When you decide to buy a stock for investment purposes, you must do your study because you are investing your hard-earned money. When purchasing a stock for the long term, your goal should be to find good value.

However, before putting your complete trust in a firm, you should conduct thorough research, analyses the fundamentals of the stock, and determine whether it fits in your portfolio.

You are not simply purchasing a stock; you are becoming a shareholder of that company, thus as an investor, you must conduct proper research.

Here are ten important things to know about a firm before investing your money in its stock.

1.Time Horizon:

Before purchasing a stock, you must first determine your time horizon, which is critical in determining whether or not to purchase that stock. Depending on your financial objectives, your investing time horizon can be short, medium, or long term.

- Short Term-A short-term time horizon is any investment that you intend to keep for one year or less. If you want to buy a company and hold it for less than a year, you should invest in reliable blue-chip stocks that pay dividends. The companies have a strong financial sheet and face less risks.

- Medium Term- A medium-term investment is one that you intend to hold for one to ten years. For medium-term investing, invest in quality emerging market stocks with a modest amount of risk.

- Long Term-Finally, long-term investments are any investments that you want to keep for more than ten years. If something goes wrong, these investments have time to recover and can provide a considerable return.

2.Investment Strategy:

Before purchasing a stock, it is critical to research numerous investing strategies and select the one that best suits your investing style.

The following are three basic sorts of techniques utilized by the most successful investors:

- Value Investing-Value investing is the practise of investing in equities that are inexpensive in comparison to their counterparts in the hopes of making a profit. Warren Buffett employs this approach to generate enormous riches.

- Growth Investing-Growth investing refers to stock investments that outperform the market in terms of revenue and earnings growth. Growth investors feel that these stocks’ rising tendencies will continue, creating an opportunity to benefit.

- Income Investing: Finally, investors should seek out high-quality stocks that provide substantial dividends. These dividends create revenue that can be spent or reinvested to boost earnings potential. As a result, before purchasing a stock, examine the technique that best fits your investing style.

3. Check Fundamentals before buying a stock:

Before purchasing a stock, investors should investigate its fundamentals.

Famous investors such as Warren Buffett made a lot of money by comparing stock market prices to fair market value. He believes that a cheap stock will eventually attain its fair or intrinsic value.

