In share trading, there is no short path to success. What then is the key to success that we are seeking? The stock or your online stockbroker are not the key to your trading and investment success. Everything depends on you.

Always keep an ear to the ground.

- The stock market always has a tale to tell. Your first responsibility as a trader is to decipher market cues and execute trades accordingly.

- The trader must base his success on the truth rather than on conjecture. You must resist the urge to try to be a market contrarian as a trader.

When the market is bearish and you are bullish, the market is telling you that you have overlooked important elements. Pay heed to the message and adjust your position as necessary.

Complete Your Research

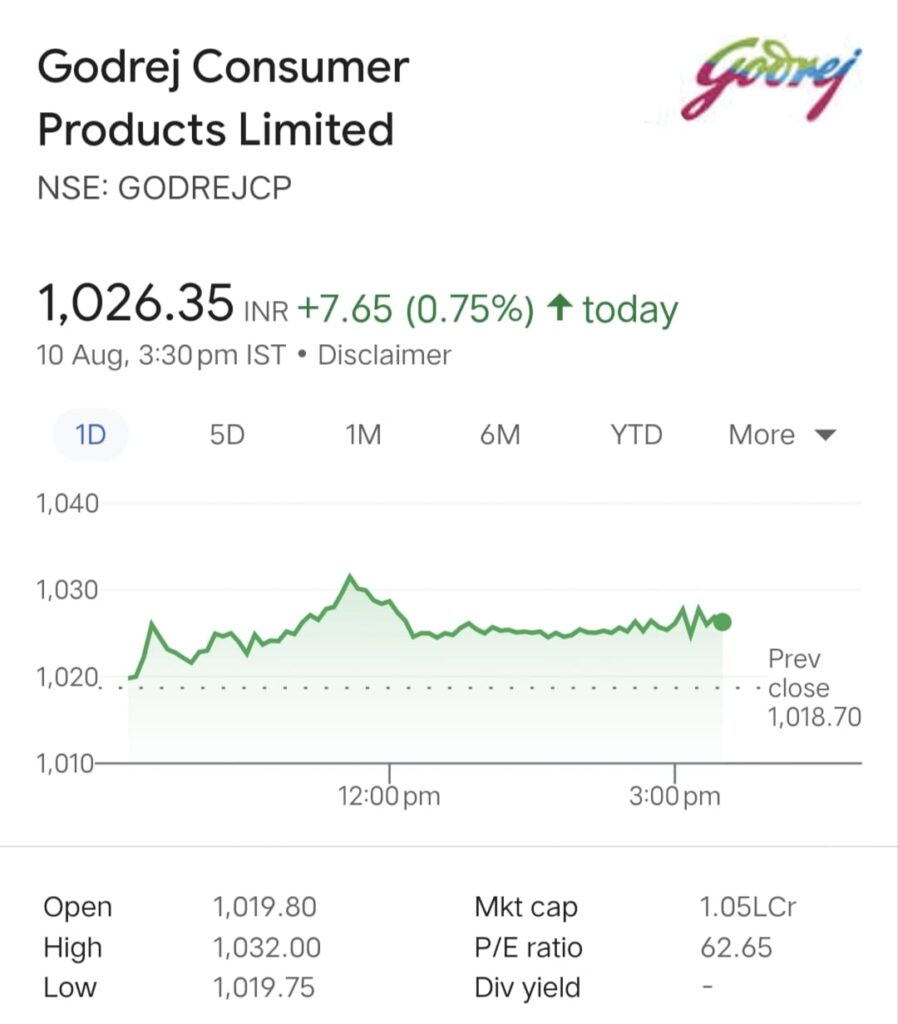

- Even a trader needs to be aware of the stock’s numerous characteristics, including company performance, the health of the balance sheet, the effect of news flow, technical charts, and more.

- You cannot comprehend signals or predict how the stock will respond to news and earnings flows without doing so. One of the fundamental rules in this situation is to begin modestly and then develop positions as your conviction grows.

Keep in mind that only a small percentage of trades result in earnings. Make them matter. Run your gains long enough and quickly cut your losses. Only thorough research into equities and markets can accomplish that.

