People are turning away from more traditional investment choices like fixed deposits, regular deposits, etc. in favor of the stock market since investing in stocks can be a good strategy to beat inflation. A few benefits of stock market investing include increased returns on your investment, wealth accumulation over time, accomplishing long-term goals, portfolio diversification, and reduced risk. In this post, we will learn about the advantages of the stock market, things to think about while buying shares, and motivations to buy stock.

This article covers:

- Why invest in stock market?

- Benefits of investing in stock market

- Things to keep in mind while investing in the stock market

Why invest in stock market?

The stock market is a crucial part of the Indian economy. It gives investors the chance to profit from changes in stock prices. It’s a great opportunity to explore different businesses while staying safe. You can make money by selling your shares for more than you bought for them.

There are numerous justifications for stock market investment. Some people believe that the stock market will always rise, therefore they wish to put some of their money there. Some people only enjoy the idea of making money through investing without having to worry about equities.

Whatever your reason, investing in the stock market is a great opportunity to put your money to work and make some additional cash. You can start with mutual funds like debt funds, multi-cap funds, and index funds if you are just beginning to invest in equities and have a basic understanding of the stock market. But if you’ve been investing in stocks for a while, you may create your own portfolio by doing careful study.

Key takeaways:

- Owning stock in a business entails making an investment in its future by devoting resources with the expectation of a return.

- When you own shares in a firm, you hold a percentage of its ownership.

- Investing in the stock market might result in very large returns over the long run.

Benefits of investing in stock market

There are many reasons why you invest in stock market:

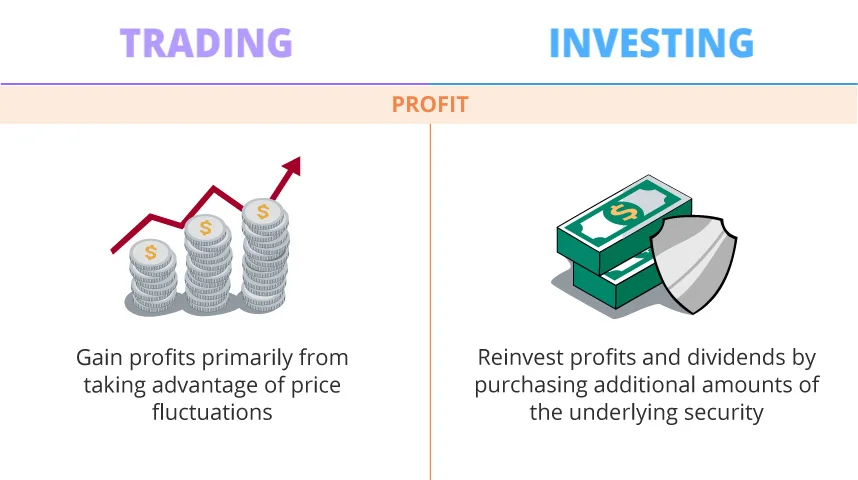

1. Earning Returns On Your Investment

One of the key benefits of investing in the stock market is the ability to earn returns on your investment. This indicates that you will make money as time goes on and the value of the stocks or investments you own increases. You can raise your income by buying stocks that offer dividends. By investing in dividend equities, you can gain from both capital appreciation and dividend income.

In addition, stock investments have the potential to provide substantially larger returns than other investment choices like bonds or savings accounts. This is because having shares gives you an interest in a company’s future success.

2. Building Wealth Over Time

Another benefit of investing in the stock market is that your wealth might grow gradually. This indicates that buying stocks or other securities will increase the value of your holdings. Over time, this can lead to large financial savings and enhanced financial security. As a result, it helps you reach your goals, including retirement, children’s education, home construction, etc.

3. Diversifying Your Portfolio

One of the key benefits of stock market investment is the possibility of diversifying your portfolio. Consequently, a variety of securities, including stocks, bonds, gold, real estate, and many others, are likely to make up your portfolio. Even if some of them might be more volatile than others, each of these will offer a unique potential payoff.

By diversifying your assets, you can reduce the risk associated with individual investments in your portfolio and increase the possibility that your entire investment will make a profit.

4. Liquidity

Because it makes buying and selling stocks relatively simple, liquidity is essential. When a stock’s market is liquid, which means there are numerous buyers and sellers, it is easy to find a willing buyer or seller when you wish to purchase or sell that stock. Real estate, on the other hand, may take longer to sell because there aren’t as many buyers and sellers interested in it.

However, it’s important to remember that market conditions might affect liquidity. During times of market or economic volatility, the liquidity of the stock market may decline, making it more difficult to acquire or sell equities.

5. Flexibility

One of the benefits of stock market investing is the chance to begin with small deposits and progressively build up your portfolio over time. Because they usually have more opportunity for expansion and the possibility for higher returns, small-cap or mid-cap companies may be a suitable location to start investing.

You also have the choice to invest directly in equities rather than through a mutual fund or another investment vehicle, which have minimal investment requirements. This enables you to make smaller, more frequent investments if you don’t have a large sum of money to put at once or wish to invest in a method that is more flexible and adjustable.

Things to keep in mind while investing in the stock market

Even though investing in the stock market can be unpredictable and risky, there are a few things to bear in mind to make sure your money is secure:

- Do your research

Make sure you have done your homework and comprehend the business model and prospects of the company before investing in any stock. You should also review the financial statements, financial ratios, cash flow, management, etc. of the company. The company’s annual report contains all of this information.

- Don’t time the market

It’s important to avoid becoming overly invested emotionally in the stock market because it can be challenging to predict how prices will evolve over time. Therefore, it is advised to implement the proper risk management plan to reduce losses.

- Diversify your portfolio

It’s crucial to spread your risk among various investment categories. You can diversify your portfolio, for instance, by purchasing various sector stocks with large, mid, and small-cap market caps. This way, even if the value of one kind of stock declines, your portfolio’s other stocks and assets will still have some value.

- Have a plan

It’s crucial to have a budget in place before investing in the stock market. By doing this, you can prevent yourself from making hasty decisions that might result in investment losses.

Conclusion

It is possible to increase your wealth over time by investing in stocks, but it’s also critical to understand that there is some risk involved and that the stock market can be volatile. As a result, when investing in stocks, it’s critical to do your research and come to a wise decision. A financial advisor should always be consulted before making any significant investment decisions, as well.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en