Opening a futures and options account with a broker is only the first step in trading in this type of investment strategy. Futures and options are much more complicated than equities investment, and you must understand the intricacies more thoroughly.

Purchasing options allows you to profit from the movement of futures contracts at a fraction of the cost of purchasing the actual future. If you believe the value of a futures contract will rise, buy a call. If you believe the value of a futures contract will fall, buy a put. The premium is the cost of purchasing the option. Option writers are also traders.

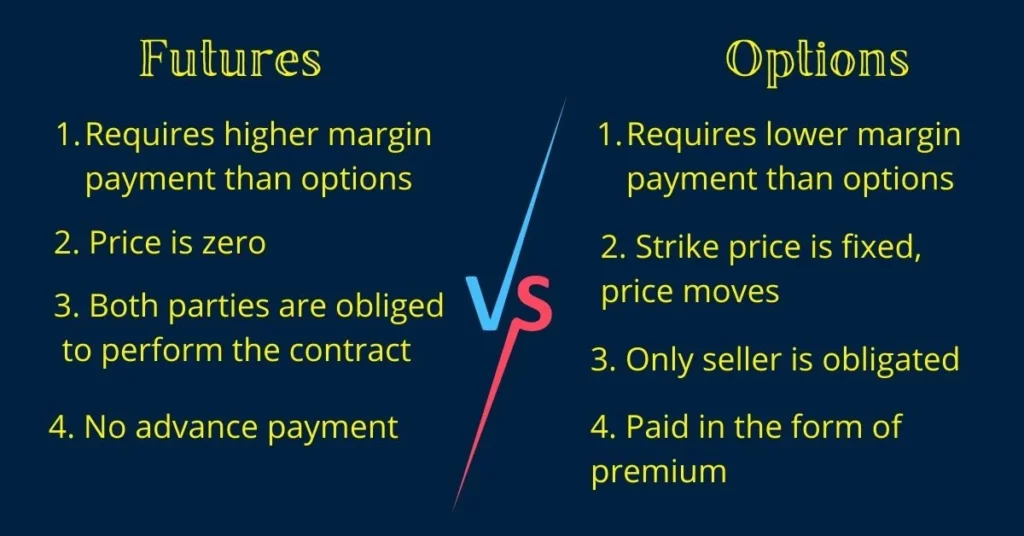

The distinction between futures and options

To trade options, you must have a margin-approved brokerage account that allows you to trade options and futures.

Both derive their value from an asset known as the underlying, which might be shares, commodities, exchange traded funds (ETFs), stock market indices, or anything else. Both represent a future transaction.

The following are some important distinctions between the two:

Right vs. Obligation: A future and an option both allow any investor to purchase any investment at a specific price by a specific time and date. However, the markets for both of these goods are fundamentally unique in terms of how they operate and the risk they pose to investors.

If you feel the underlying’s price will rise, buy a call option. If the underlying price rises before the option expires, the value of your option will climb as well.

Date of transaction: A futures holder is obligated to exchange the securities on the agreed-upon date. While there are differences, you can exercise various options at any moment until the expiration date.

In India, for example, an index option can only be executed on the expiration day, whereas a stock option can be exercised at any time until the expiration date.

Payments in advance: You only pay when you square off the futures contract on the designated date. However, futures contracts require you to put up a “margin,” which is a percentage of the trade’s value. As a result, “leverage” magnifies your gains and losses.

You must keep INR 20,000 with your broker in order to execute this deal. If the stock rises 10%, you will have made a profit of INR 10,000 while investing only INR 20,000. As a result, your profit margin is 50% rather than 10%, as it would have been if you had purchased the shares.

Risk: You can choose not to exercise your options if the price falls. When it comes to futures, you won’t have the same level of freedom because the trade must take place on the designated date, regardless of price.

As a result, options theoretically lower the chance of loss. However, in practise, 97% of options expire without being traded. As a result, option traders are more likely than not to lose their premium.

Writing Options for Income

The option writer’s profit is restricted to the premium collected, but liability is high because the option buyer expects the option’s value to rise. As a result, option writers often own the underlying futures contracts on which they write options.

This is known as “covered call writing,” and it allows a trader to create trading profits by using options on futures she already owns.

look at more info: https://learningsharks.in/

Follow us on insta” http://learningsharks