The Chicago Board of Options Exchange Volatility Index, or VIX, is a gauge for stock market volatility and investor sentiment.

The VIX strives to predict market volatility through the lens of options trades.

What Is the VIX and How Does It Measure Volatility?

The Volatility Index of the Chicago Board of Exchange is referred to in finance as VIX. This index serves as a general benchmark for stock market volatility and gauges S&P 500 index options. The trading environment is more choppy the higher the index level, thus its other moniker, the fear index, is rather appropriate.

Based on a snapshot of trade behaviour over the preceding 30 days, it gauges expected future volatility.

What Do the VIX Numbers Mean?

- Typically, a VIX reading of 20 or more is regarded as “high.”

- The VIX is often regarded as “low” below 12.

- Any age between 12 and 20 is regarded as “normal.”

Put options provide investors the right to sell shares of a stock on a given date at a specific price, therefore investing in a put option is equivalent to betting that the price of a stock will decrease before the put contract expires.

These are investments that can profit from negative feelings like dread; they are bearish. Because it is widely believed that volatility may have peaked or reached a turning point, there is a saying on Wall Street that goes, “When the VIX is high, it’s time to buy.”

In other words, a dropping VIX number means that the stock market’s general mood is more upbeat or positive. The VIX should be thought of as a percentage even though it isn’t expressed that way. At a VIX of 22, the implied volatility for the SPX is 22%.

How Is the VIX Calculated? What Is the VIX Formula?

The VIX is composed of a continually shifting portfolio of SPX options, unlike the S&P 500 index, which is made up of specific equities. It uses both normal weekly SPX options and those with Friday expirations. Further information on the Chicago Board of Options’ process and selection criteria can be found on the website.

How Do I Interpret the VIX?

There are various ways to read the VIX, but it’s crucial to remember that it’s a theoretical index and not a forecasting tool. Fear, the emotion it tracks, is not even something that can be quantified by concrete facts like the most recent Consumer Price Index. Instead, the VIX uses option pricing to predict how the market will behave in the future.

“The VIX does not measure actual volatility, but rather, implied volatility.”

It’s also critical to comprehend how strongly emotions can influence the stock market. For instance, during earnings season, a company may post strong growth but face a sharp decline in its value because it fell short of analyst expectations. Investors trying to preserve their interests by selling their shares, which lowers prices, is an indication of fear.

At its worst, fear-driven selling has the potential to crash the market and trigger feelings of panic that may lead to capitulation.

But, the VIX is not meant to elicit fear.

Can the VIX Go Above 100?

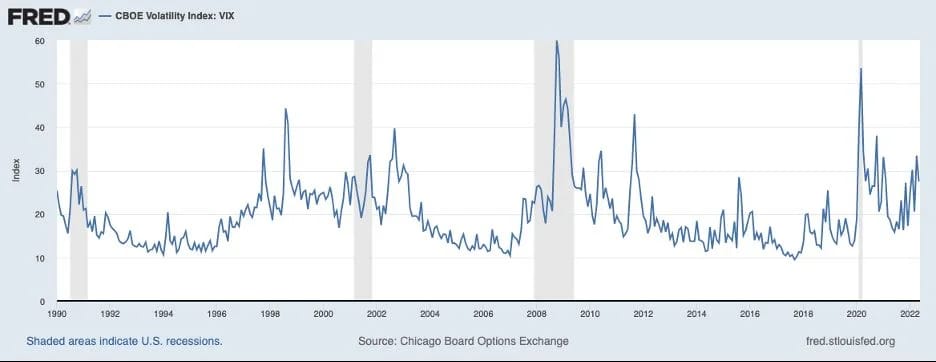

Although it hasn’t done so since data collection started in 1990, theoretically the VIX can rise over 100.

The VIX attained its two highest points at the following times:

- The VIX peaked 89.53 on October 24, 2008, at the height of the Financial Crisis, which resulted from the global collapse of mortgage-backed securities.

- The VIX peaked at 82.69 on March 16, 2020, at the start of the COVID-19 pandemic.

Experts also contend that the VIX would have reached 100 on Monday, October 19, 1987, during the Black Stock Market Collapse if data collection had started in the 1980s.

The VIX is seen in this chart from the Federal Reserve’s data centre, FRED, from 1990 to 2022. Receding areas are indicated by shading:

How Do I Trade the VIX? Can You Buy Options on the VIX?

Investors can invest in derivatives that track the VIX but cannot directly purchase the VIX itself. Examples of these derivatives include exchange-traded funds (ETFs) based on the VIX, such as ProShares VIX Mid-Term Futures ETF (VIXM), and exchange-traded notes (ETNs), such as the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) and the iPath Series B S& (VXZ).

What Is the VIX at Today?

Visit the daily updated website of the Chicago Board of Options Exchange to see the VIX’s current level.