Adani Group intends to refinance loans totaling up to $3.8 billion; Adani is anticipated to pay back at least $300 million of the first Ambuja facility.

Reportedly, Adani Group is in discussions to restructure a loan it took out to pay for the acquisition of Ambuja Cements. One of Asia’s largest syndicated loans this year, totaling $3.5 billion, is said to have been distributed among the lenders into three categories.

Adani is anticipated to return at least $300 million on the initial Ambuja facility, according to sources in the know, according to Bloomberg, which covered this event.

- DBS Group Holdings, First Abu Dhabi Bank, Mizuho Financial Group, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Banking Corp. would each provide about $400 million, according to the article, while other banks would finance smaller banks.

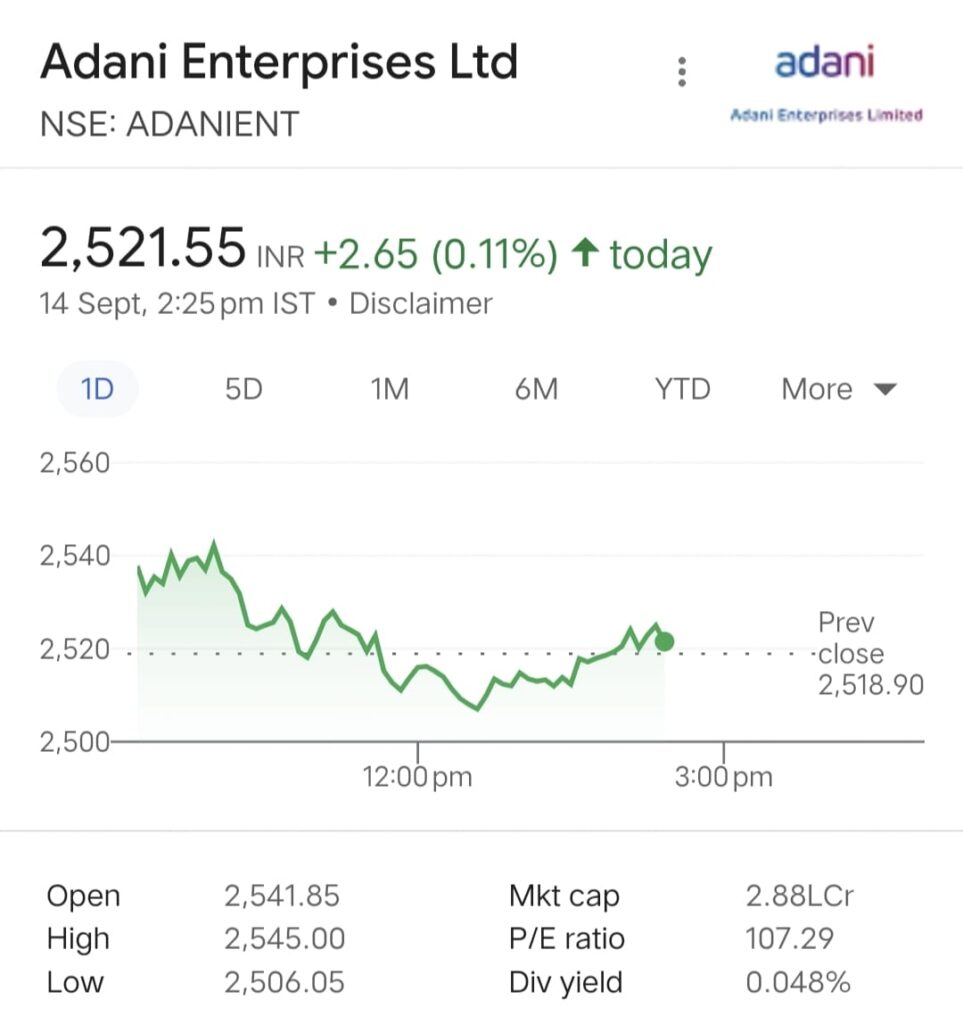

- Adani Enterprises Ltd, Adani Ports, Adani Green Energy Ltd, Adani Transmission Ltd, and Ambuja Cements are the five Adani stocks in which it has a combined stake, and their combined market value is now close to Rs 26,000 crore.

- Subsequently, on August 16, GQG Partners paid $1.1 billion in block agreements for an 8.1% share in India’s Adani Power. On August 17, it increased its holding in Adani Ports And Special Economic Zone Ltd. to 5.03 percent.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en