In the past year, IRFC shares have soared 85%, with most of the gains occurring in 2022. Just 17.63% of the stock’s gains have come this year.

INTRODUCTION

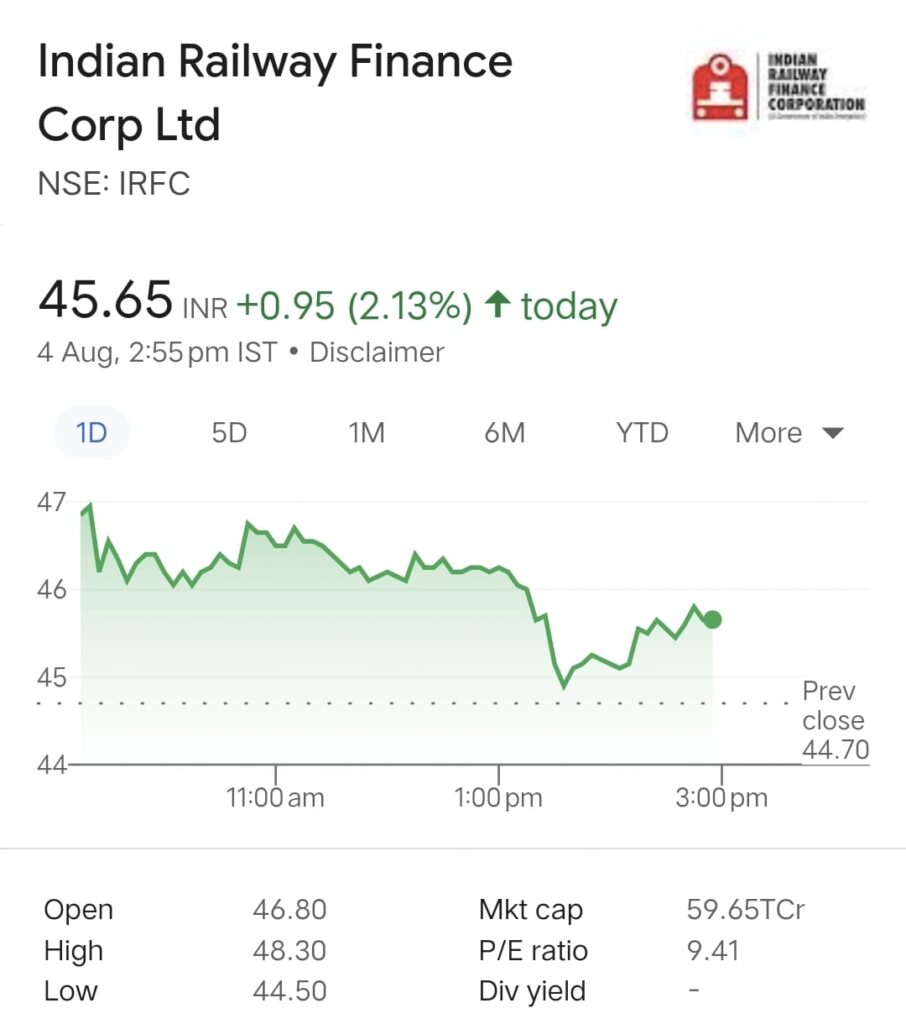

The company’s market value increased to Rs 60,520 crore. One of the largest turnovers on the BSE occurred when 168.73 lakh shares of the company were traded for a total of Rs. 78.71 crore.

- The IRFC stock has increased by 117.60% in the past year, with most of the gains occurring in 2022. Just 41.85% of the stock’s gains have come this year. With a PE of 9.51, the IRFC stock is overpriced when compared to its industry.

- Sectoral PE is currently 6.41. IRFC shares closed 12% higher on Thursday at Rs 44.72 compared to the previous close on BSE of Rs 39.74. The stock on the BSE has soared 21.51% in just three sessions.

A one-year beta of 0.8 on the IRFC stock indicates that there was very little volatility during that time.

Investors should take gains now since a daily closing below the support level of Rs. 42.5 could eventually result in a target price of Rs. 38.85.

Operating revenue for the FY23 increased 17.70% to Rs 23,891 crore from Rs 20,298 crore reported the previous year. At the end of FY23, the company’s earnings per share were Rs 4.85 as opposed to Rs 4.66 in the same period the previous year.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en