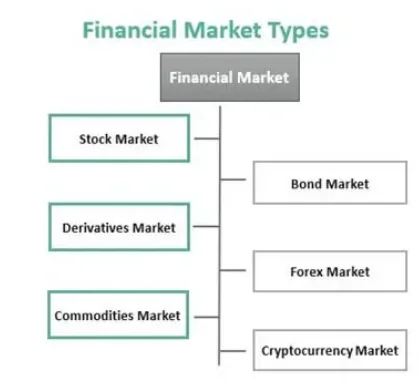

The marketplaces where financial assets are bought and traded are referred to as “financial markets.” The term “financial assets” refers to things like stocks and bonds. The financial markets, broadly speaking, comprise a number of smaller marketplaces, including the stock market, bond market, forex market, commodities market, and derivatives market.

While some financial markets may be unregulated, others may be. And just like in any market, there are a variety of factors that affect the pricing of the financial assets traded there.

A business setting where various bonds and securities are traded at lower transaction rates is referred to as a financial market. It consists of several types of financial instruments, such as bonds, stocks, derivatives, and foreign exchange markets, to name a few.

The financial market is essential for a capitalist economy to run smoothly since it aids in resource allocation and provides liquidity for businesses.

The financial market makes sure that the right allocation of cash is made between investing and collecting parties.

KEY TAKEAWAYS

- The marketplace where various financial assets, including bonds, shares, commodities, currencies, and derivatives, are traded is known as the financial market.

- In order to transact in their desired financial assets at a defined price, it brings together the sellers and purchasers.

- Depending on the state of the economy, millions of dollars are traded every day on the capital market through OTC or stock exchanges.

- Some of the several categories of the financial market include stocks, bonds, derivatives, currencies, commodities, and cryptocurrency markets.

How Do Financial Markets Work?

A financial market is a venue where companies and investors hope to raise money to expand their operations and see a positive return on their investments. In this market, the buyers find the right vendors, and the sellers score a win by attracting the most qualified customers for their financial products.

Based on a variety of criteria, these marketplaces are divided into many categories. The primary classifications, however, are determined by the type of claim, the maturity of the claim, the delivery schedule, and the organisational structure.

For instance, a financial market is categorised as either a debt market or an equity market depending on the form and type of claim. Investors exchange bonds and debentures in the former, but they deal with stocks and other securities in the latter.

There is a money market that deals with money-backed securities and short-term funds like treasury bills, commercial paper, and certificate of deposit (CDs), depending on the maturity length. These investments expire after a year. The capital market is another one; it creates a platform for investors looking to purchase medium- and long-term assets.

Types of Financial Markets

- Stock Market

For businesses trying to raise finance, this is the centre. They first register their shares and then sell them in an initial public offering (IPO) on the secondary market to interested investors. They list the shares or stocks on stock exchanges, such as the NASDAQ, the NYSE, or OTC, a virtual trading floor.

- Bond Market

It is the market, which enables investors to purchase bonds from businesses to fund their projects. The bonds are a pledge to pay back the businesses or the government who buys them within a predetermined time frame. For a full settlement, the corporations are required to pay the principal sum and interest.Corporations, as well as cities, states, and other sovereign entities, issue bonds to fund operations and projects. Securities like notes and bills issued by the US Treasury, for instance, are sold on the bond market. The debt, credit, or fixed-income markets are other names for the bond market.

- Derivatives Market

Derivatives, which derive their value from an underlying asset, are traded on the derivatives market. Here, futures, options, forward contracts, and swaps can be traded by both individuals and businesses. To manage the financial risk, such deals can be entered either over-the-counter or in exchange-traded derivatives.The value of derivatives, which are secondary securities, is wholly based on the value of the primary security to which they are tied. A derivative has no value by itself. A derivatives market trades complex financial products like futures and options contracts, which derive their value from underlying securities like bonds, commodities, currencies, interest rates, market indices, and stocks, as opposed to trading equities directly.

- Forex Market

Currency exchange is facilitated by the foreign exchange (Forex) market. These markets, which are run by financial firms, are used to calculate the exchange rates for all currencies.The forex market is decentralised and made up of a global network of computers and brokers from all over the world, just as the OTC markets. Banks, commercial enterprises, central banks, asset management businesses, hedge funds, as well as small-scale currency dealers and investors, make up the forex market.

- Commodities Market

A commodity market deals with items like gold, oil, wheat, rice, and other commodities. There are over 50 significant commodity markets worldwide.However, the majority of these commodities’ trading occurs on derivatives markets, which use spot commodities as the underlying assets. Commodity forwards, futures, and options are traded over-the-counter (OTC).

- Cryptocurrency Market

.Given the opportunities provided to investors and traders, digital assets are in demand. Blockchain technology is utilised for the transactions and their recording. The digital currencies, such as Bitcoin, Ethereum, and others, are accessible on internet crypto exchanges, enabling traders to engage in trade on a worldwide scale.

