Because you are investing your hard-earned money when you choose to purchase a stock for investment purposes, you must conduct thorough research. Finding a stock at a good price should be your objective while investing for the long run.

However, you should do extensive research, examine the stock’s fundamentals, and decide whether it fits in your portfolio before putting all of your faith in a company.

As an investor, you must do adequate research since when you buy a stock in a firm, you also become a shareholder in that business.

Ten things you should know about a company before investing in its stock are listed below.

1.Time Horizon:

Your time horizon must be established before buying a stock because it will affect whether or not you should buy it. Your investing time horizon can be short, medium, or long term depending on your financial goals.

- Short Term: Any investment that you plan to hold for a year or less is considered short-term. You should choose dependable blue-chip stocks that pay dividends if you want to invest in a company and hold it for less than a year. The businesses are less risky and have a solid financial standing.

- Medium Term: An investment that you plan to hold for one to 10 years is considered medium term. Invest in high-quality, low-risk stocks from emerging markets for medium-term investing.

- Last but not least, long-term investments are ones that you plan to hold for longer than ten years. These investments have time to recover if something goes wrong and can offer a sizable return.

2.Investment Strategy:

Research a variety of investing strategies before buying a stock, then choose the one that best fits your investing philosophy.

The three fundamental types of strategies used by the top investors are as follows:

- Value Investing-Investing in shares of stock that are undervalued relative to their competitors in the hopes of making a profit is known as value investing. This strategy has helped Warren Buffett amass huge wealth.

- Growth Investing- Stock investments that exceed the market in terms of revenue and earnings growth are referred to as “growth investments.” Growth investors believe that these stocks’ upward trends will persist, offering them a chance to profit.

- Income Investing: Last but not least, investors should look for top-notch stocks that pay sizable dividends. These dividends generate income that can be used for personal expenses or reinvested to increase future earnings. As a result, consider the strategy that most closely matches your investment style before buying a stock.

3. Check Fundamentals before buying a stock:

Investors should examine a stock’s fundamentals before buying it.

By comparing stock market prices to fair market value, well-known investors like Warren Buffett made a lot of money. A cheap stock, in his opinion, will eventually rise to its fair or intrinsic value.

