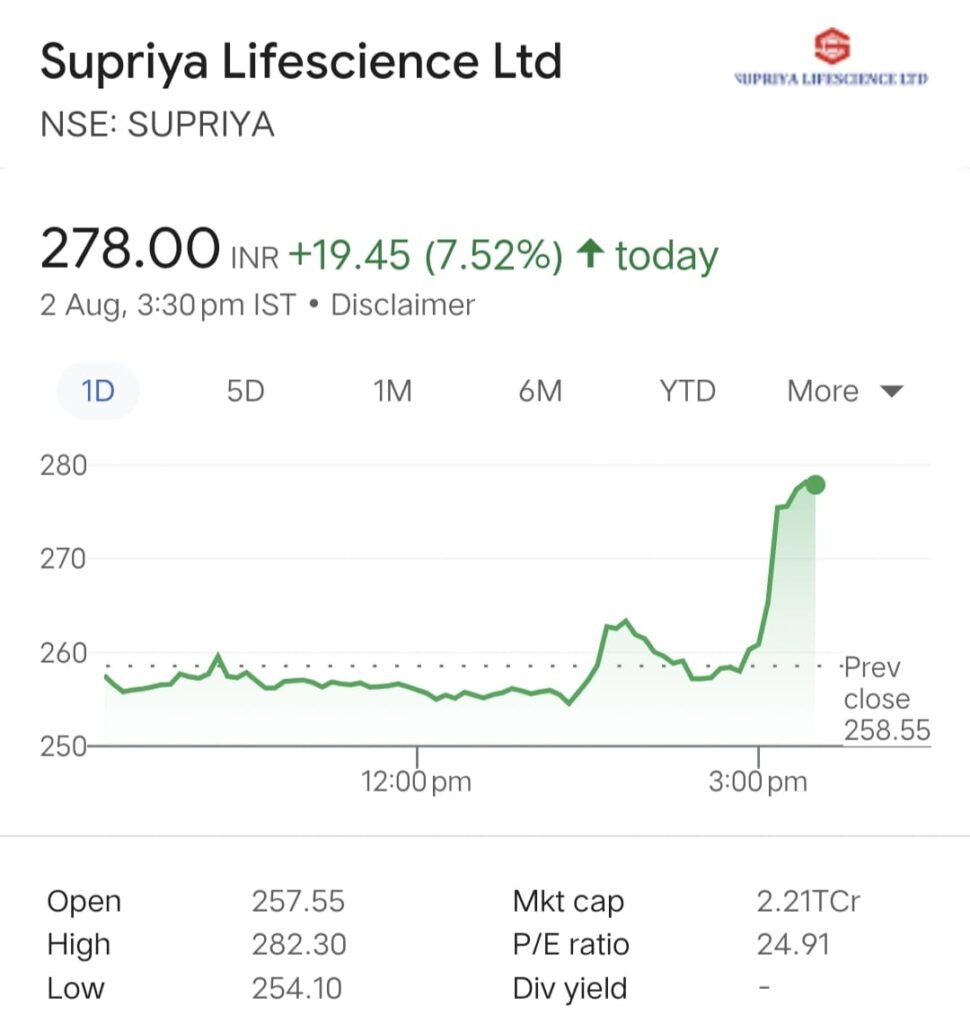

Shares of Supriya Lifescience increased by more than 7% as a result of the news. The share price was up 7.52 percent at Rs 278.00 at 3:45 PM.

INTRODUCTION

In order to produce Ingredient Optimized Protein (ioProtein), Supriya Lifescience, based in Mumbai, has signed a memorandum of understanding with Plasma Nutrition, a company based in the US that specializes in cutting-edge consumer goods.

The strategic alliance includes a technology licensing contract that grants Supriya Lifescience the sole authority to produce and market ioProtein in India.

According to Plasma Nutrition, ioProtein naturally improves your body’s capacity to utilize protein, enabling your body to maximize the benefits of the daily nutritional supplements you take.

- Shares of Supriya Lifescience increased by more than 7% after the announcement. The shares were trading at Rs 278.00 at 3:45 PM, up 7.52%.

- The ioProtein method is protected by a patent (US application pending). The protein powder has a key benefit in that it is highly bioavailable and is made for protein supplements.

- We have a fantastic chance to deliver this highly bioavailable protein powder, which has been well-received in other markets, to India’s fast expanding need for protein supplements.

According to Flynn-Rozanski, “We think that this alliance will establish a new benchmark for protein dietary supplements in India.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en