Although you’ve definitely heard of brokers, you’re probably not familiar with what a sub-broker in the stock market is. If so, the definition of a sub-broker (sometimes referred to as an authorized person) is given below.

A sub-broker (Authorised Person) is a person who performs similar duties to a broker but serves as the go-between for the client and the principal broker. A sub-broker acts as a go-between for the stockbroker and the investor, while a stock broker acts as a go-between for investors and the stock exchange.

A sub-broker’s duties include serving as a liaison between the broker and the client and helping the client with various tasks like paperwork and financial transactions. Since the sub-broker works for a stock broker, they typically have to bring clients to the brokerage business as part of their duties. The sub-broker additionally helps clients with investing and dealing in securities. The sub-brokers receive a set fee on the transaction that the clients make as payment for the services they provide to the brokers.

You can now proceed to explore the notion in detail after having a clear knowledge of what a sub-broker is.

Understanding Sub-Broker

Nearly all of the broking houses in India have switched to an online trading method that allows you to register a Demat account quickly, much like signing up for a website. Although most investors still prefer to visit a physical person when submitting their KYC documents and ultimately creating a Demat account, the digital shift is still relatively new. Additionally, the sub-broker helps the clients make informed investment decisions and adds transparency to every transaction after the Demat account is setup.

Since the online brokerage business is unable to physically contact clients to register a Demat account, the sub-broker serves as a link between clients and the platform for online stock brokers. As a result, sub-brokers make sure to work on behalf of such internet brokers, finding new clients and helping them with investing activities.

The sub-brokers are entitled to a fixed commission on the transactions carried out by the clients or the sub-brokers on their behalf after they enroll a new client on the online platform. The sub-brokers make more money the more expensive these transactions are. You should be aware, though, that a sub-broker is not a trading member of the stock exchange; rather, they are authorized to operate on behalf of a trading member who has a legitimate Demat account.

Difference between Sub-Broker and Stock broker

Understanding the distinction between a stockbroker and a sub-broker is one of the finest methods to comprehend what a sub-broker is. Sub-brokers, as was already noted, work for or under a broker. However, there are a few additional crucial differences between the two.

- Trading Member:- Sub-brokers are not listed as licensed trading members on the stock exchange, whereas stock brokers are. This does not imply that sub-brokers lack any stock exchange certification. They must possess a SEBI Certification of Registration in order to operate as a sub-broker and meet SEBI’s definition of what qualifies as a sub-broker.

- Brokerage Fee:- A significant distinction between a stock broker and a sub-broker is that, while stock brokers are compensated through brokerage fees, sub-brokers are compensated through commission. Only brokers who are officially listed as trading members of the stock exchange are permitted to charge brokerage fees, according to the law. Sub-brokers are unable to charge a brokerage because they are not listed as trading members. In other words, stock brokers profit from every transaction their client completes by charging a brokerage charge. The sub-broker receives commission, which is a portion of the brokerage fee, from the broker.

Benefits of Sub-Broker

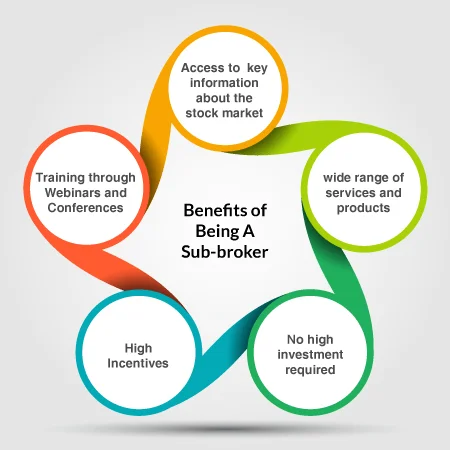

The first step to entering a career that can provide you a variety of professional prospects is understanding what a sub-broker is. As a sub-broker, you have endless potential for financial gain, which opens up many options for career progression. The sub-broker collaborates with the largest online brokerage firms and serves as a conduit between clients and the brokerage house. It is a given that sub-brokers make a good commission on the transactions as practically all of the clients they onboard engage in investment activity. Here are both the advantages of being a sub-broker and the benefits of becoming one.

- Financial Knowledge:- Gaining financial knowledge is one of the main advantages of working as a sub-broker or as a franchise sub-broker. Sub-brokers who work for a broker have access to essential stock market knowledge that they can utilize to improve their understanding of the market and their own trading. Despite being unable to act as brokers, they are nevertheless able to trade directly and with their own money with any broker. Sub-brokers can better serve their clients thanks to this self-sufficient cycle, which also allows them to fund their investments.

- Added Services:- Being a sub-broker also has the advantage of allowing you to provide your clients services other than financial advice and strategy, depending on the brokerage firm you work with. For instance, some brokers permit their sub-broker franchisees to provide clients with lending choices and mutual fund distribution. The sub-broker gains opportunities to receive a commission and expand the sub-broker franchise as a result of these additional services.

- Low Investment Amount:- Once you understand what a sub-broker is, you realize that a small amount of capital is required to launch your business. One of the main advantages of becoming a sub-broker is that you don’t need a large investment because your franchiser covers most of the costs. Sub-brokers just need a minor initial investment, such as 10,000 rupees or more, to get started in the business. There is no cap on the commission a sub-broker can make depending on the client’s transactions, regardless of the initial investment size.

Conclusion

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en