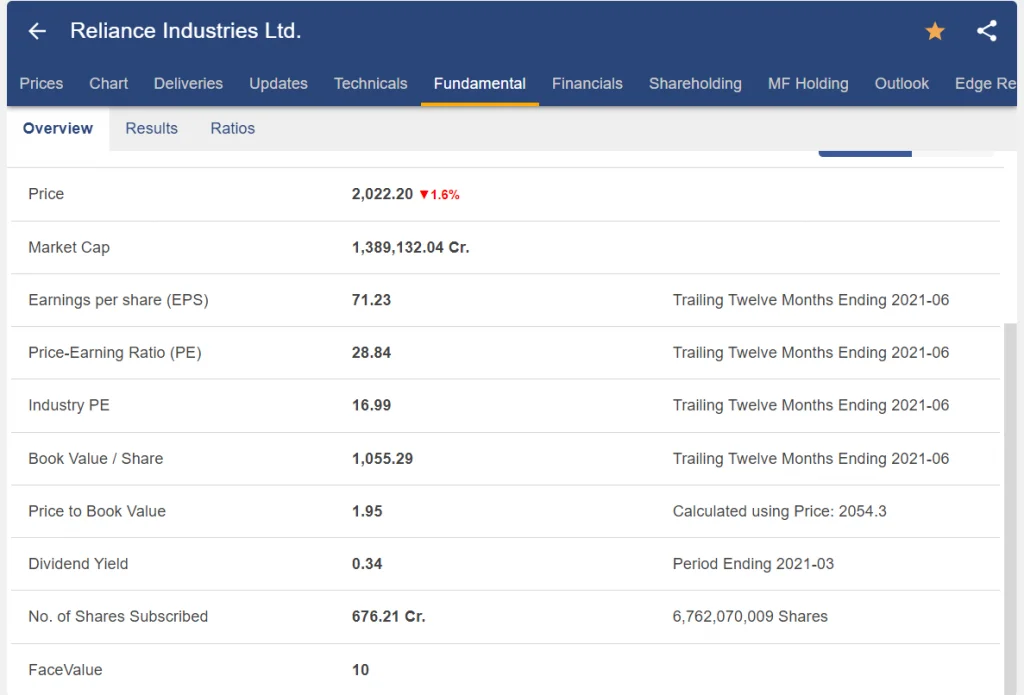

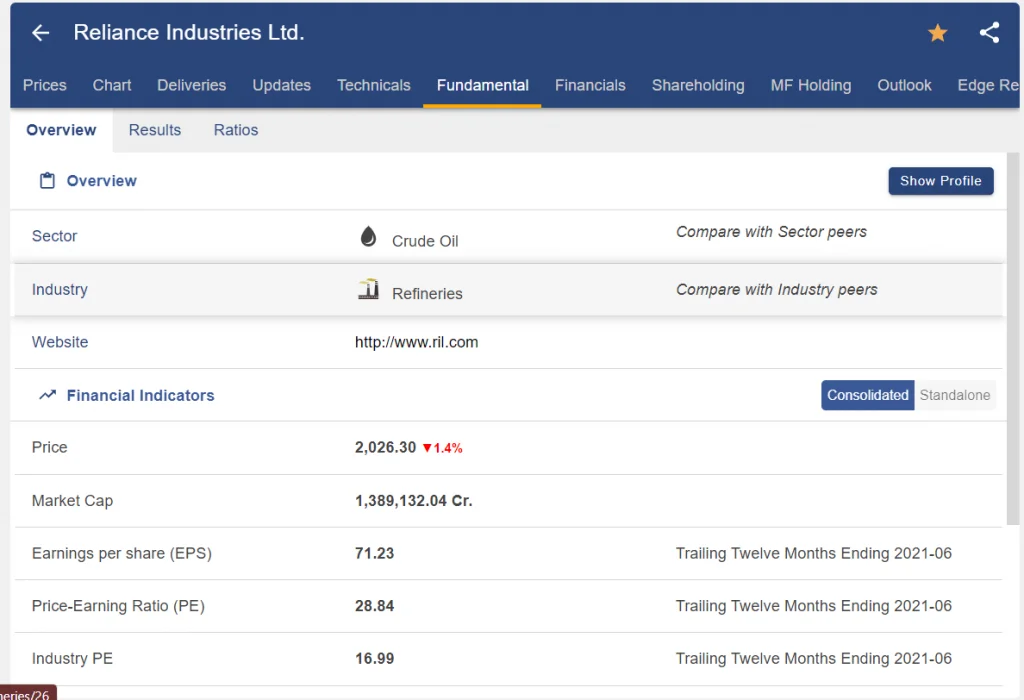

Some of the most important ratios to look at before buying a company are as follows:

- P/E ratio (price-to-earnings ratio):A company’s price is compared to its earnings per share (EPS) using the P/E ratio. For instance, if a corporation has a share price of 20 rupees and earns an earnings per share of 1 rupee annually, its P/E ratio is 20, meaning that the share price is 20 times the annual earnings of the company.

- Debt to Equity Ratio: This ratio tells you how much debt the company has in relation to its equity. Being overly indebted is undesirable since it signals impending bankruptcy.

- Ratio of Price to Book Value (P/B Ratio) :The P/B ratio divides the number of outstanding shares by the net value of the company’s assets, which is calculated by dividing the stock price by that amount.

