Investing can frequently be simplified into a handful of straightforward guidelines that everyone may use to make money. But achieving success might involve both doing and not doing things. In addition, the procedure is complicated by our emotions. Although everyone is aware that you should “buy low and sell high,” our disposition frequently causes us to do the opposite.

To assist you get through the difficult times, it’s important to establish a set of “golden rules.” When the market is rising, everyone can become wealthy. But when the market is bumpy, successful investors are those who have a long-term strategy that works.

Following these 10 golden rules will help you become a more successful and hopefully wealthy investor.

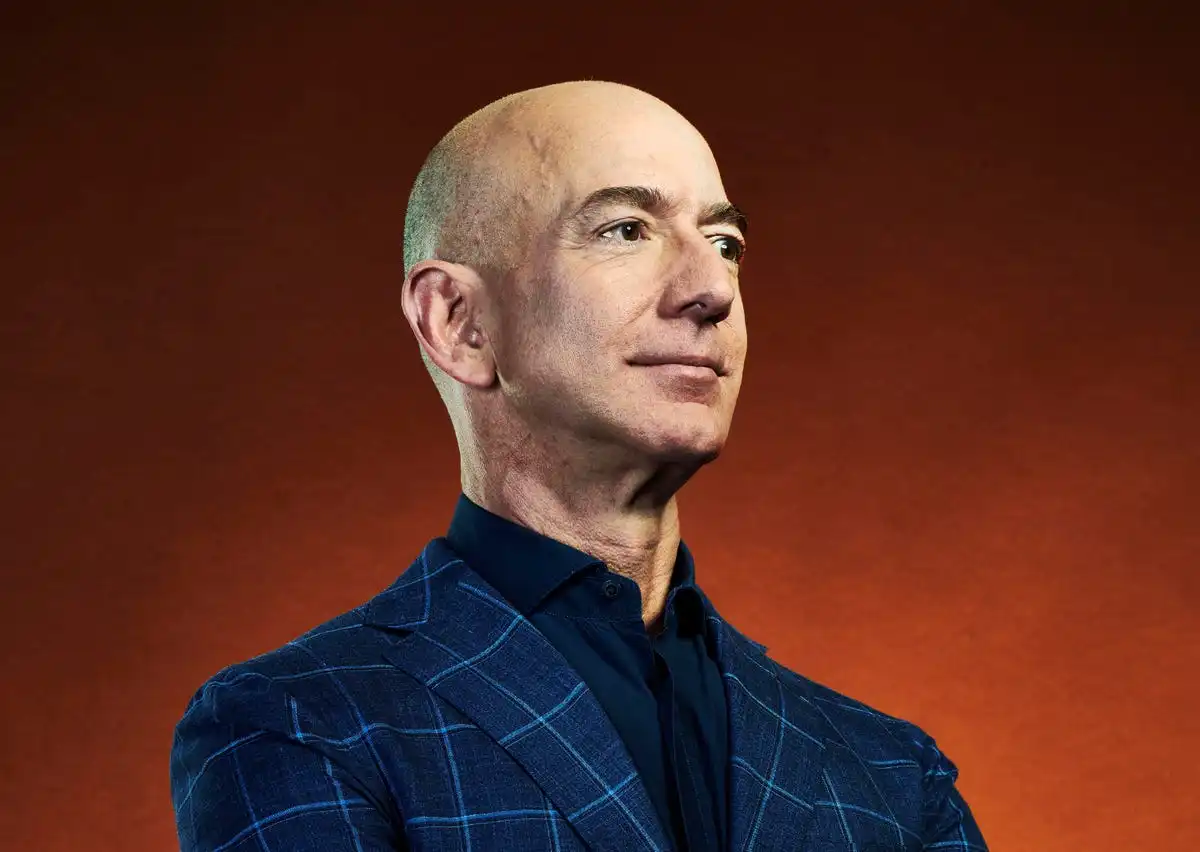

Rule No. 1 – Never lose money

Let’s begin with some wise words from the late great investor Warren Buffett, who once remarked, “Rule No. 1 is never losing money. Never forget Rule Number One is Rule Number Two. The advice from The Oracle of Omaha emphasizes how crucial it is to protect your portfolio against loss. Your ability to profit from your portfolio increases as it grows. Thus, a setback reduces your potential earning capacity.

Of course, saying that you won’t lose money is simple. The basic idea behind Buffett’s rule is to consider an investment’s drawbacks as well as its possible rewards. The investment might not be worthwhile if you don’t stand to gain enough from the risks you’re taking. That is one reason why many investors are currently staying away from long-term bonds. Buffett advises concentrating on the negative initially.

Rule No. 2 – Think like an owner

Chris Graff, RMB Capital’s co-chief investment officer, advises “thinking like an owner.” Keep in mind that you are not just investing in stocks but also in businesses.

Real businesses are behind those stocks, despite the fact that many investors approach equities like a game of chance. Stocks represent a small portion of a firm’s ownership, and as it turns out, the stock of the company will probably go in the same direction as its profitability.

