You understand that the stock market can help you make money, but you’re not sure how investors decide when to buy and sell. Perhaps you’ve come across terms like “noise trader” or “arbitrage trader” and want to learn more. In any case, a look at some of the most common types of trading techniques can give you a better understanding of the trading terminology and strategies used by different individuals looking to make money in the markets.

Understanding these strategies may help you decide which one best suits your personality.

Fundamental Trader

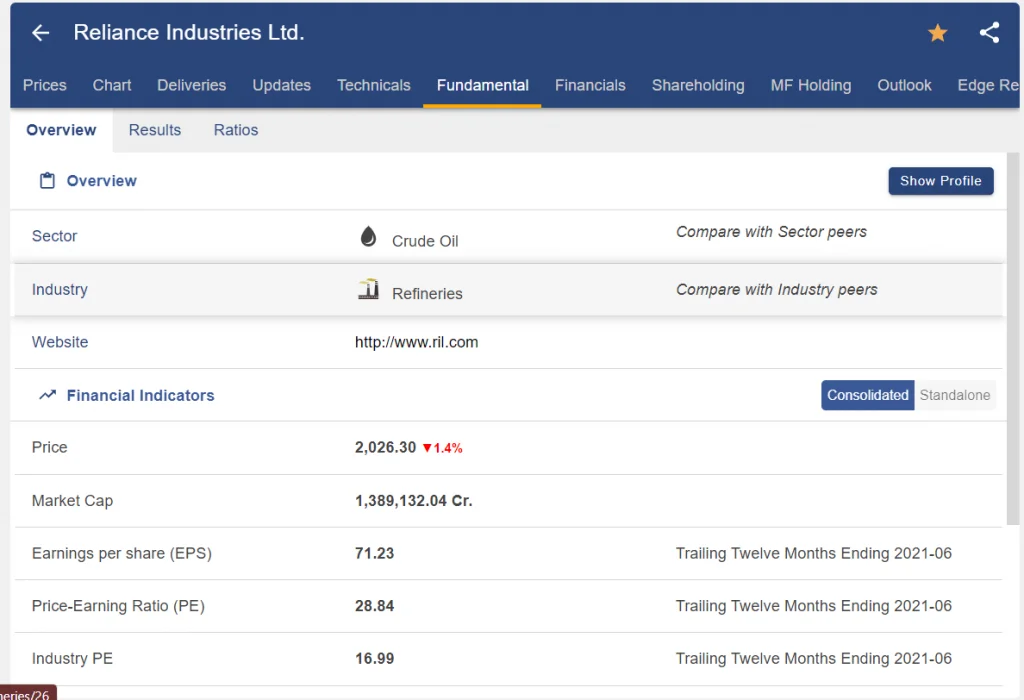

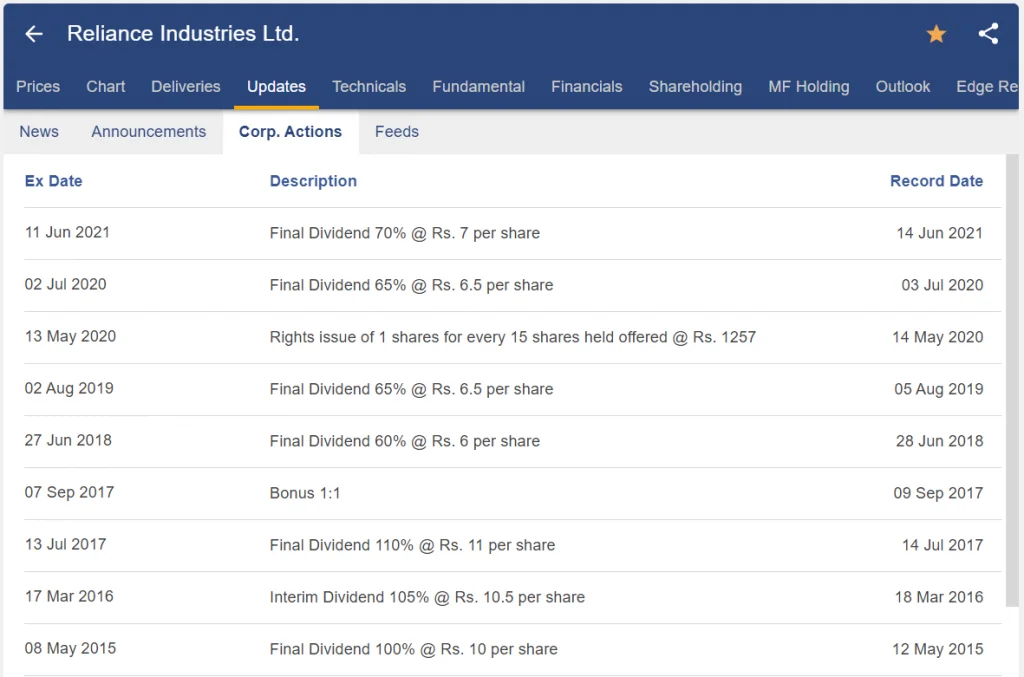

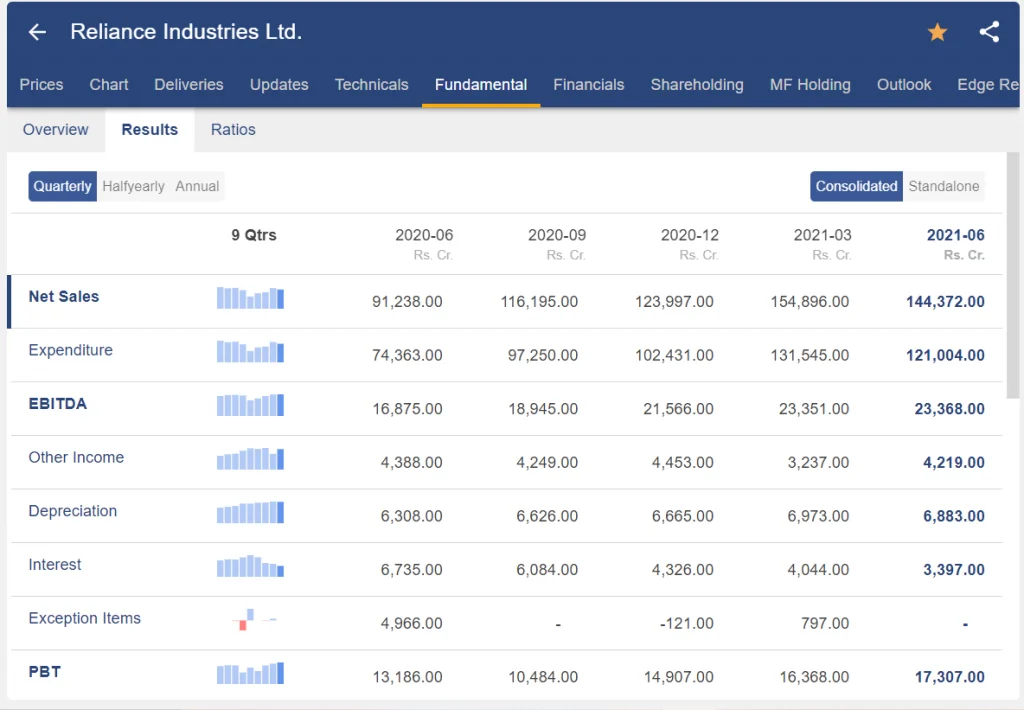

A fundamental trader is a trader or investor who analyzes and trades based on fundamental factors that affect the value of a financial instrument, such as stocks, bonds, or commodities. Fundamental analysis entails assessing an asset’s underlying economic, financial, and qualitative characteristics to determine its intrinsic value and potential for future growth or decline.

