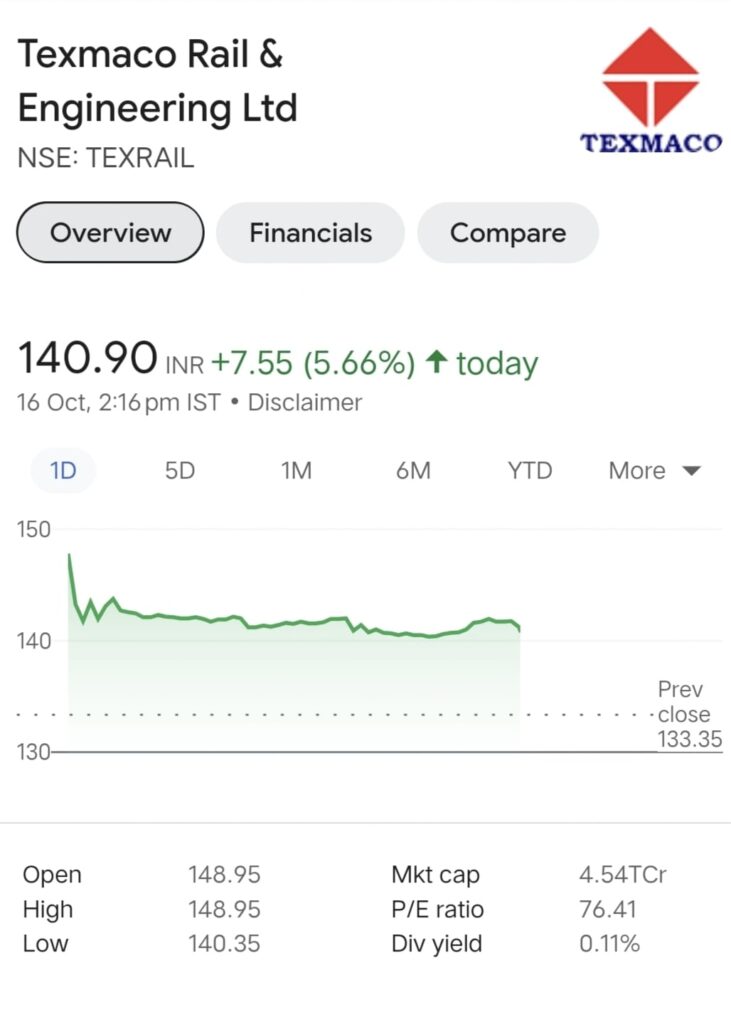

The counter lost a significant portion of its gains during the course of the session and was last seen trading 5.19 percent higher at Rs 140.80.

At the time that this story was being written, 6.52 lakh shares had been traded on the BSE today. The amount exceeded the two-week average volume of 1.37 lakh shares by a significant margin. The counter’s turnover was Rs 9.34 crore, and it had a Rs 4,531.93 crore market capitalization (m-cap).

- Financially speaking, the business reported total revenue of Rs 810.41 crore for the quarter ended September 30, 2023 (Q2 FY24), up from Rs 692.56 crore for the quarter ended June 30, 2023 (Q1 FY24). As opposed to a profit of Rs 12.75 crore for the period ending June 30, 2023, it reported a net profit of Rs 24.65 crore for Q2 FY24.

- “Texmaco Rail is looking strong on technical setup with the parameters of RSI (Relative Strength Index) and MACD (Moving Average Convergence/Divergence) are in buy zone,” stated Ravi Singh, the founder of DRS Finvest.

- “Texmaco Rail has turned bearish on the daily charts with strong resistance at Rs 146.5,” according to AR Ramachandran of Tips2trades. In the near future, a daily close below the support level of Rs. 137 might cause a precipitous drop to Rs. 115.

- Bourses The Texmaco Rail securities have been added to the long-term ASM (Additional Surveillance Measure) framework by BSE and NSE. Exchanges place equities in short-term or long-term ASM frameworks to alert investors to high share price volatility.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en