Users can swap digital currencies, including conventional currencies, using the exchanges’ digital wallets. And These platforms are likely to experience cyber problems like hacks and frauds because they are centralised markets.

Functions of Financial Markets

- They enable the mobilisation of money:When you set aside a percentage of your salary, it just sits there until you decide to do something with it. However, financial markets give you a way to invest, which enables you to mobilise your savings. Thus, financial markets assist in bridging the gap between those who have the needed capital and those who do not.Additionally, they assist in re-directing stagnant money into the economy so that it can be productively used rather than just sitting about. After all, a country’s economy can only flourish if there is enough money in circulation.

- They help determine the price of assets:The price of items increases as demand outpaces supply. And the price decreases when there is a surplus of supply compared to demand. That is how supply and demand affect how much anything costs. And the financial markets also follow this rule.Demand and supply are undoubtedly two of the most significant variables at play, continuously and reliably guiding world economic systems. Without either supply or demand, an economy cannot function in balance. These two forces also contribute to determining the price of the traded financial assets because they are the only two things that drive the financial markets. Without these markets, it would be practically impossible to correctly assess the pricing of financial assets because they would be unregulated.

- They ensure liquidity of the assets:In essence, liquidity is a number that assesses how easily an item may be bought, traded, or turned into cash. Let’s further deconstruct it using a comparison illustration.Given its swift saleability and ability to be transformed into cash, gold is regarded as a highly liquid kind of investment. That is as a result of the high levels of yellow metal demand. In contrast, because real estate cannot be immediately sold off, it is often thought to be far less liquid.Financial markets serve as fair marketplaces for the selling and acquisition of assets. They also make certain that these financial assets are liquid by making it easy for you to buy and sell the aforementioned assets. In other words, you don’t have to look very far in these markets to find a buyer or a seller.

- They help save time and money:Building on the concept of liquidity and taking into account the ease with which a buyer or a seller can be found, financial markets significantly reduce the amount of time required by all parties. Not only that. Additionally, they help you avoid wasting a lot of time and energy searching for potential buyers or sellers.The prices and fees connected with each transaction have also greatly decreased as a result of the financial markets’ entire transition to electronic trading. You can then save a tonne of money as a result of this.

Advantages and Disadvantages of Financial Markets

Advantages

- Businesses can use it as a platform to raise money for both long- and short-term investments.

- Companies might be able to finance themselves for less money than they would pay for a high-interest loan from a commercial bank. Furthermore, big loans are not offered by commercial banks.

- Companies are able to borrow money whenever they need to, up until the point where their authorised share capital is exhausted.

- Intermediaries in the financial sector, such banks and financial institutions, advise businesses and investors on financial and strategic matters. They provide knowledge, counsel, and expert skills that might not otherwise be available.

- It provides a trading and dealing platform for many different shares, stocks, bonds, derivatives, and other financial instruments.

- Stricter financial market laws and regulations foster trust among investors and firms, which helps to grow the economy.

- create a platform for international borrowing and lending of money in different currencies

Disadvantages

- The process could get too drawn out if regulatory agencies impose too many steps.

- Some companies are unable to access the financial sector because of rigorous laws and regulations. They cannot set up resources that require ongoing oversight and compliance checks.

- Investors may lose money as a result of ignorance or lack of information about the situation.

- A company’s focus could change from investors to profits. The Board of Directors must adopt decisions that are in the best interests of all parties involved in the business and refrain from using investor funds for personal advantage.

Which is India’s Largest Financial Market?

The main financial market in India was founded in 1992 and is called the National Stock Exchange. It was recognised as a stock exchange under the Securities Contracts (Regulation) Act of 1956, and it started operating in 1994. It was the first entirely computerised electronic trading exchange in the nation.

- Mumbai, Maharashtra, serves as the home base for the National Stock market, an Indian stock market. It is India’s largest stock exchange by daily turnover and number of trades for both equity and derivatives trading, and it is the eleventh-largest stock exchange in the world by market capitalization.

- The NSE had about 2000 listings as of August 2021 with a market capitalization of more than US$3.4 trillion.

- The NSE and the Bombay Stock Exchange are India’s two most significant stock exchanges, accounting for the vast majority of share transactions despite the existence of numerous other exchanges.

- The S&P CNX Nifty, also referred to as the NSE NIFTY (National Stock Exchange City), is an index of fifty big stocks that is weighted according to market capitalisation.

- Although a number of the biggest banks, insurance companies, and other financial intermediaries in India control a portion of NSE, its ownership and administration are two distinct entities.

- NSE shares has been acquired by at least two foreign investors, NYSE Euronext and Goldman Sachs. As of 2006, there were 2799 Stock NSE VSAT terminals covering more than 1500 cities across India.

FOLLOW OUR WEBSITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/