BPCL share price: According to the earnings announcement, the oil marketing business made a standalone profit of Rs 6,477.7 crore for Q4FY23, up from Rs 1,959.6 crore in the previous quarter, while the profit was expected to be Rs 5,500 crore.

On Monday, the business reported a whopping 158.99% or 2.58 fold growth in standalone profit after tax (PAT) to 6,477.74 crore in Q4FY23, compared to 2,501.08 crore in Q4FY22.

Revenue for the current quarter was down 0.9% to Rs 1,18,112.1 crore from Rs 1,19,158.1 crore in the previous quarter, although it was still better than the projection of Rs 1,09,500 crore.

BPCL and other oil marketing companies (OMCs) did not modify fuel prices during the April-June quarter, resulting in higher operating expenses that harmed the businesses’ bottom-line margins.

The basket of crude oil that India buys was worth more than $100 a barrel in April of last year, but it is currently worth less than $75.

Let’s see what the brokers have to say:

According to the firm, core earnings have exceeded expectations, thanks to a robust refinery margin of $20/bbl. Furthermore, the brokerage anticipates that the good margin will persist.

“The new buy will only be activated above the daily close of 375 with a target of 400 and a stop-loss of 365 on a daily close basis,” stated Jigar S Patel, Senior Manager – Technical Research Analyst, Anand Rathi Shares & Stock Brokers.

In terms of revenue segments, the downstream petroleum segment generated 1.33 lakh crore in the fourth quarter, while the exploration and production of hydrocarbons segment generated 26.3 crore.

Emkay Global

We boost our target multiple to 5.6x FY25E EV/EBITDA and lower our target price by 13% to Rs395/share.

While earnings are expected to remain stable, there are system-wide risks due to the company’s new $500 billion capital expenditure plan and forthcoming national elections. “We keep ‘hold,'” stated the brokerage.

It is crucial to note that these figures do not account for the effects of the Special Additional Excise Duty and Road & Infrastructure Cess, which went into effect on July 1, 2022.

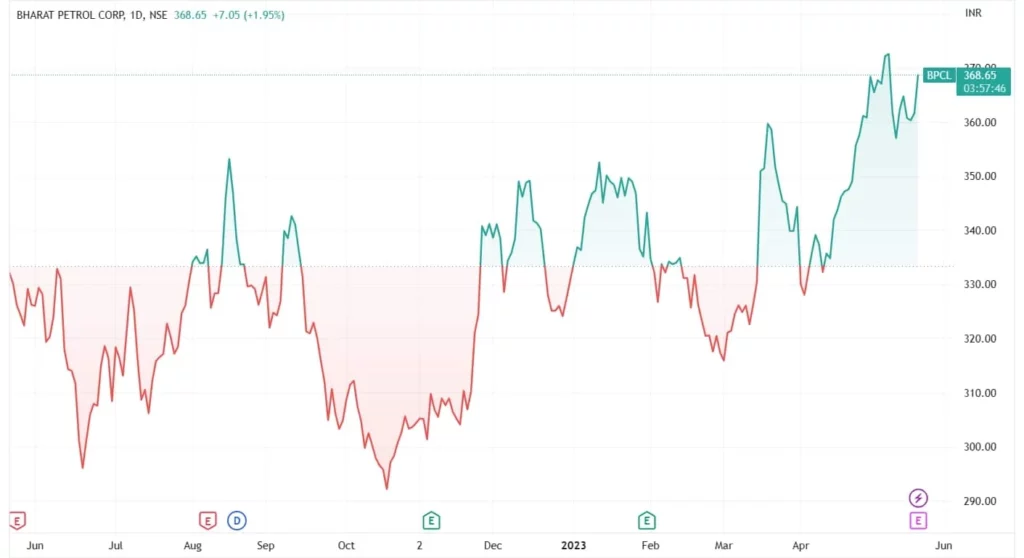

In response to the good Q4 results, the stock began trading on Tuesday at 367 and subsequently soared to an intraday high of 371, up 2.6% from the previous closing price of 361.60.

BPCL share price history

BPCL stock has increased by more than 10% year to date (YTD), while the Nifty50 has increased by less than 1%.

look at more info: https://learningsharks.in/

Follow us on insta” learningsharks