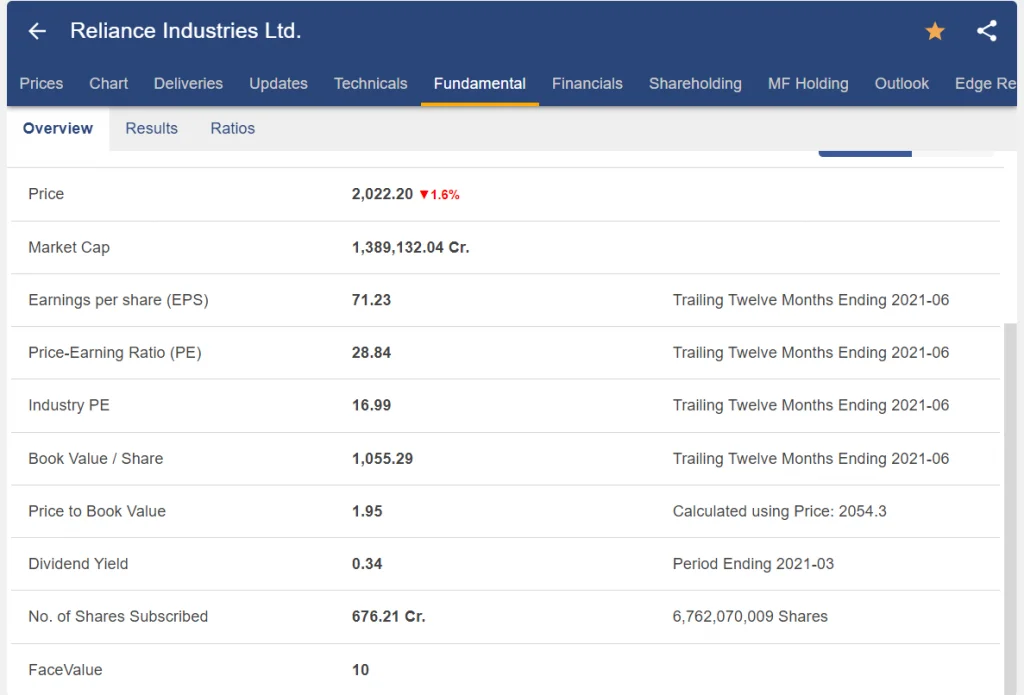

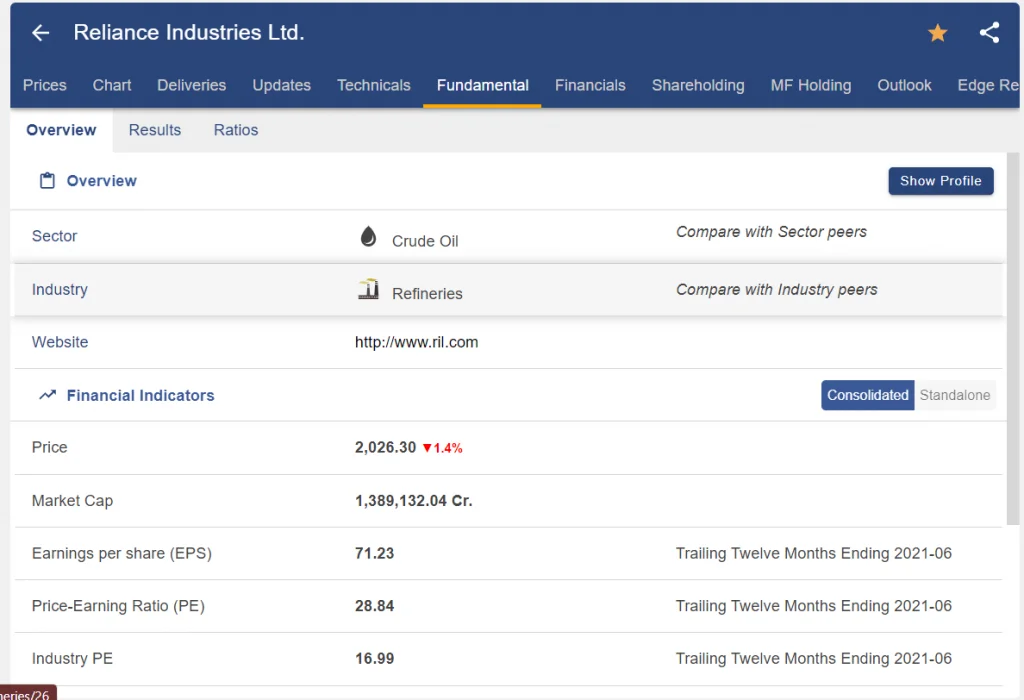

The following are some of the most significant ratios to examine before purchasing a stock:-

- Price-to-Earnings Ratio (P/E Ratio)-The P/E ratio compares the price of a firm to its earnings per share (EPS). For example, if a firm is trading at Rs. 20 per share and generates EPS of Rs. 1 per year, its P/E ratio is 20, indicating that the share price is 20 times the company’s earnings every year.

- Debt to Equity Ratio- The debt-to-equity ratio determines how much debt the company has. High levels of debt are undesirable since they indicate impending insolvency.

- Price-to-Book-Value Ratio (P/B Ratio)- The P/B ratio compares the stock price to the net value of the company’s assets, which is then divided by the number of outstanding shares.