Spread Out Your Trades Enough

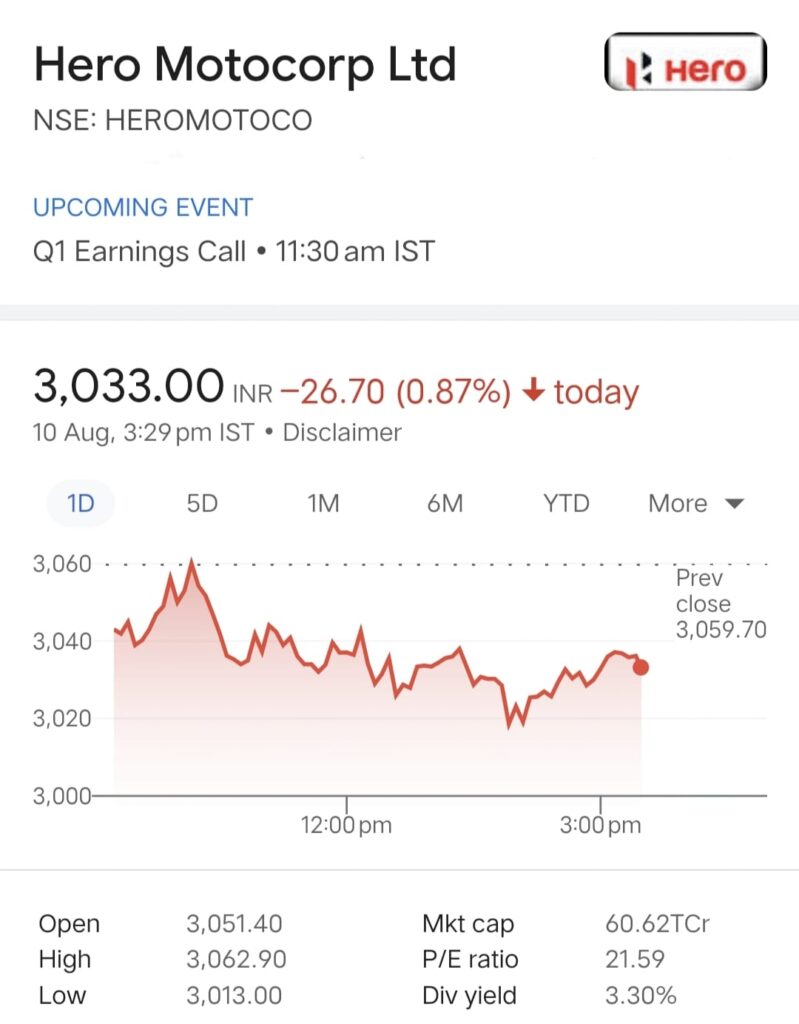

Don’t risk all of your money on a small number of trades. Don’t try to concentrate all of your wealth on just one or two stocks, even if it is vital to keep your universe of stocks limited because that is the only way you can trade with insight.

- Your transactions will be vulnerable to interest rates if they are all focused on banks, NBFCs, automobiles, and real estate. All of your trading positions will be impacted if the RBI announces a raise in the repo rates, and losses may be greater than you had anticipated.

- To ensure that your trading book is not dependent on just one or two events, diversification in trading is a good idea.

Eliminating emotion from trading

Although traders frequently engage in various psychological exercises to numb their emotions, it takes hundreds of actual trades to completely numb those choices.

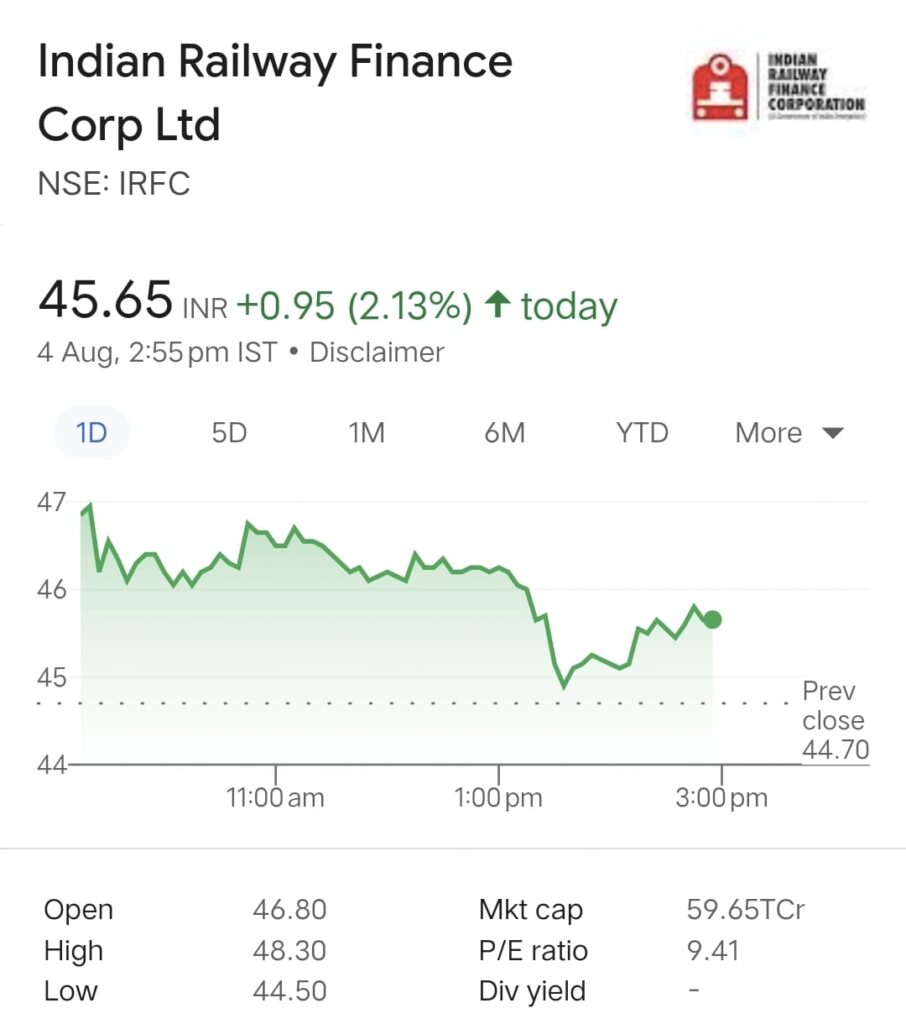

- Programs that analyze the market in real-time and inform traders when a stock exhibits particular patterns have just entered the market. These patterns indicate that the stock is a suitable candidate for a trade.

- Nevertheless, there is a shortcut that makes this procedure much simpler: using computer software to carry out the study and highlight important buy and sell spots.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en