Best Mutual Fund Apps In India: As we all know, purchasing mutual funds is one of the most effective strategies to increase the value of our investments over the long run. And these days, following, managing, and investing in various mutual fund schemes is much faster and simpler thanks to some of the top mutual fund applications available in India. Additionally, you can complete all of these tasks with a single app.

There are numerous mobile apps for these mutual fund investments in the Google Play Store, giving you the convenience of purchasing and selling on the tip of your fingers, whether you’re interested in investing in normal funds or direct mutual funds. Additionally, if you intend to invest in direct funds using these applications, they may be able to assist you in avoiding an additional commission of 1% to 1.5%, which is a significant benefit.

What are Direct Mutual Funds?

You can invest cheaply and directly in a Mutual Fund AMC’s plan through a Direct plan. The direct plans are less expensive than the normal plans since you will spend less money on commissions for middlemen. When comparing the two plans, the return difference appears to be as low as 0.25% and as high as 1%.

These discrepancies have substantial long-term effects. It is so abundantly clear that you should always choose to invest in Mutual Funds’ Direct Plans.

6 Best Mutual Fund Apps for Direct Investment:

We have hand-picked six of the top mutual fund applications in India for direct investment out of the hundreds of mutual fund investment apps offered on the Google Play store. The best mutual fund apps for Indian investors are listed below:

Best Mutual Fund Apps #1 – Groww

One of the mutual fund industry’s fastest-growing apps in India is called Groww. And the sleek user-interface deserves the praise. With little to no paperwork and no hassles, this app makes it easy to invest in mutual funds for free. A single investment app contains all information on mutual funds. Groww allows anybody to invest in direct mutual funds with $0 commission and offers an additional discount of up to 1.5%+ in comparison to standard plans, much as the applications mentioned above in this post.

Key features include:

- Simple construction, ideal for both novices and professionals

- An investing dashboard that displays annualised returns and total returns

- Top mutual funds list for many categories with the most recent financial information

Total Downloads: +10 Million

Rating on Google Play store: 4.3 out of 5 with a total of 3,50,672 ratings.

Here is the direct link to the app on play store.

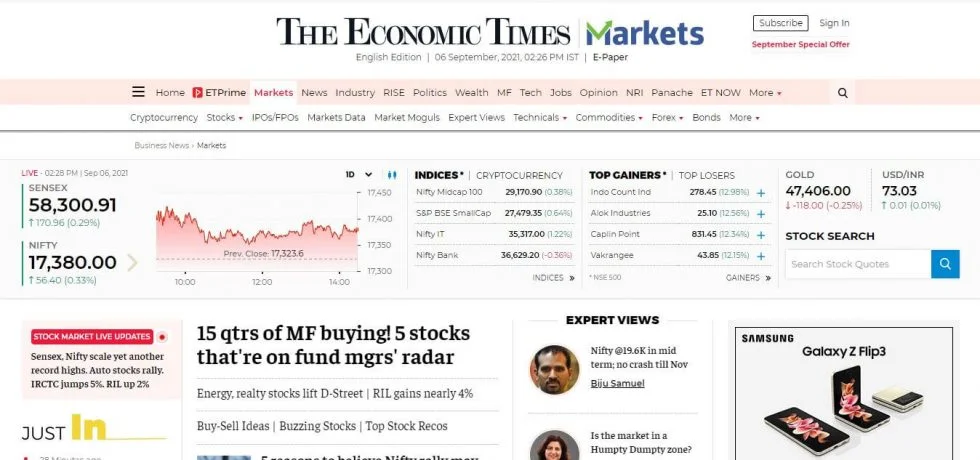

Best Mutual Fund Apps #2 – ETMONEY Mutual Fund App

A team of dedicated entrepreneurs, IITians, and designers with extensive experience in technology, mobile, and financial services launched ETMONEY. This Mutual Fund app, which is affiliated with the well-known Economic Times brand, is a one-stop shop for everything related to investing. It can be used to track and manage spending using an expense manager, invest in mutual funds through SIP or Lumpsum, save tax with SIPs in ELSS mutual funds, and more.

Total Downloads: +5 Million

Rating on Google Play store: 4.5 out of 5 with a total of 1,22,341 ratings.

Here is the direct link to the app on play store.

Best Mutual Fund Apps #3 – myCAMS Mutual Fund App

A single gateway to invest in several Mutual Funds schemes is myCAMS. The app enables quicker, simpler, and more intelligent ways to transact with direct money.

MyCAMS provides many features, including mobile PIN and Pattern login, one view of your mutual fund portfolio, the ability to open new folios, make purchases, redeem investments, swap investments, set up SIPs, and more. One of the top apps for mutual funds, it also aids in the scheduling of transactions, enabling investors to plan out future Mutual Fund transactions.

Total Downloads: +1 Million

Rating on Google Play store: 4.3 out of 5 with a total of 73,805 ratings.

Here is the direct link to the app on play store.

Best Mutual Fund Apps #4 – KFinKart – Investor Mutual Funds

This app’s main goal is to make the customer’s experience with mutual funds simpler. It is a one-touch login software that gives you the ability to invest in a variety of mutual funds and offers a unique way to do so. It also emphasises using a single app from all fund firms to manage your profile, make decisions, and transact instantaneously while managing your investments.

The uniqueness of this software is that it allows you to link and follow your family folios across AMCs, invest in NFOs, transact or reinvest, start or stop SIPs, and more to make the most of your time and money.

Total Downloads: +1 Million

Rating on Google Play Store: 4.3 out of 5 with a total of 42,253 ratings.

Here is the direct link to the app on play store.

Best Mutual Fund Apps #5 – Zerodha Coin

In my opinion, one of the greatest apps for direct mutual fund investing is Zerodha Coin. Over 3,000 commission-free direct mutual funds from 34 fund houses are available through their investment services. When compared to traditional mutual funds, this can help with savings of up to 1–1.5% more annually. Zerodha Coin has already established a significant brand and clientele with over 1,50,000 investors who have spent over 2500 crores and together saved over 30 crores in commissions.

Key features of the app include:

- Over 3,000 commission-free direct mutual funds are available through 34 AMCs for you to search, filter, and buy.

- absolute returns, annualised (XIRR), P&L visualisations, and a single capital gain statement.

- Mutual funds can be more easily used as collateral for loans against securities because they are kept in Demat form.

Total Downloads: +1 Million

Rating on Google Play store: 4.0 out of 5 with a total of 14,996 ratings.

Here is the direct link to the app on play store.

Best Mutual Fund Apps #6 – PayTM Money Mutual Funds App

By investing in Direct Plans of Mutual Fund Schemes with no commissions or other fees on purchasing and selling of direct mutual fund plans, Paytm Money, provided by the Paytm group, is emerging as one of the most reliable platforms in India.

The consumer can choose between converting from Regular to Direct Plans, fully Transparent Tracking, Data Privacy & Protection, tracking, managing, and automating SIP Investments, among other features.

Total Downloads: +10 Million

Rating on Google Play Store: 3.8 out of 5 with a total of 1,02,148 ratings.

Here is the direct link to the app on the play store.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en