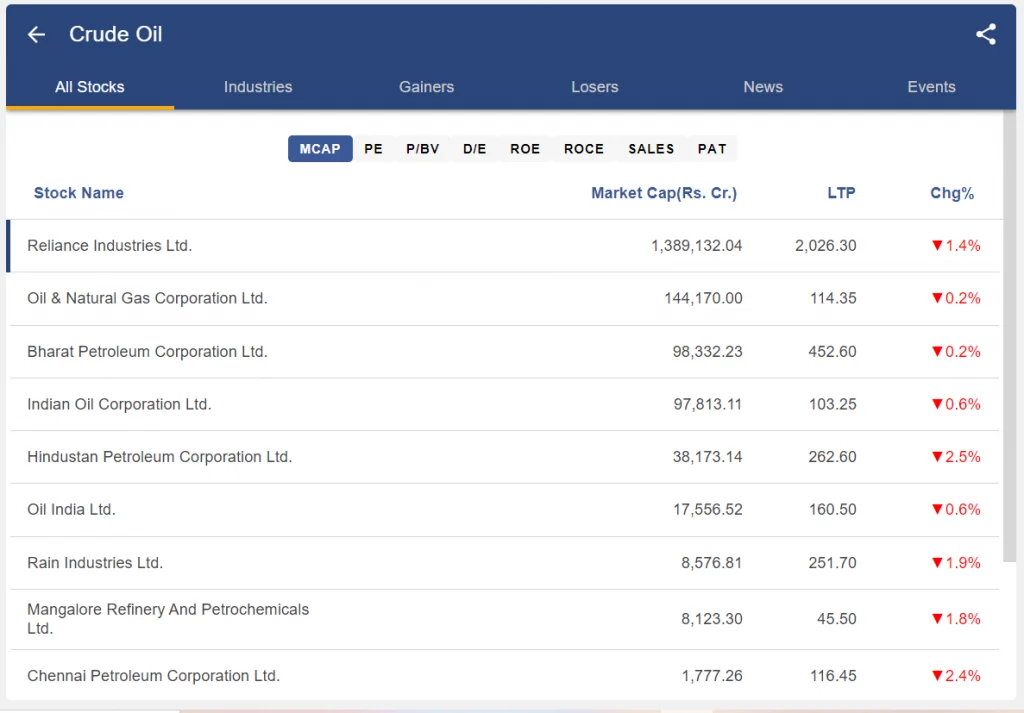

4. Stock Performance compared to its peers:

Investors might also think about how the firm has performed in comparison to its competitors. Companies can compare themselves to their rivals using tools like Stock Edge and Google Finance.