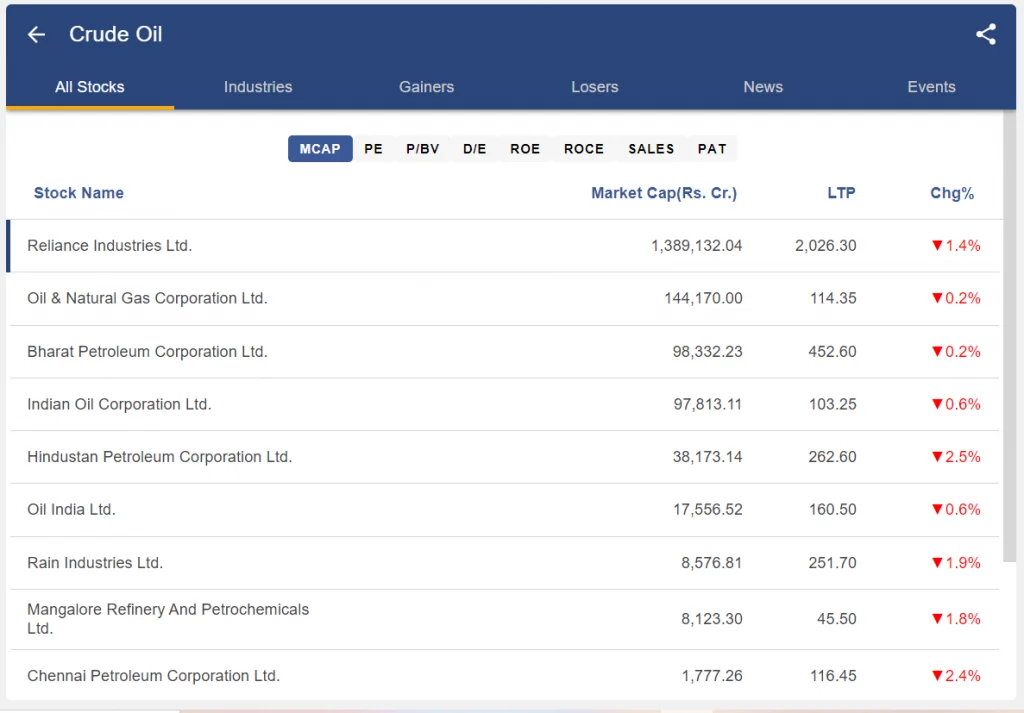

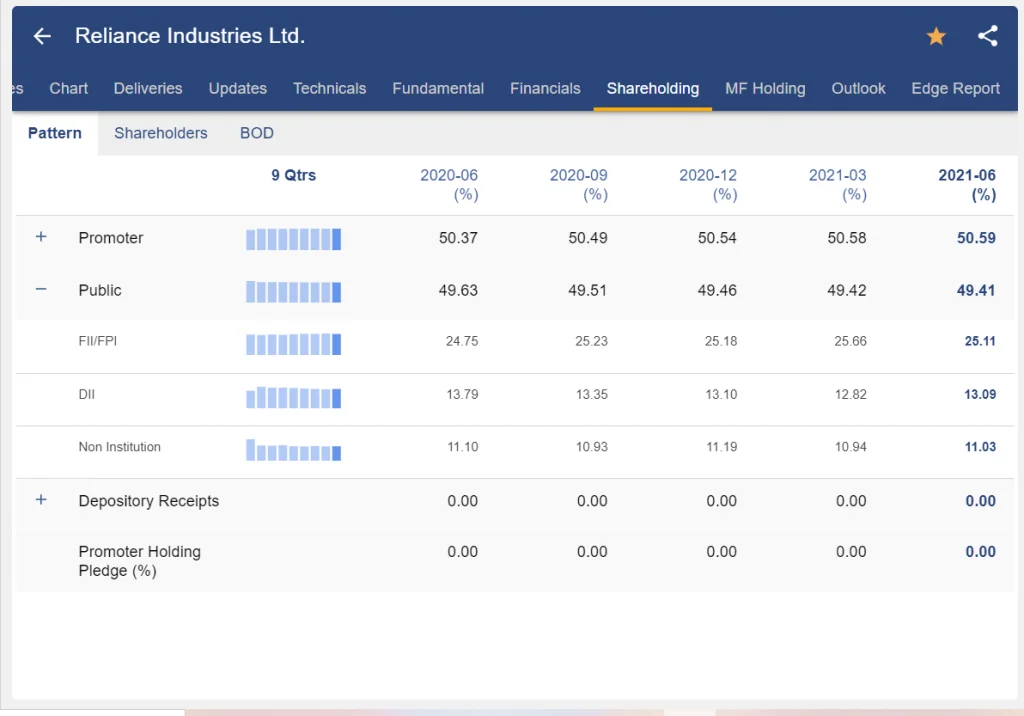

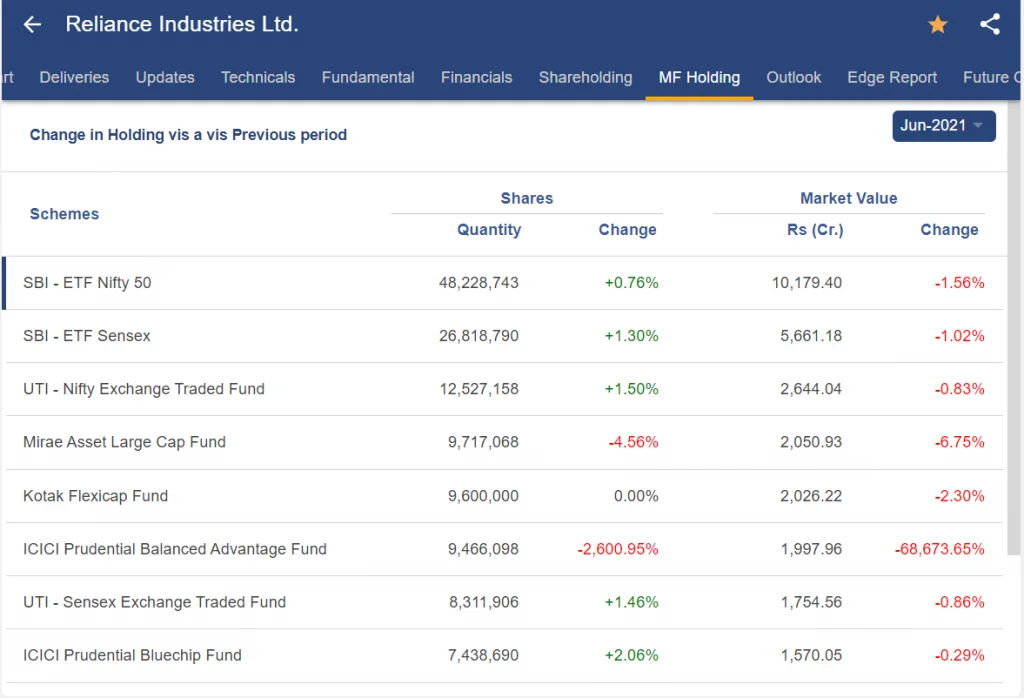

Fundamental traders look at a variety of factors, such as company financial statements, industry trends, macroeconomic indicators, management quality, competitive positioning, and other pertinent information. They seek to identify disparities between an asset’s current market price and its perceived intrinsic value, with the hope that the market will eventually reflect the true value of the asset.

