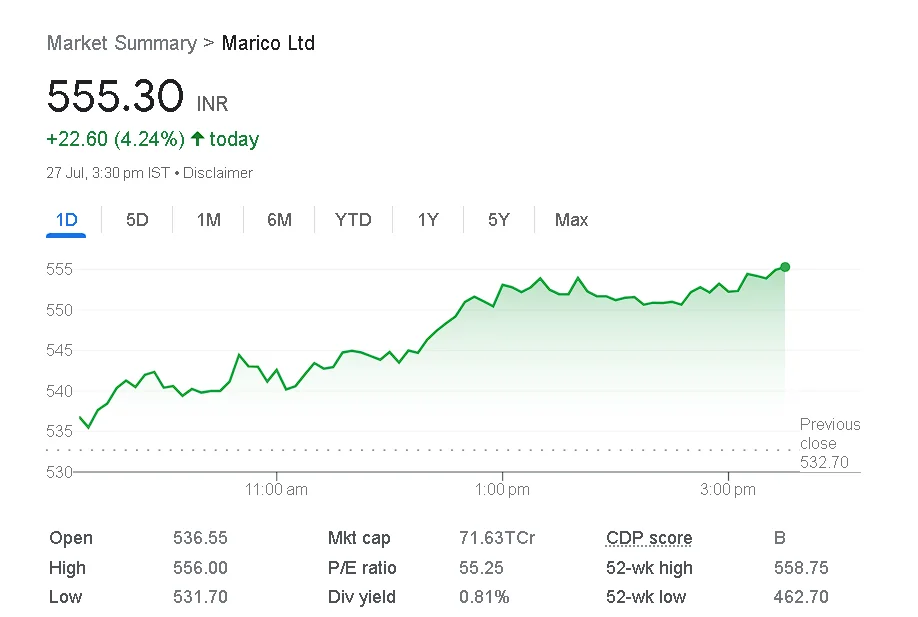

Compared to its previous finish of Rs. 532.50 on the BSE, Marico shares increased 2.46% to Rs. 545.60.

Shares of Marico Ltd rose more than 2% today after the FMCG giant announced it has signed agreements to buy up to 58% of Satiya Nutraceuticals Private Limited’s paid-up share capital on a fully diluted basis.

- Compared to its previous finish of Rs. 532.50 on the BSE, Marico shares increased 2.46% to Rs. 545.60. The large cap stock has increased 7.52% since the start of this year and 5.71% over the past year.

- The company’s market value increased to Rs 70,432 crore on the BSE. On April 20, 2023, the stock hit a 52-week low of Rs. 462.95 and on June 1, 2023, it reached a 52-week high of Rs. 559.

- A total of 0.24 lakh shares were traded, totaling Rs. 1.27 crore in turnover. The price of Marico shares is currently above the 5-day, 20-day, 50-day, 100-day, and 200-day moving averages.

Satiya Nutraceuticals, with its headquarters in Mumbai, is the owner of “The Plant Fix- Plix,” a well-known plant-based nutrition brand with a significant market share in the quickly expanding health & wellness sector, according to a regulatory filing by Marico.

For Rs 369 crore, Marico will purchase the company’s majority interest. In addition, Marico intends to purchase a further 22.5 percent of Satiya Nutraceuticals, which will be done in a single or several installments by May 2025.

The brokerage claimed that Marico will meet its FY24 sales target of Rs 400 crore with the aid of the Plix brand.

“The acquisition will help Marico expand into value-added wellness and nutrition portfolio and has a target of scaling up its foods, digital-first, and personal care portfolios,” stated Morgan Stanley.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en