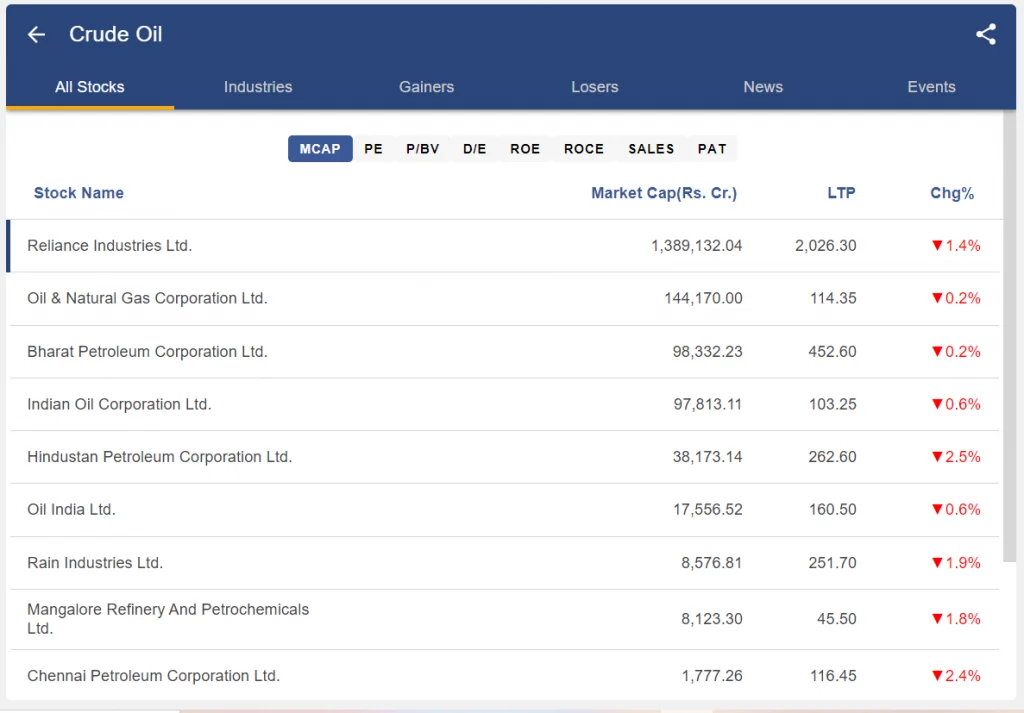

4. Stock Performance compared to its peers:

Investors can also consider how the company has done in contrast to its peers; tools such as Stock Edge and Google Finance assist companies in comparing themselves to their counterparts.

