The government recently gave the state-owned company ‘Navratna’ status, which has a positive impact on the price of IRCON shares. With an annual turnover of Rs 10,750 crore and a net profit of Rs 765 crore on a consolidated basis for the financial year 2022–23 (FY23), IRCON claimed to be the 15th Navratna among CPSEs.

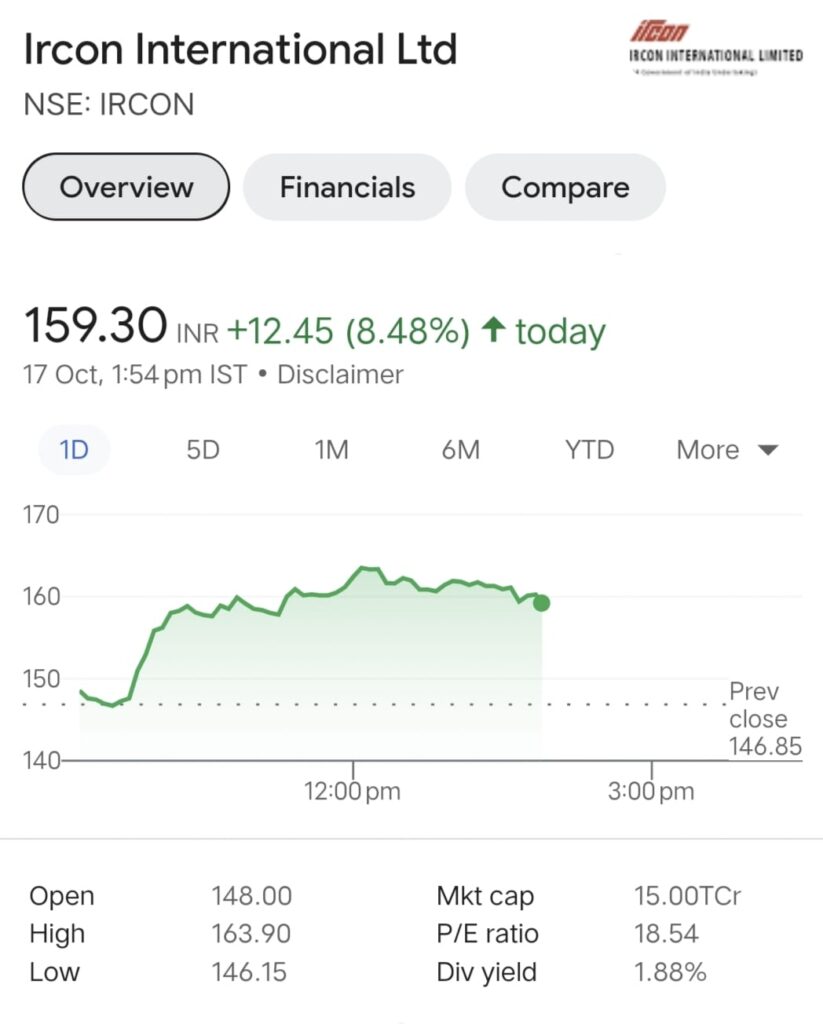

- IRCON International Ltd. shares increased significantly in Tuesday’s trading, following the upward trend of domestic benchmarks. The stock increased 11.68% from its previous close of Rs 146.80 to a day high of Rs 163.95 in value.

With an annual turnover of Rs 10,750 crore and a net profit of Rs 765 crore on a consolidated basis for the financial year 2022–23 (FY23), IRCON claimed to be the 15th Navratna among CPSEs.

- According to the technological setup, support on the counter was between Rs. 134 and Rs. 140. A short-term goal would be Rs 170, according to an analyst.

- According to Jigar S. Patel, Senior Manager – Technical Research Analyst at Anand Rathi Shares and Stock Brokers, “The counter has made a nice base near the 21-day exponential moving average (EMA), which comes around Rs 135-140.”

The 14-day relative strength index (RSI) for the counter was 68.11. Oversold is defined as a value below 30, and overbought as a value beyond 70. The price-to-equity (P/E) ratio of the company’s stock is 16.93, while the price-to-book (P/B) ratio is 2.83.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en