Stock market investment can be challenging, especially for those who are just starting out. Nowadays, investing is hassle-free because people can choose to invest in shares through a variety of digital platforms.

Here is a comprehensive instruction on how to invest in the stock market online in case you are not familiar with the procedure.

If you’re wondering how to invest in the Indian stock market online, we can help.

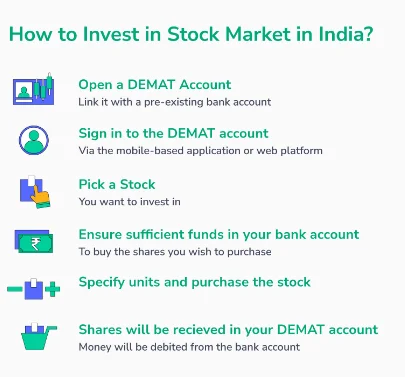

The actions you must take in order to conveniently purchase stocks from the convenience of your home are as follows:

- Step 1: To facilitate smooth transactions, open a DEMAT account and link it to an existing bank account.

- Step 2: Use the web platform or the mobile application to log into your DEMAT account.

- Step 3: Choose a stock in which you want to invest.

- Step 4: Make sure you have enough money in your bank account to acquire the shares you want.

- Step 5: Buy the stock at the indicated price and specify how many units you want to buy.

- Step 6: Your purchase order will be carried out once a seller agrees to it. Your bank account will be debited with the needed amount after the transaction is complete. You will simultaneously get the shares in your DEMAT account.

Factors To Consider Before Making Stock Market Investment

Some factors to consider before investing in the stock market are as follows-

- Investment Objectives

You must first decide what your financial objectives are if you’re wondering How to Start Investing in the Stock Market in India or any other investing option. The investing purpose is not constant and changes depending on the investor.

As a result, you must choose stocks after considering your financial objectives. Prior to investing, choose your investment horizon.

- Risk-Bearing Ability

Your risk tolerance is a crucial consideration to take into account when investing in shares. Low-risk investors could think about buying defensive equities, which offer steady returns and are less affected by market volatility.

- Diversification

You can reduce risks by creating a diverse portfolio. In other words, your investment’s financial risk will be lower the more evenly distributed it is among several industries.

There are two marketplaces you might think about while investing in equities.

Conclusion

You can now invest in the Indian stock market online by opening a DEMAT account with the broker of your choosing and following the steps outlined above. Additionally, keep in mind the different crucial elements while selecting the stocks to include in your portfolio for better results.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en