When the RBI discovered the same and asked the accused to restore the amount to the depositors, the accused answered to the RBI that they have repaid the money to the depositors, but an ED probe revealed that there is no proof of payback or no KYC of the depositors, the ED claimed.

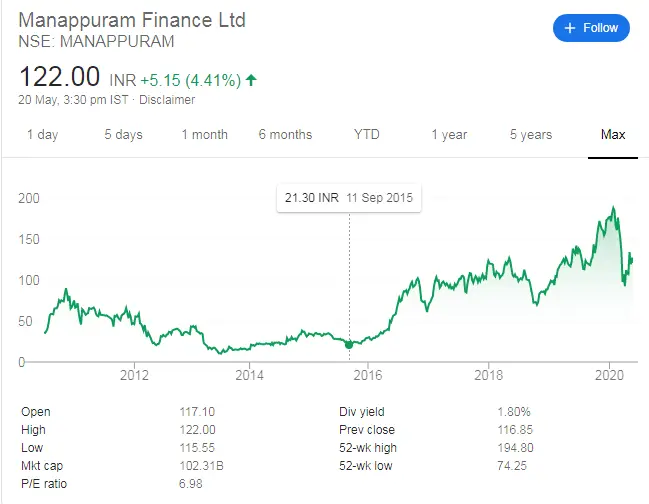

Manappuram Finance Ltd’s shares fell 14% in early trade, trading at Rs 103 on the BSE at 9:32 a.m., after the Enforcement Directorate froze the assets worth Rs 143 crore of the major Kerala-based NBFC’s MD and CEO VP Nandakumar in a money laundering case.

According to the ED, the proceeds of the crime were “diverted and invested” by Nandakumar into immovable assets in his name, the names of his spouse and children, and shares of Manappuram Finance Ltd.

The frozen assets include deposits in eight bank accounts, investments in listed shares, and shares of Manappuram Finance Limited, according to the agency. Various “incriminating” documents demonstrating money laundering, as well as property documents for 60 immovable properties, were also seized during the searches.

- It stated that “evidence” of money laundering and large-scale cash transactions in the form of public deposits carried out without RBI authorisation by Nandakumar through his proprietary entity Manappuram Agro Farms (MAGRO) had been collected.

- The deposits were “illegally” acquired by Nandakumar through some of the staff of Manappuram Finance Limited, a listed firm.

“The outstanding illegally collected deposits, which are crime proceeds, total Rs 143 crore.”

the accused answered to the RBI that they had repaid the money to the depositors, but an ED probe revealed that “there is no proof of repayment or no KYC of the depositors,” the ED claimed.

Deposits totaling Rs 53 crore are reported to have been returned in cash, but with no proof of repayment or KYC, according to the report.

The role of Manappuram Finance Limited’s chief finance officer (CFO) and other staff accused of assisting in money laundering is being scrutinised, according to the agency.