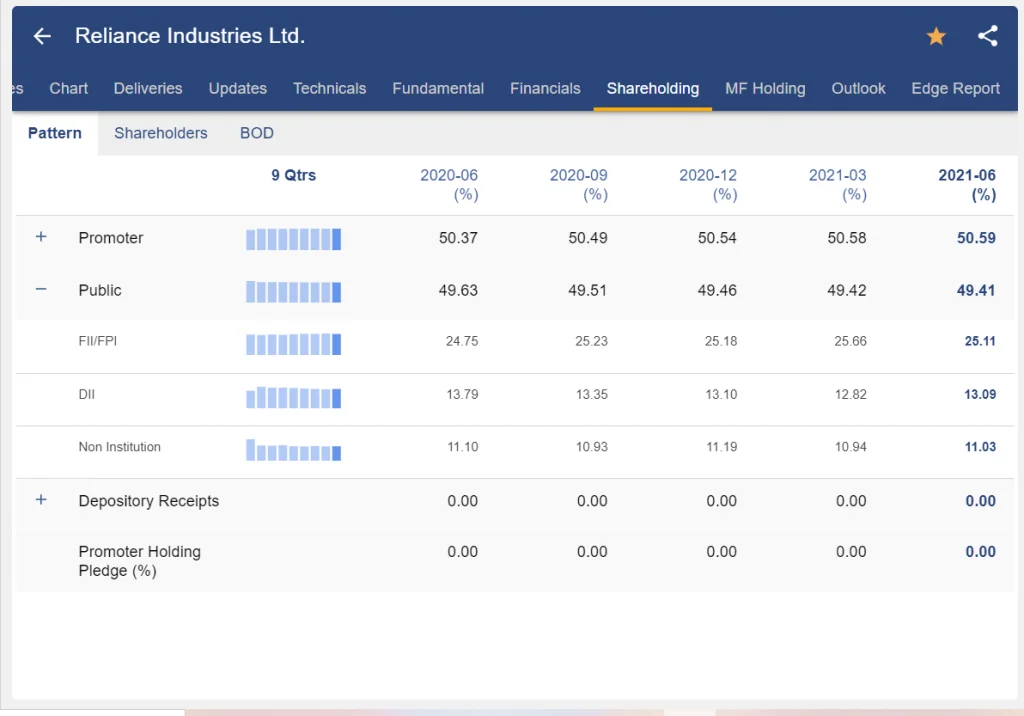

5. Shareholder Pattern:

Investors should look at the shareholding structure before buying a stock.

Promoters are organisations that significantly affect a company. They might be major shareholders in the business or occupy important executive positions.

Investors should therefore put their money into businesses where the promoter owns a sizable portion as well as those where both domestic and foreign institutional investors possess sizable portions.

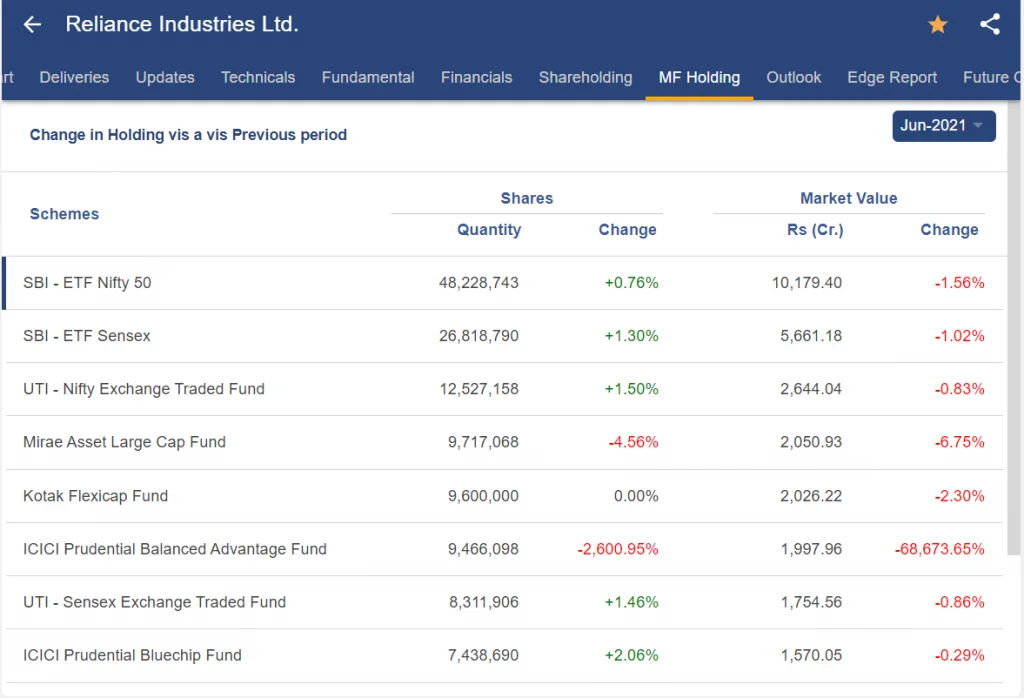

6. Mutual Funds Holding:

A stock is frequently considered to be a safer investment than other stocks that are not held by any mutual funds when a significant number of mutual funds own it.

7. Size of the Company:

The amount of risk you are willing to take on when buying a stock is greatly influenced by the size of the company you are interested in investing in.

Consider the size of the company in relation to your time horizon and risk tolerance before buying a stock.

As seen below, the market capitalization of publicly traded companies can be used to estimate their size.