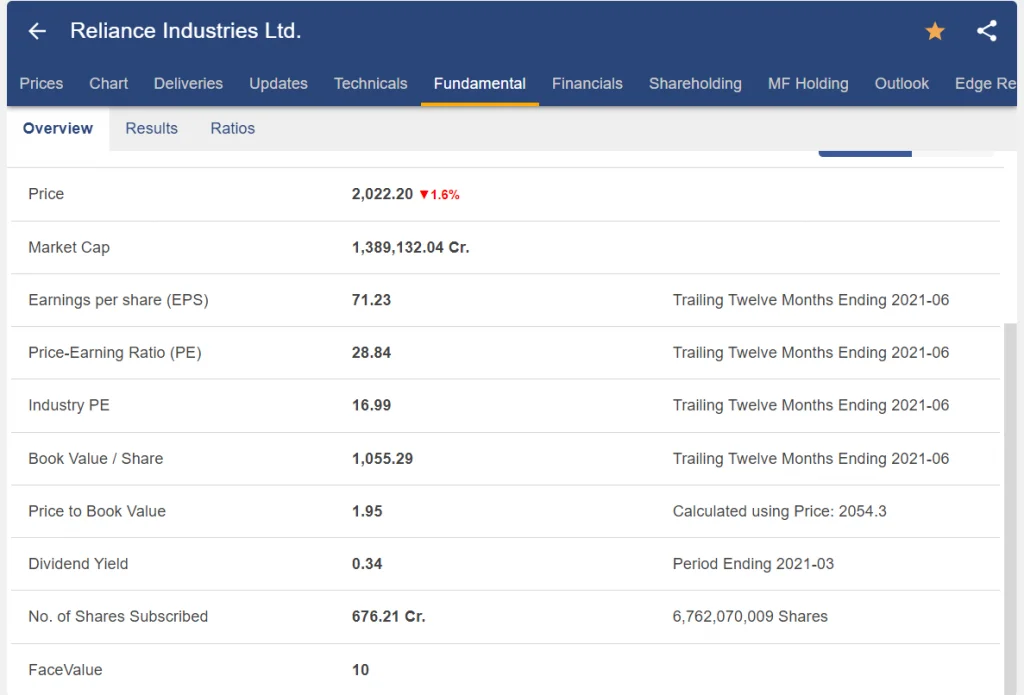

To evaluate investments, fundamental traders frequently employ a combination of quantitative and qualitative techniques. They may examine financial ratios such as the price-to-earnings ratio (P/E), the price-to-sales ratio (P/S), or the return on equity (ROE) to assess a company’s financial health and valuation. They also take qualitative factors into account, such as industry dynamics, the regulatory environment, the competitive landscape, and overall market conditions.

Fundamental traders make buy or sell decisions based on their analysis to capitalize on perceived market discrepancies. They may employ long-term investment strategies, with the goal of holding positions for an extended period of time, or they may employ short-term trading strategies based on news events or earnings releases.

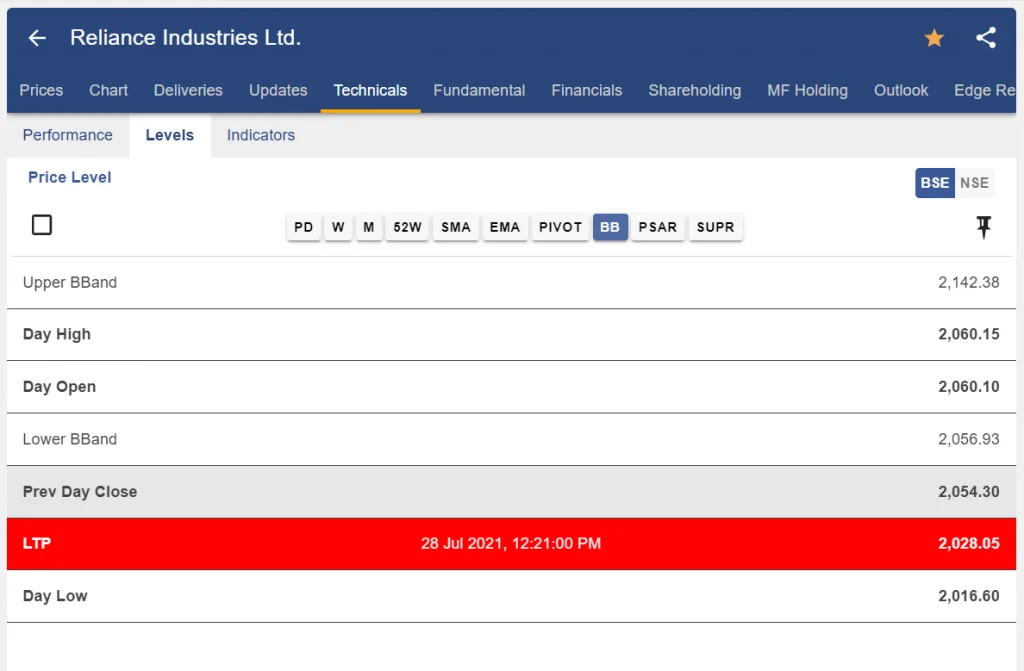

Technical trading, which focuses on analyzing historical price patterns and trading volumes, is frequently contrasted with fundamental trading. While technical traders rely on charts and indicators to make investment decisions, fundamental traders believe that understanding an asset’s underlying fundamentals is critical for making informed decisions.

It is critical to understand that trading and investing are risky endeavors, and no strategy, including fundamental trading, can guarantee profits. Successful fundamental traders keep their analysis up to date in order to adapt to changing market conditions and new information.

Meanwhile, do not forget to check our Fundamental analysis course by learning sharks share market institute.

Noise Trader

A noise trader is an investor or trader who makes trading decisions based on factors unrelated to the financial market or asset’s underlying fundamentals. Instead, they are frequently influenced by emotions, short-term market trends, rumors, or other non-fundamental factors.

Noise traders tend to disregard or minimize the importance of fundamental analysis in favor of more speculative or impulsive behavior. Rather than objective analysis of an asset’s value, they may be influenced by market sentiment, media hype, social media buzz, or the actions of other traders.