5. Shareholder Pattern:

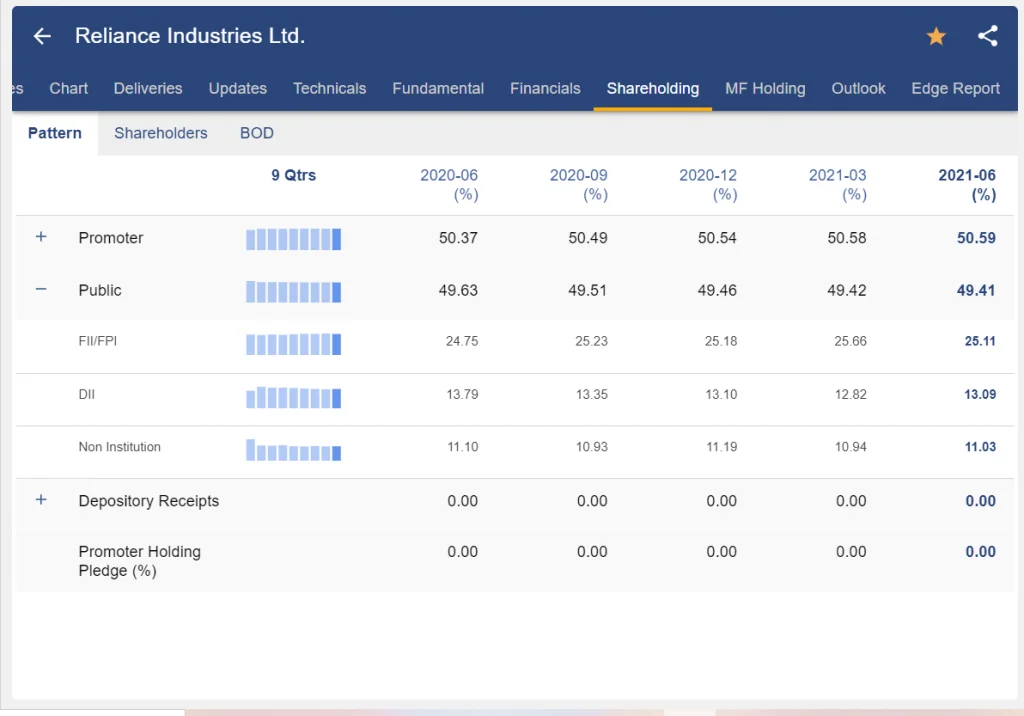

Before purchasing a stock, investors should examine the shareholding pattern.

Promoters are entities that have a significant impact on a firm. They may own a large portion of the company or hold key executive positions.

As a result, investors should invest in companies with a large promoter ownership, a large domestic institutional investor holding, and a large foreign institutional investor holding.

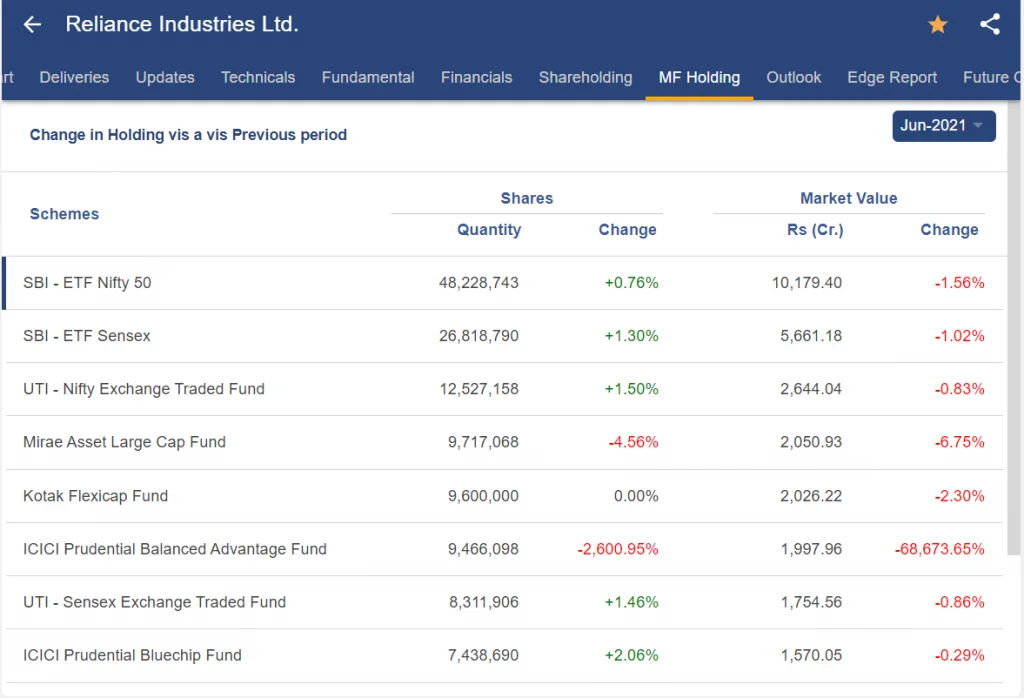

6. Mutual Funds Holding:

When a stock is held by a large number of mutual funds, it is often thought to be a safer investment than other equities that are not held by any mutual funds.

7. Size of the Company:

The size of the firm in which you are interested in investing has a significant impact on the level of risk that you are willing to face when purchasing a stock.

Before purchasing a stock, assess the company’s size in relation to your risk tolerance and time horizon.