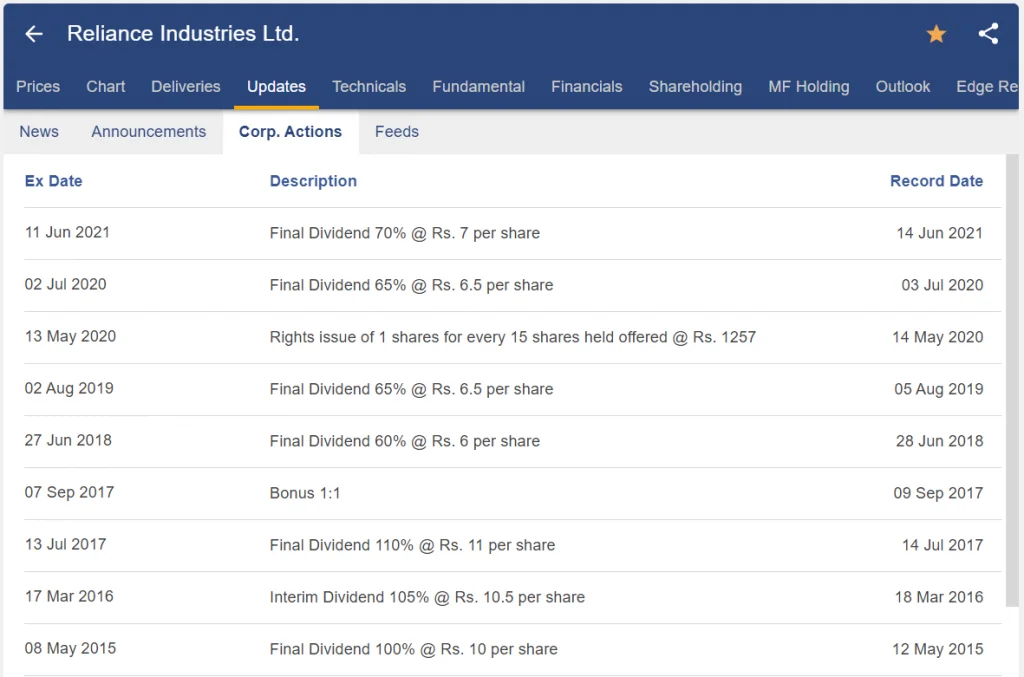

8. Dividend History:

The term “dividend stock” refers to securities that distribute dividends to investors as a share of their earnings.

Investors who employ the income investing approach may want to think about buying these dividend stocks.

Before buying a company’s stock, an investor should research the company’s dividend history if their objective is to generate income from their assets.

The company’s dividend yield, which is presented as a percentage, may be taken into consideration by income investors desiring a high level of income in comparison to the stock price.

