Introduction

It is impossible to ignore the significant impact and significance of financial markets in the world of finance. The world economy depends heavily on financial markets, which play a crucial role in capital allocation and economic expansion. This article explores the complex structure of financial markets, breaking down their elements, purposes, and vital role in determining the direction of the financial system.

What Are Financial Markets?

Any location, real or virtual, where people, organizations, or other entities with capital to invest come together to pursue financial instruments is considered a financial market. These instruments come in many different forms, such as derivatives, stocks, bonds, and commodities. The fundamental function of financial markets is to act as middlemen, bringing together capital holders and those in need of it. They also aid in risk mitigation and the effective distribution of resources.

Types of Financial Markets

- Investment Markets

The cornerstone of long-term investment and financing is the capital markets. Primary and secondary markets are separated among them. Companies issue new securities on the primary market in order to raise capital, and investors trade previously issued securities on the secondary market. - Financial Assets

The short-term financial instruments that are the focus of money markets are usually defined by low risk and high liquidity. Commercial paper, certificates of deposit, and Treasury bills are exchanged amongst participants in the money markets. - Commodity Markets

Commodity markets facilitate the exchange of goods and raw materials. These markets can be further divided into futures markets, which are where contracts for future delivery are bought and sold, and spot markets, which are where immediate delivery occurs. - Markets for Foreign Exchange (Forex)

Forex markets act as the hub of global trade by making it easier to exchange one currency for another. Through these exchanges, the value of one currency in relation to another is established.

The Key Players

Financial markets are dynamic ecosystems that are fueled by the involvement of numerous players. Some of the important participants are as follows:

- Investors

The financial markets are vital to individuals, institutional investors, and retail investors alike. The pricing and liquidity of financial instruments are impacted by their actions. - Financial Institutions

In the market, banks, brokerage houses, and investment firms serve as middlemen, bringing together buyers and sellers. They also offer a range of financial services, including advisory and asset management. - Regulators

The fair and transparent operation of the financial markets is guaranteed by governmental organizations and regulatory bodies. In order to protect the interests of investors, they impose rules and regulations.

Market Efficiency

A key idea in financial markets is market efficiency. It speaks to the extent to which asset prices accurately represent all available data. Three types of market efficiency exist:

- Weak Form Efficiency

Asset prices already take into account all historical trading data, including volume and price histories, in this form. As a result, using this information to analyze returns is not possible to consistently achieve superior returns. - Semi-Strong Form Efficiency

This form specifies that asset prices take into account all information that is publicly available in addition to weak form efficiency. Consequently, it is impossible for technical or fundamental analysis to produce higher returns. - Strong Form Efficiency

According to the strong form efficiency theory, asset prices fully account for all information, including insider knowledge. No one has an informational advantage in such markets.

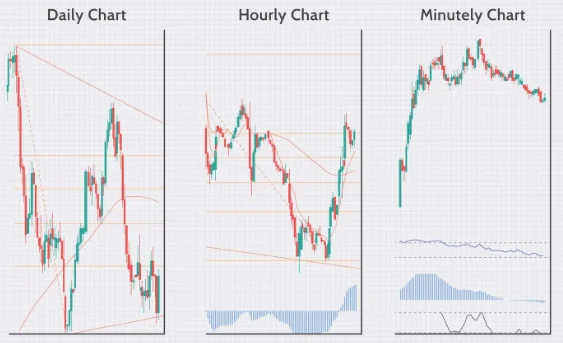

Market Dynamics and the Role of Information

The lifeblood of the financial markets is information. The rapid interpretation and distribution of information can lead to significant and quick changes in the market. To obtain an advantage in this cutthroat market, traders and investors use a variety of techniques, including algorithmic trading, technical analysis, and fundamental analysis.

Conclusion

Financial markets are evidence of the wonders of contemporary finance. They guarantee the effective use of resources, stimulate economic growth, and present a variety of investment options. Anyone trying to navigate the complicated world of finance needs to have a solid understanding of the intricate workings of these markets.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en