According to its FY22 annual report, it stands to gain from the government’s policy on vehicle scrapping.

INTRODUCTION

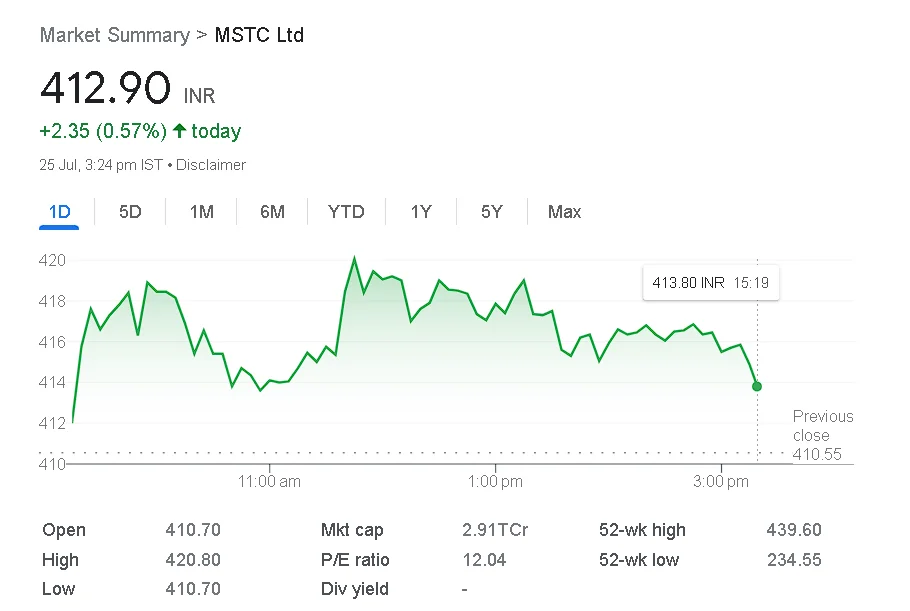

A rapid increase in the local equities market has created a buzz on Dalal Street for the small-cap public sector undertaking (PSU), MSTC Ltd.

- The company is positioned to gain from the vehicle scrapping program, according to a review of the annual report for FY22.

- The company reported a roughly 22% increase in consolidated net profit for the fiscal year that ended in March 2023, coming in at Rs 241.96 crore.

- On the other side, MSTC’s combined total sales fell by around 18% YoY to Rs 720.97 crore.

“MSTC is making a rounding formation on the long-term chart with a major breakout above the Rs 380 levels,” said Nirav Chheda, Senior Technical Analyst at Nirmal Bang Securities.

The operating performance of the business has been increasing, according to Kranthi Bathini, Equity Strategist at WealthMills Securities.

Through its joint venture, Mahindra MSTC Recycling Private Limited (MMRPL) with Mahindra Intertrade Ltd, it has also established India’s first authorized collection and dismantling center at Greater Noida for the scientific recycling of end-of-life vehicles (ELV) and white goods.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en