Investing in the stock market can be difficult, especially for beginners. Because customers can choose to invest in shares through a variety of digital channels, investing is now hassle-free.

If you are unfamiliar with the process, you may find detailed instructions on how to invest in the stock market online here.

We can assist if you’re unsure about how to invest online in the Indian stock market.

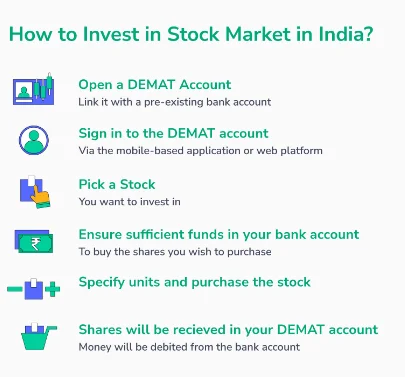

The following steps must be taken in order to effortlessly buy stocks from the comfort of your home:

Step 1: Create a DEMAT account and link it to an active bank account to enable easy transactions.

Step 2: Log into your DEMAT account via the web platform or the mobile application.

Step 3: Pick a stock you want to invest in.

Step 4: Verify that you have sufficient funds in your bank account to purchase the shares you choose.

Step 5: Decide how many units you wish to purchase and buy the stock at the specified price.

Step 6: After a seller accepts your purchase order, it will be executed. After the transaction is finished, the required amount will be deducted from your bank account. The shares will appear in your DEMAT account simultaneously.

Factors To Consider Before Making Stock Market Investment

Investment Purpose

If you’re wondering How to Start Investing in the Stock Market in India or any other investing option, you must first identify what your financial goals are. The goal of investing fluctuates and is dependent on the investor.

You must therefore choose stocks after taking your financial goals into account. Decide on your investment horizon before you invest.

Risk-Taking Skills

When investing in shares, it’s important to take your risk tolerance into mind. Defensive shares, which provide constant returns and are less impacted by market volatility, may be an option for low-risk investors to consider.

Diversification

By building a diversified portfolio, you can lower your risks. In other words, the more equitably your investment is spread throughout several industries, the lesser the financial risk will be.

When investing in stocks, you might consider one of two markets.

Conclusion

By registering a DEMAT account with the broker of your choice and following the steps indicated above, you can now invest in the Indian stock market online. For better outcomes, keep in mind the several important factors while choosing the companies to include in your portfolio.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en