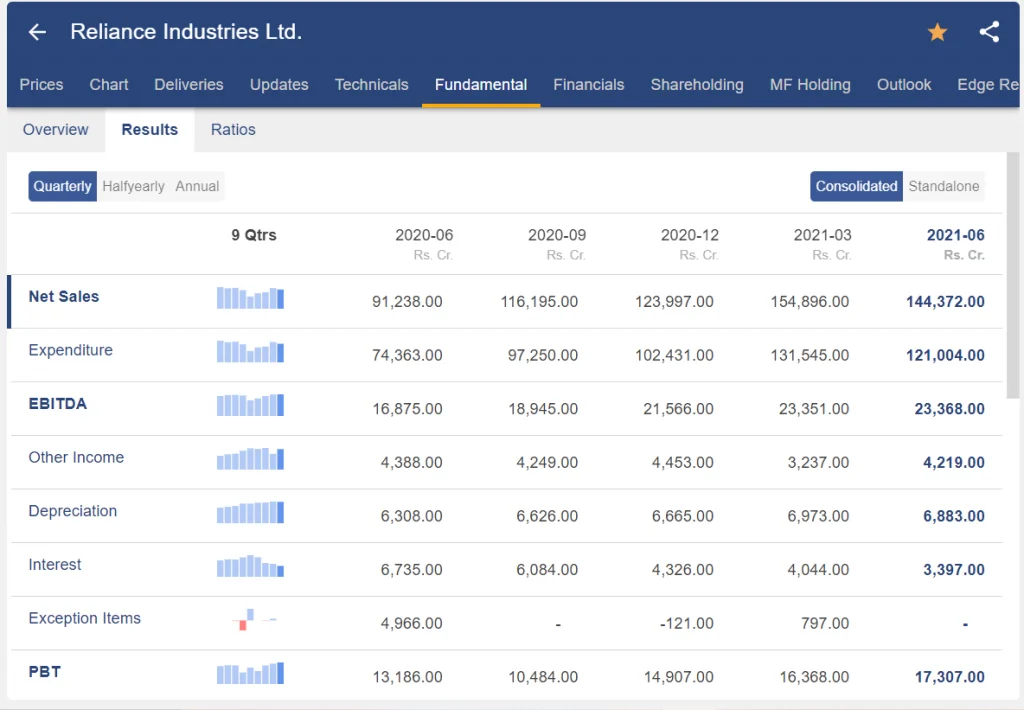

9. Revenue Growth:

Investors should look for companies that are expanding before buying a company. This can be evaluated by looking at its profitability and revenue.

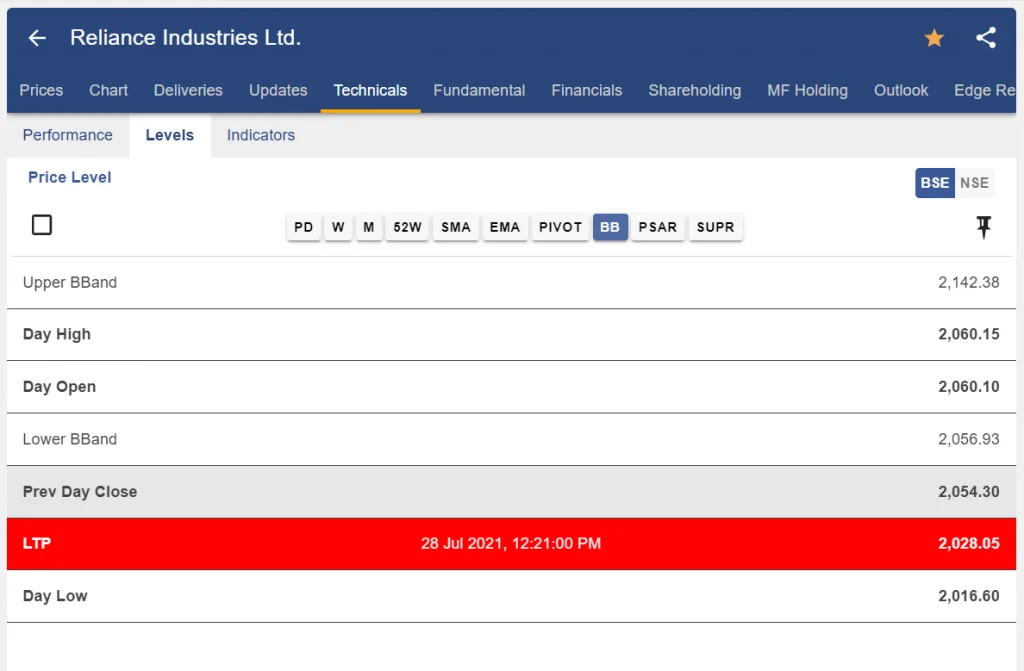

10. Volatility:

High volatility stocks will rise quickly on bullish days and plunge sharply on bearish days.

If a recent advance starts to reverse after you invest in a low-volatility, slow-moving stock, you can cash out your gains before they disappear.

Fast-moving stocks, on the other hand, give you less time to withdraw your money from the investment, and you run the risk of losing money if the trend changes.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en