The market capitalization of publicly listed corporations can be used to determine their size, as demonstrated below:

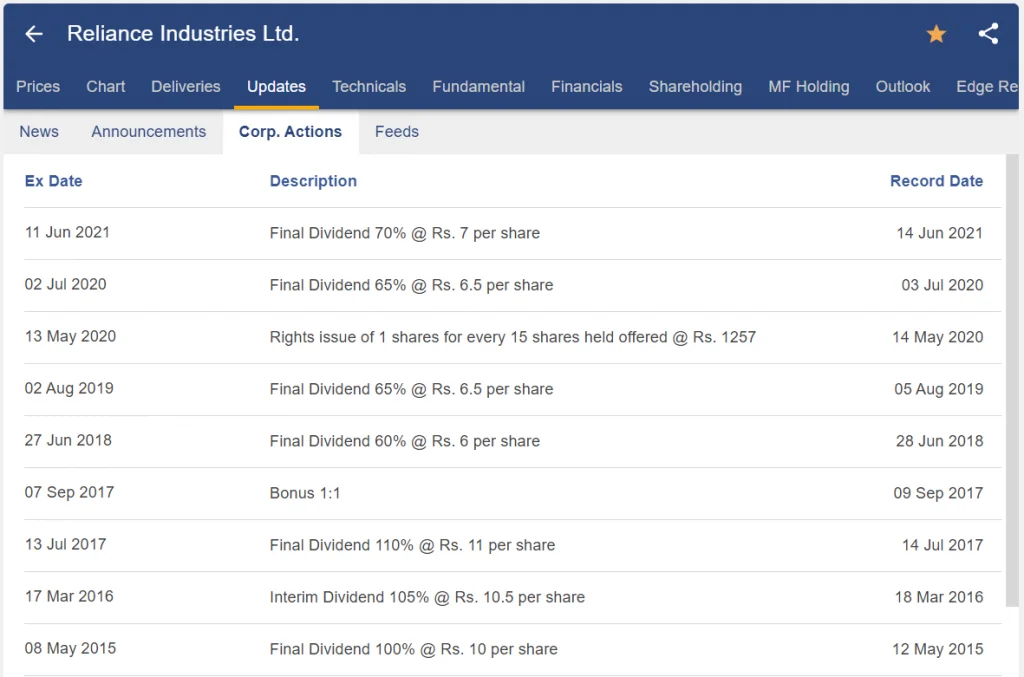

8. Dividend History:

Dividend stocks are known for paying out a portion of their profits to investors in the form of dividends.

Investors who use the income investing method can consider investing in these dividend equities.

If the investor’s goal is to produce income from their assets, they should investigate the company’s dividend history before purchasing its stock.

Income investors seeking a high level of income relative to the stock price may consider the company’s dividend yield, which is expressed as a percentage.