These traders are frequently associated with increased market volatility and price fluctuations in the short term. Their trading decisions can occasionally cause market overreaction or under reaction, causing prices to deviate from their intrinsic value in the short term.

When compared to other trading approaches, such as fundamental or technical trading, noise trading is generally regarded as less rational and more speculative. Noise traders may engage in high-frequency trading in order to profit from temporary market inefficiencies or momentum. Their trading strategies, however, may not be sustainable in the long run because they are not based on a thorough understanding of the underlying fundamentals.

It is critical to understand that the presence of noise traders in the market does not imply that all market participants are noise traders. Indeed, noise traders are frequently contrasted with informed traders who make decisions based on fundamental or reliable information. The interaction of noise and informed traders can influence market dynamics and price discovery processes.

Sentiment Trader

A sentiment trader is an investor or trader who bases trading decisions on market sentiment or the emotions and attitudes of other market participants rather than fundamental or technical analysis. Sentiment traders believe that market participants’ collective psychology can influence price movements and identify potential trading opportunities.

Sentiment traders frequently employ a variety of indicators or tools to assess market sentiment. Sentiment surveys, social media sentiment analysis, news sentiment analysis, and other sentiment-based metrics may be used as indicators. Sentiment traders attempt to identify periods of excessive optimism or pessimism in the market by analyzing these indicators.

When sentiment is overly positive, indicating a high level of optimism, sentiment traders may become cautious or even consider taking short positions in anticipation of a market correction or reversal. When sentiment is overly negative, indicating a high level of pessimism, sentiment traders may see it as an opportunity to enter long positions, anticipating a possible market upturn.

Sentiment traders may also employ contrarian strategies, in which they take positions that are diametrically opposed to market sentiment. For example, if market sentiment is overwhelmingly bullish, a sentiment trader may consider taking a bearish position in anticipation of a market downturn caused by overconfidence.

It should be noted that sentiment trading is predicated on the belief that market sentiment can be a significant driver of short-term price movements. However, sentiment alone may not provide an accurate picture of market dynamics; other factors such as fundamental analysis, technical analysis, and risk management should be considered as well.

Sentiment trading is frequently associated with shorter-term trading horizons due to the volatility of market sentiment. Sentiment traders must keep up with the latest news, events, and market trends that may impact sentiment and adjust their trading strategies accordingly.

Sentiment trading, like any other trading strategy, carries risks, and traders should carefully evaluate the dependability and accuracy of sentiment indicators, as well as use proper risk management techniques.

Market Timer

A market timer is an investor or trader who attempts to forecast short-term financial market movements and then makes trading decisions based on those forecasts. Market timers aim to enter or exit positions at specific times to capitalize on anticipated market trends or avoid potential losses.

Market timers forecast market movements using a variety of techniques and tools, such as technical analysis, fundamental analysis, economic indicators, market trends, and even market sentiment. To identify potential entry or exit points, they may use chart patterns, technical indicators, or historical price data.

Market timing’s primary goal is to profit from short-term price fluctuations by correctly predicting market tops (when prices are expected to peak) and market bottoms (when prices are expected to fall). To capitalize on anticipated market movements, market timers may employ strategies such as momentum trading, trend following, or contrarian approaches.

It is important to note, however, that market timing is notoriously difficult, and even experienced traders struggle to accurately predict short-term market trends. Market movements can be influenced by a variety of factors, including economic news, geopolitical events, investor sentiment, and unexpected market shocks, making market timing difficult.

Arbitrage Trade

Arbitrage traders profit from temporary price differences in different markets or financial instruments. Arbitrage traders seek to profit from price differences by purchasing an asset at a lower price in one market and simultaneously selling it at a higher price in another. Their goal is to generate profits while avoiding market risk.

For example, if a security trades on multiple exchanges and is cheaper on one, it can be purchased at a lower price on one platform and sold at a greater price on the other.

In conclusion

So, what if none of these trading strategies seem to fit your personality? There are several other strategies to consider, and with a little research, you might be able to find one that works best for you. Perhaps proximity to your financial goals, rather than company-specific considerations or market indicators, is the most important factor driving your buy/sell decisions. That’s fine.

Some people trade in order to achieve their financial goals. Others simply buy and hold assets in the hope that their values will rise over time.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en