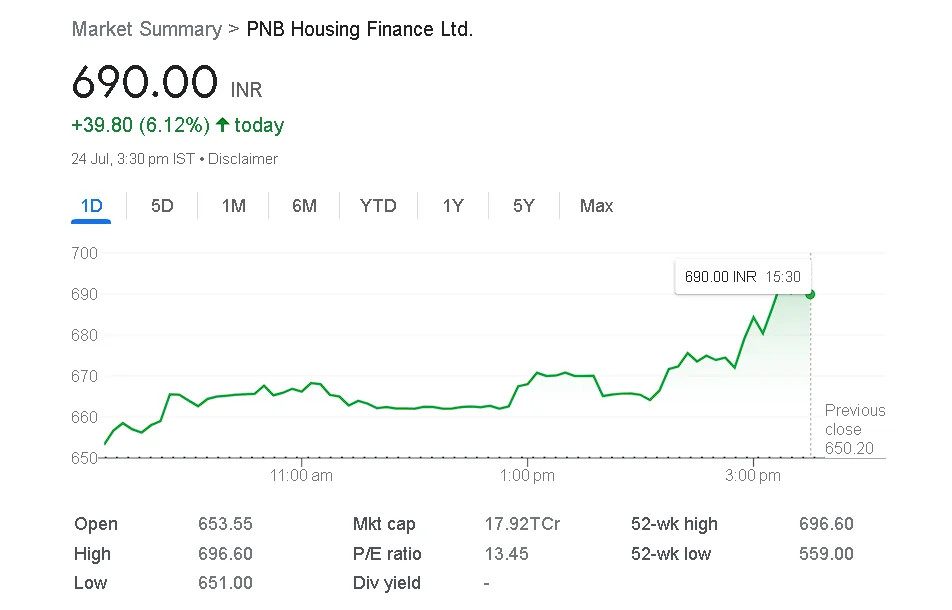

The stock today increased 7.11% over yesterday’s close of Rs. 649.80 to reach a 52-week high of Rs. 696.

INTRODUCTION

Following the release of the company’s solid June 2023 quarter (Q1 FY24) results, shares of PNB Housing Finance Ltd. rapidly increased on Monday to reach their one-year high level.

- Profit after tax for the company climbed to Rs 347 crore, up 48% year over year and 24% quarter over quarter.

- “The disbursements in the first quarter of FY24 increased by 7% YoY to Rs 3,686 crore. 99 percent of the payments were made in the retail sector, which saw an 8% YoY increase to Rs 3,667 crore.

- Retail loans increased to Rs 56,978 crore by 11% YoY and 3% QoQ. As of June 30, 2023, corporate loans were at Rs 3,416 crore, a reduction of 45%, according to PNB Housing’s exchange filing.

Asset quality-wise, gross bad loans, or NPAs, were at 3.76 percent as of June 30, 2023, down from 6.35 percent year-over-year and 3.83 percent quarter-over-quarter.

- As of June 30, 2023, the company’s CRAR (Capital to Risk Asset Ratio) increased to 29.93% from 23.91% YoY.

- Additionally, we have seen an improvement in asset quality, which has led to greater profitability. The company’s annualized ROA for this quarter is the highest in a decade, at 2.07%.

- The stock was last observed trading above the 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, according to the technical setup. The 14-day relative strength index (RSI) for the counter was 78.14.

Oversold is defined as a level below 30, while overbought is defined as a level beyond 70. Price-to-book (P/B) is 1.54 and the shares of the company has a price-to-earnings (P/E) ratio of 15.97.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en