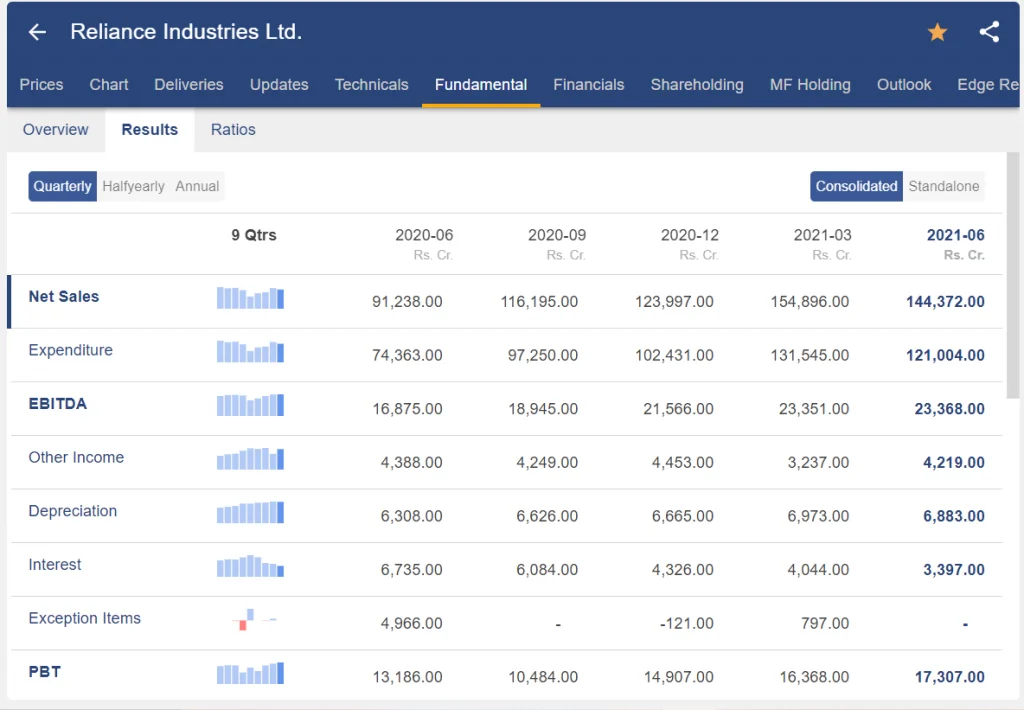

9. Revenue Growth:

Before purchasing a stock, investors should seek for companies that are expanding. This can be assessed by examining its revenue and profitability.

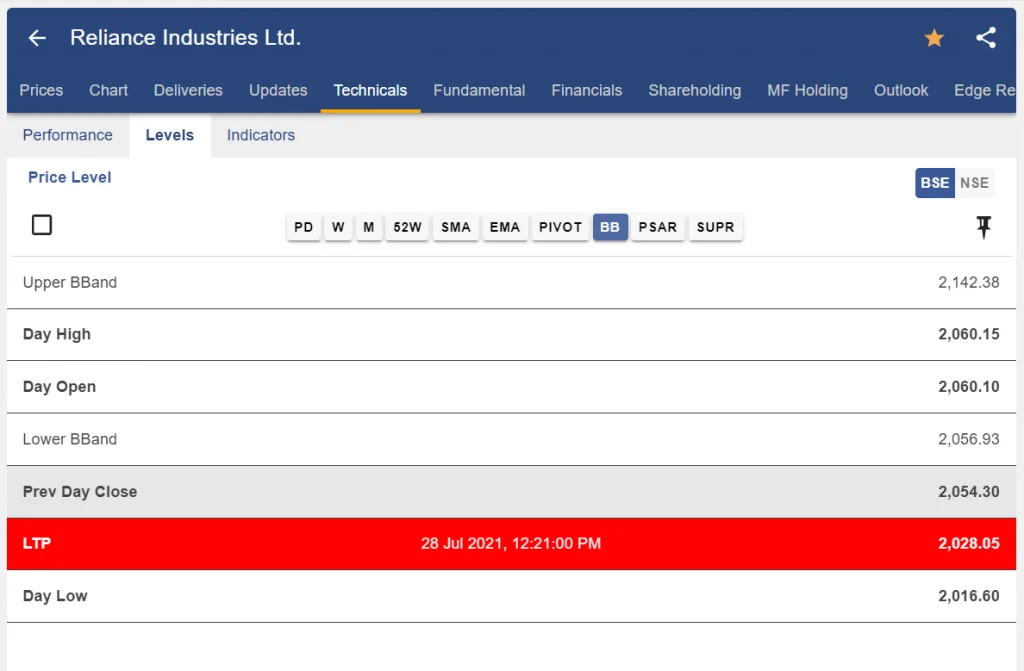

10. Volatility:

Stocks with high volatility will climb swiftly on bullish days and fall hard on bearish days.

If you invest in a low-volatility, slow-moving stock and a recent rise begins to reverse, you can cash out your profits before they vanish.

Stocks with fast-paced moves, on the other hand, do not allow you much time to quit the investment, and when a trend reverses, you may suffer losses.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en