When investing, Christopher Mizer, CEO of La Jolla, California-based Vivaris Capital, advises being conscious of your motivations. “Do you gamble or do you invest? The fundamentals of an investment, as well as its price and future performance prediction, are all considered.

Graff advises making sure the company is in a good financial and competitive position, that the management team is capable and supportive of shareholders’ interests, and all of the aforementioned.

Rule No. 3 – Stick to your process

Sam Hendel, president of Easterly Investment Partners, asserts that “the best investors build a process that is consistent and effective over several market cycles.” “Stay with the tried and true, even if there are temporary obstacles that make you question your abilities.”

A long-term buy-and-hold strategy is among the finest for investors. For instance, you may consistently invest in stock funds in a 401(k) and hang onto them for years. However, it might be simple to stray from your plan when the market becomes erratic since you’re momentarily losing money. Stop doing it.

Rule No. 4 – Buy when everyone is fearful

Investors frequently sell or simply stop paying attention to the market when it is down. However, that is the time when sales are rife. It is accurate to say that the stock market is the only market where products are on sale but no one wants to buy. Be fearful when others are greedy, and greedy when others are fearful, as Warren Buffett once advised.

The good news for 401(k) investors is that once your account is set up, there is nothing else you need to do to keep investing. Your emotions are kept out of the game by this arrangement.

Rule No. 5 – Keep your investing discipline

Investors should keep saving throughout time, in good and bad economic times, even if they can only spare a small amount. By continuing to make regular investments, you’ll develop the habit of living within your means even while you gradually amass a nest egg of assets in your portfolio.

The 401(k) is the perfect vehicle for this discipline because money is deducted from your paycheck automatically without your consent. A skilled investment selection process is also essential; learn how to choose your 401(k) investments here.

Rule No. 6 – Stay diversified

Maintaining diversification in your portfolio is crucial for lowering risk. Having just one or two stocks in your portfolio is risky, regardless of how well they have done for you. Therefore, experts suggest diversifying your money in a portfolio.

Diversification is the investment strategy that Mindy Yu, a former director of investments at Stash, advises investors to keep in mind. “Diversification can help you better withstand the ups and downs of the stock market.”

The good news is that diversity may be simple to do. A portfolio’s diversification is accelerated by an investment in a Standard & Poor’s 500 Index fund, which contains hundreds of holdings in the best companies in America. If you want to diversify your investments even more, you can add a bond fund or other options, such a real estate fund, which could perform differently depending on the status of the economy.

Rule No. 7 – Avoid timing the market

Experts frequently urge clients not to try timing the market, which involves trying to buy or sell at the ideal time, as is made popular in television and movies. Instead, they frequently quote the adage “Time in the market is more essential than timing the market,” which implies that in order to earn big returns, you should refrain from bouncing in and out of the market.

And that’s what Veronica Willis, an investment strategy specialist at the Wells Fargo Investment Institute, advises: “The greatest and worst days are generally close together and occur when markets are at their most volatile, during a bear market or economic recession. To trade in one day, out the next, and back in the next, an investor would need to be quite precise.

To take advantage of dollar-cost averaging, experts usually suggest making frequent purchases.

Rule No. 8 – Understand everything you invest in

Chris Rawley, founder and CEO of Harvest Returns, a fintech marketplace for investing in agriculture, advises investors to “avoid investing in a product you don’t understand and make sure the risks have been fully stated to you before investing.”

You need to be aware of how something you invest in operates. You need to understand why it makes sense to acquire a stock and when it is likely to make money if you plan to do so. When purchasing a fund, you should be aware of its history as well as its expenses. It’s critical to comprehend the annuity’s mechanics and your legal rights if you’re purchasing one.

Rule No. 9 – Review your investing plan regularly

Even though it can be a good idea to create a strong investing strategy and just make minor adjustments to it, it’s a good idea to routinely check your plan to ensure that it still meets your needs. This could be done each time you review your accounts for tax-related purposes.

Kevin Driscoll, vice president of advisory services at Navy Federal Financial Group in the Pensacola region, adds, “Remember, though, that first financial plan won’t be your last.” In particular, when you hit milestones like starting a family, moving, or changing careers, you should reassess your plan at least once a year.

Rule No. 10 – Stay in the game, have an emergency fund

You must have an emergency fund in order to stay invested for the long run as well as to get you through difficult times.

According to Craig Kirsner, president of retirement planning services at Stuart Estate Planning Wealth Advisors in Pompano Beach, Florida, “keep 5 percent of your assets in cash, because setbacks happen in life.” It makes reasonable to have at least six months’ worth of expenses in your savings account, the author continues.

If you have to sell any of your investments during a difficult time, it will probably be when they are at a loss. You may be able to continue investing for longer if you have an emergency fund. Short-term (less than three-year) cash needs to stay in cash, ideally in high-yield online savings account or possibly in a certificate of deposit (CD). To obtain the best deal, shop around.

Bottom line

Effective investing involves both doing the right things and avoiding the incorrect ones. In the midst of all of that, it’s crucial to control your fury so that you can inspire yourself to act morally even though it may feel risky or unsafe to do so.