“If I were to set a target, Rs 1,450 is a level at which we should anticipate the stock to be. For the time being, unless Rs 1,600 is successfully handled, it is more of a’sell on rise’ stock, Sharma said BT TV.

- On Wednesday, Federal Bank was chosen by Rahul Sharma, Director & Head of T&D Research at JM Financial, as one of his top stock selections. Sharma told BT TV that despite the Nifty Bank fall, the stock has displayed exceptionally strong resilience.

- “We anticipate Federal Bank Ltd. testing the Rs. 160 mark soon, and one can buy the counter with a stop loss of Rs. 145. Once Nifty Bank gets going, the relative strength the company has shown should convert into momentum, he said.

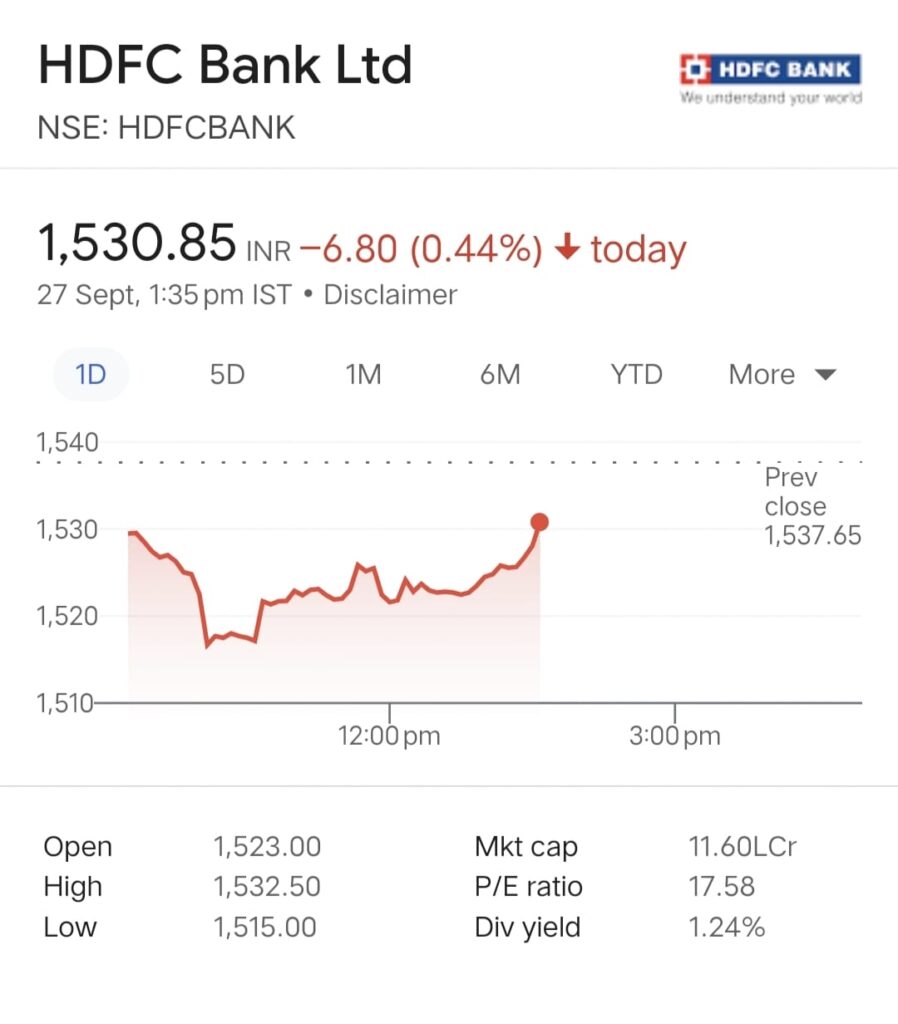

The market analyst responded to a question concerning HDFC Bank by stating that the stock is currently trading below both the short-term and long-term moving averages.

- The market analyst stated in answer to a question regarding Aditya Birla Fashion and Retail Ltd. that the counter today had an upswing with respectable volumes. Long-term investors may consider holding this stock, and Rs. 174 should serve as support, Sharma noted.

- According to preliminary stock market statistics, domestic institutional investors (DIIs) purchased shares worth Rs 714 crore during the previous session, while foreign institutional investors (FIIs) sold shares worth Rs 693 crore on a net basis.

In terms of individual stocks, ICICI Bank was the worst performer in the Nifty group as the stock fell 1.38 percent to close at Rs 935.6. As much as 1.37 percent was lost by HDFC Bank Ltd., Tata Steel Ltd., Eicher Motors Ltd., and Bajaj Finance Ltd.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en