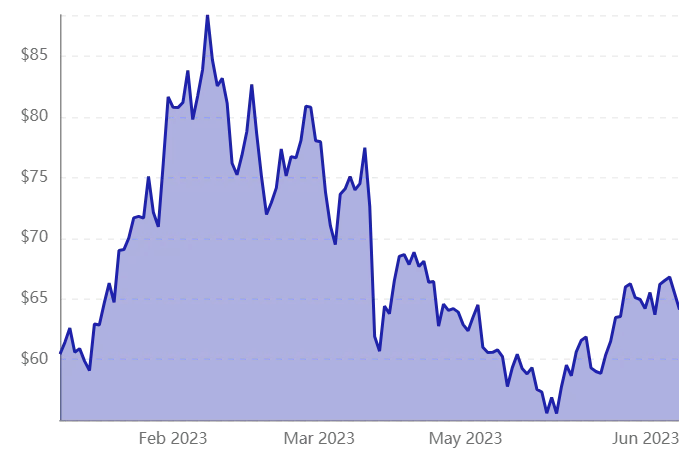

Top five fintech stock investments for 2023

Many fintech stocks have suffered greatly as a result of the recent stock market downturn. Most fintechs are growth stocks, which have taken the biggest hit from the decline.

However, given the long-term potential of the fintech sector, it is a good idea to look for dependable businesses to invest in right now. Here are five fintech stocks to take into account for your portfolio in light of that:

- Block

- PayPal

- Bank of America

- Adyen

- MercadoLibre

1.Block

Block’s (SQ -2.06%) product line, formerly known as Square, has developed into a substantial financial ecosystem for people and small businesses from its beginnings as a way for retailers to accept credit cards using their mobile phones. The business now handles more than $200 billion in card payments annually, has a successful small business lending platform, and owns a banking subsidiary called Square Financial Services. Additionally, it recently entered the buy-now, pay-later lending market with the acquisition of Afterpay.

2.PayPal

The undisputed leader in online payments is PayPal Holdings (PYPL 0.56%), among other things. Its Venmo platform for person-to-person payments has become a market leader and is rapidly growing its sizable user base. In addition, PayPal has invested in a number of other profitable businesses, such as MercadoLibre (MELI 2.53%), Uber (UBER 0.35%), and others, as well as complementary businesses like the e-commerce tool Honey. Thanks to more than $1.8 billion in free cash flow generated in the most recent quarter alone, PayPal has the financial flexibility to seize opportunities as they present themselves.

432 million PayPal accounts are active today across more than 200 nations. PayPal is doing a great job figuring out how to monetize its user base, despite the fact that user growth has recently slowed. There is still a ton of long-term potential for PayPal. In a nutshell, this is a very successful market leader that doesn’t appear to be slowing down anytime soon.

3. Bank of America

This one might initially seem strange. Bank of America (BAC -2.13%) is frequently connected to traditional banking, which is the exact opposite of fintech innovation.

However, there are several compelling reasons why Bank of America is more of a fintech than it appears. CEO Brian Moynihan and his team have done an excellent job of improving asset quality and focusing on efficiency in the years since the 2008-09 financial crisis. Technology has played a significant role. Bank of America was named the No. 1 bank for “Online Banking and Mobile Banking Functionality” by Javelin in 2022, as well as the “Best Consumer Digital Bank in the U.S.” by Global Finance. As more customers use the bank’s excellent digital channels, the business will become more efficient. Bank of America is an out-of-the-box fintech with a lower valuation than many other large banks and a 2.6% dividend yield.

4. Adyen

Adyen (ADYE.Y 2.4%) isn’t a household name among most US investors, but it belongs in the same conversation as Block and PayPal.

Adyen, a company with its headquarters in the Netherlands, provides payment processing solutions to companies all over the world, with a focus on the US market. It offers options for making payments through in-person, online, and mobile channels. Contrary to the other major payment processing tech companies, Adyen focuses almost exclusively on large businesses. Microsoft (MSFT 1.84%), Uber (UBER 0.35%), and McDonald’s (MCD -0.41%) all use Adyen as their payment processor. You might remember that a few years ago, eBay changed its preferred payment processor from PayPal to Adyen.

5. MercadoLibre

MercadoLibre (MELI 2.53%) is frequently referred to as the Amazon.com (AMZN 4.26%) of Latin America, and the moniker fits. The company has a massive e-commerce business, with annualized merchandise sales volume of well over $30 billion, and it is growing at an impressive rate. In addition, the company has a logistics platform (Mercado Envios) and a lending business (Mercado Credito), both of which have grown significantly in recent years. Mercado Credito stands out, with 146% year-over-year growth in the most recent quarter.

From a fintech perspective, the Mercado Pago payments platform is the most intriguing. The company is expanding much more quickly than e-commerce and currently processes more than $120 billion in annualized payment volume. Particularly encouraging is the fact that Mercado Pago is expanding more quickly when it comes to handling payments outside of MercadoLibre’s e-commerce platform. Think of Mercado Pago as a PayPal at an earlier stage (remember when it was a part of eBay?) that is starting to grow into a significant business on its own.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en